Flat earnings at Investec (JSE: INP | JSE: INL)

Some years you hit 6s and 4s, others are about getting the singles and consolidating

Investec released a pre-close update dealing with the six months to September. There isn’t much here for shareholders to feel excited about, with HEPS expected to be move by between -4% and +4%. That’s a flat move at the midpoint of guidance.

Pre-provision operating profit is likely to be in the red, with an expected range of -6% to 0% vs. the prior year. Strong credit quality and the cost-to-income ratio being in line with guidance helped improve the HEPS result vs. pre-provision operating profit.

In the South African business, Investec expects adjusted operating profit to be ahead by up to 7% year-on-year, so the core local banking operations are still achieving growth. The impact of lower income from group investments will drag adjusted operating profit down to a move of between -5% and 0%. The credit loss ratio is thankfully at the lower end of their through-the-cycle range and so they expect to achieve return on equity of 18.5%, comfortably within the 16% to 20% medium-term target.

In the UK, which includes Rathbones, adjusted operating profit will be a move of between -1% and +6%. The credit loss ratio is expected to be at the upper end of the guided range. Return on tangible equity will be around 13%, at the bottom of the medium-term target of 13% to 17%.

Overall, group return on equity metrics are within target ranges. Things definitely need to improve in the UK in particular though.

An interesting insight is that there’s a year-on-year dip in investment and trading income in South Africa, showing how the shine has come off the local story in the wake of the initial GNU excitement. On the plus side, funds under management in the Southern African Wealth business were up 7.8%, including positive net inflows.

Finally, if you read all the way down the announcement, you’ll find a note that Investec believes that the current provision of £30 million for the UK motor industry commissions nightmare is sufficient. You would’ve seen this issue playing out at a much bigger scale for sector peer FirstRand (JSE: FSR) and their significant exposure to vehicle finance in the UK.

Investec’s share price is flat over 12 months, which is a fair reflection of the underlying earnings.

Mustek is struggling for revenue (JSE: MST)

And the COVID-era margins are gone

Mustek has had a difficult time in the aftermath of the pandemic. CEO and founder David Kan passed away in 2022, thrusting the group into a new era at a time when the world was just emerging from COVID, an historic event that had a significant impact on the IT industry. To add to the volatility in the journey, we’ve also seen the disappearance of load shedding, which meant a negative impact on Mustek’s energy products.

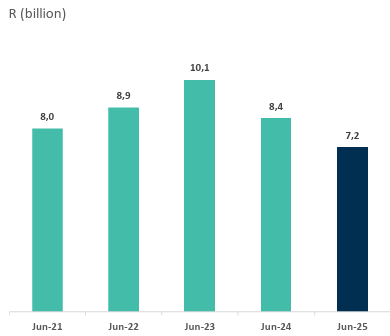

You can see the broader environment come through clearly in the investor presentation for the year to June 2025, including in this chart of revenue:

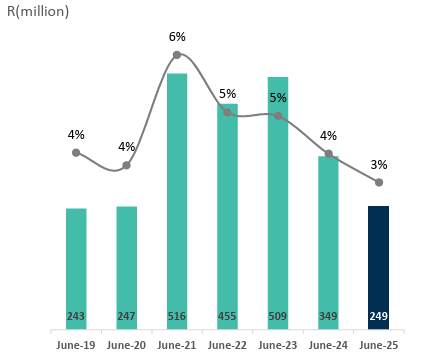

The EBITDA chart is even more striking, showing that margins have now gone below pre-COVID levels as the company generated EBITDA in line with the June 2020 and June 2019 years:

Once you factor in the higher net interest costs thanks to where we are in the interest rate cycle, you get to HEPS of just 73 cents for FY25, approximately a fifth of where they were in the pandemic. HEPS is up by 9% year-on-year though, despite revenue being down 15%, so perhaps the worst is behind them.

