Accelerate Property Fund has finally released the Portside disposal circular (JSE: APF)

Turning the Portside stake into cold, hard cash is crucial for the fund

If you’re familiar with the Cape Town CBD skyline, then you already know the Portside building. It’s the gigantic glass building in town that towers above everything else. When Accelerate originally bought it from Old Mutual Life Insurance Company in 2016, they paid R755 million for it. That was then and this is now, with the latest valuation being R610 million and Accelerate achieving a selling price of R580 million.

Before you get out the torches and pitchforks, I must tell you that many property deals done around 2014 – 2016 in South Africa were concluded at ridiculously high prices. Property certainly isn’t immune to bubble risks, with the level of equity capital raising activity among listed property funds as a great indication of whether things are overcooked or not. During those years, the pot was boiling over with capital being thrown at every property company in the market.

The relevance of this deal isn’t the return (or lack thereof) over the past decade, but rather the critical importance of this disposal to the recovery of Accelerate. With a bruised and broken balance sheet (and share price), Accelerate simply cannot afford any further missteps. They are dealing with very tough related party risks, as well as the difficulty in transforming Fourways Mall from a white elephant into a cash cow. There are also other assets that need to be disposed of, including several that aren’t nearly as impressive as the Portside silhouette.

This disposal reduces Accelerate’s total debt from R3.85 billion to R3.27 billion. The total asset value after the disposal will be just over R7 billion. The net asset value (NAV) of the company is barely impacted vs. the March 2025 level, as they’ve sold the property at the carrying value as at that date. In other words, one type of asset is being turned into another. That’s not the point though – you see, when a share is trading at a vast discount to NAV, it creates a lot of value for investors (punters?) if that NAV evolves from illiquid fixed assets to liquid cash.

The net asset value per share as at March 2025 was R2.03. The dilutive rights offer took that down to R1.83. The pro forma number after this deal is R1.82. And the share price? Just R0.39 per share, reflecting a discount to NAV of 79%!

This is why existing shareholders should feel very good about every single example of Accelerate turning an asset into cash at or near the carrying value.

Accelerate shareholders will vote on this deal on 6th November. The other remaining condition for the disposal is a Competition Commission approval without any onerous conditions attached to it. I can’t see why that would be a problem in a property deal like this.

Is Afrimat primed for a big positive swing? (JSE: AFT)

The latest update shows a remarkable turnaround in the business

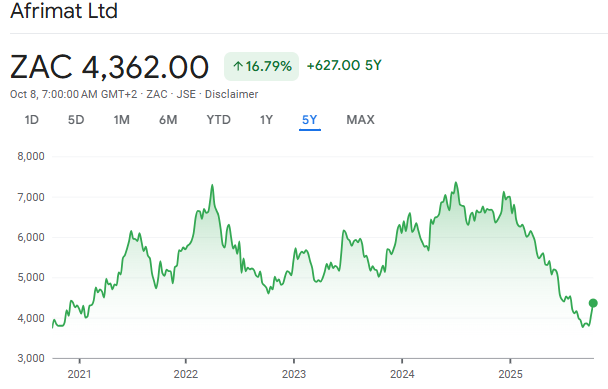

Afrimat has released a trading statement for the six months to August. With the share price having lost well over 40% of its value year-to-date, they desperately needed to show some positive momentum in the group.