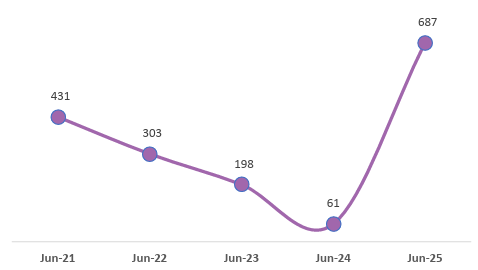

The highlight here is clearly the cash generated from operations, with Mustek achieving a significant reduction in inventory and receivables. This chart is best viewed in the context of the charts above, showing just how much cash has been released:

The thing is, working capital is called that for a reason: this is cash put to work in the business. As Mustek’s revenue has gotten smaller in the past couple of years and the business has therefore shrunk, it should’ve released cash. The question now is whether the management team can do something with it to achieve a return to growth.

This will be the true test of the new management team as they take Mustek into the future. Perhaps their cute robotic protea flower mascot is a sign of things to come in an SA-focused tech strategy.

Safari Investments enjoyed another strong year (JSE: SAR)

They’ve flagged a desire to raise capital

Safari Investments has an unusual property portfolio. For a start, there’s no Western Cape exposure at all. 92% of the portfolio’s GLA is in Gauteng and the other 8% is in Limpopo. The portfolio is almost exclusively retail, with a tiny medical component that comprises just 0.9% of GLA.

As you’ve perhaps guessed by now, Safari’s strategy is focused on retail properties where the anchor tenants would typically be the grocery players like Shoprite and Boxer rather than Woolworths. These lower-income malls offer decent growth prospects in South Africa as they capture the shift from informal to formal retail spending.

Here’s a comment made by the Safari Investments chairperson that tells a candid story about the local grocery sector: “Again, we see the Shoprite brand running away with the gold medal and being the choice retailer in our food segment of the market.”

Simple as that – and something for Shoprite (JSE: SHP) shareholders to note (along with investors in competitors).

Another refreshingly straightforward comment made by the chairperson involves the company’s desire to return to shopping centre development, which means they will need capital. They couldn’t make it more obvious that capital raising activities are coming down the line, which probably means accelerated bookbuilds if the typical sector behaviour is anything to go by. This is another sign that things have improved significantly in the property sector in the JSE, with more companies looking at ways to tap the market for growth capital.

The good news is that they are doing this from a position of strength, with a distribution per share this year of 74 cents vs. 62 cents in the prior period on an adjusted basis (FY24 was a 15-month period as they changed their financial year-end).

One of the key metrics powering these numbers is the reversion ratio, with positive reversions of 10.8% for this period after enjoying positive reversions of 8.3% in the prior period. There aren’t many local funds that are putting out numbers like that. In case you aren’t familiar with the term, positive reversions mean that new leases are being executed at higher rates than the old leases – in other words, income for landlords is going up.

The loan-to-value ratio is 31.5%, an improvement from 33% in the prior year and a strong base off which to raise capital. They just need to be careful not to dilute the investment case, as one of the buildings they are considering is an upmarket mixed-use centre in Lynnwood that would include their new head office. That sounds like a Woolworths mall, not a Shoprite mall.

Nibbles:

- Director dealings:

- Woolworths (JSE: WHL) announced that the group company secretary and the company secretary of a major subsidiary sold shares worth a total of R3.4 million. The announcement isn’t explicit on whether this is only the taxable portion of awards, so I assume that it isn’t.

- A non-executive director of Deneb Investments (JSE: DNB) sold shares worth R3 million.

- Des de Beer has bought shares in Lighthouse Properties (JSE: LTE) worth R2.2 million.

- The company secretary of Hammerson (JSE: HMN) sold shares worth almost R2 million.

- The current CFO and soon to be CEO of KAP (JSE: KAP) bought shares worth R582k.

- Not a director dealing in the traditional sense, but interesting nonetheless that Bowler Metcalf (JSE: BCF) issued R1 million in treasury shares to a director in settlement of a once-off bonus.

- I don’t usually comment on general director changes, but given all the difficulties at Conduit Capital (JSE: CND), I thought it was worth mentioning that an independent non-executive director and executive director have resigned.

Note: Ghost Bites is my journal of each day’s news on SENS. It reflects my own opinions and analysis and should only be one part of your research process. Nothing you read here is financial advice. E&OE. Disclaimer.