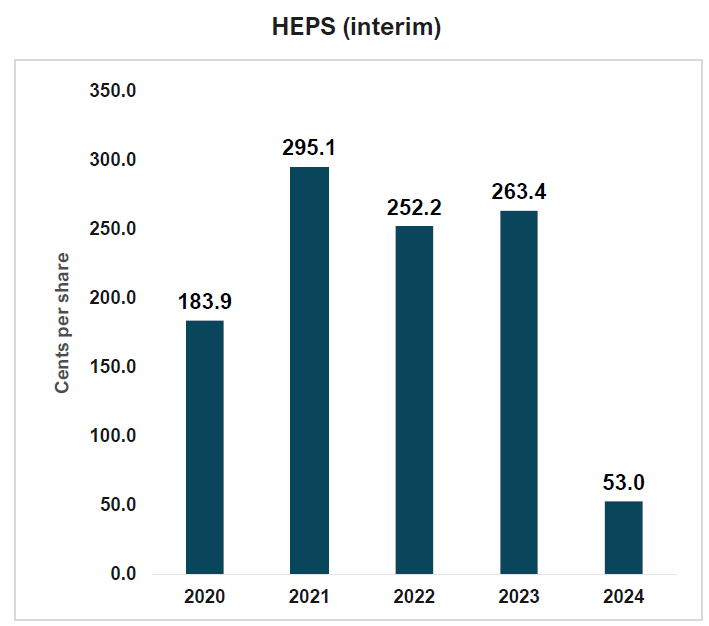

The good news is that they’ve done exactly that, with an expectation for HEPS of between 100.7 cents and 103.4 cents. That’s an increase of between 90% and 95% vs. the comparable period! When you see moves like these, it’s very useful to go back a bit further and example the multi-year performance. In the six months to August 2023, HEPS was 263.4 cents. In fact, if you go back to the results presentation for the six months to August 2024, you’ll find this excellent chart:

The key point here is that HEPS was incredibly depressed in 2024, so the year-on-year move of between 90% and 95% doesn’t mean much. The guided range is still way off the pandemic levels and even the pre-pandemic levels.

It therefore makes sense that the share price is also still miles off those levels:

Of course, the real question is whether this will be enough to stop the slide and perhaps drive a rally back up to the R50 level. Afrimat closed 10.7% higher in response to this announcement, so that’s a sharp improvement in momentum.

The fundamental drivers of the improved performance in this period look good overall, although there’s still a long way to go.

In Construction Materials for example, there was a slow start to the first quarter and then a much better second quarter. The fly ash business had its best ever month in July in terms of volumes. But the cement business remains loss-making overall for the first half, showing just how difficult it is to make that business work.

The Bulk Commodities business enjoyed a massive increase in iron ore sales, with local volumes more than doubling vs. the comparable period. International volumes posted a more modest increase of 13.5%. Don’t get too excited though, as planned maintenance shutdowns of the Saldanha export line during the second half should lead to a situation where full year volumes are flat vs. the prior year. Another concern is the anthracite mining operation, which is suffering with decreased demand from ferrochrome smelters that have been forced to temporarily shut down in South Africa due to harsh economic realities in that sector. Afrimat is exporting anthracite via Mozambique to try and mitigate this lack of demand.

The Industrial Minerals business is a small part of the group, but had a weak half due to delayed demand from the agricultural sector based on the timing of rainfall.

The Future Materials and Minerals business is an early-stage business, with the economics expected to be three years away. Thankfully, no additional capital investment is expected to get them there. The Glenover project is selling phosphate material and is decreasing its operating losses.

Detailed interim results are expected to be released on 23 October.

Datatec has taken some inspiration from how global tech companies report numbers (JSE: DTC)

The good news is that they are firmly in the green either way

Datatec has released a trading statement for the six months ended 31 August 2025. The underlying story is great, with Westcon achieving stronger margins and both Logicalis International and Logicalis Latin America achieving much better numbers than before.

This has driven a juicy increase in HEPS of more than 100%, with expected earnings of between 21 and 23 US cents for the period.

Datatec has decided to present underlying earnings excluding share-based payments (and with various other adjustments). This will sound familiar to anyone who regularly reads the reports of global technology companies. I’m not a fan of this approach, as US companies use it as a great excuse to ramp up share-based payments and then conveniently adjust earnings accordingly. I’m hoping that Datatec won’t behave in that way and that they are rather doing this to improve comparability of their earnings to global peers.

On this adjusted basis, underlying earnings will be between 18 and 20 US cents, or between 33.3% and 48.1% higher than the prior year. This seems to be a decent indication of the year-on-year growth that the company achieved.

Either way, it’s excellent.

Finbond is back in the green (JSE: FGL)

The share price has been strong this year

Finbond is one of those companies that always seems to be bubbling under the surface. They have some interesting elements to their business model, yet it rarely seems to all come together for them in a way that rewards investors. But in the latest period, they’ve at least swung back into profitability.

A trading statement for the six months to August 2025 suggests HEPS of between 0.88 cents and 1.28 cents, which is much better than a loss of 2 cents in the comparable period. But it’s also nowhere near high enough to justify the current price of R1.05 per share, so the market is clearly pricing in much more upside in earnings. The share price is up more than 65% year-to-date.

Newpark REIT has released updated earnings guidance (JSE: NRL)

The large negative reversion at the JSE has hurt the year-on-year performance

Newpark is a particularly unusual property fund on the JSE. They have a very focused portfolio with literally only a handful of buildings. This means that any negative changes to the leases have a significant impact on the numbers.

Exhibit A: the large negative reversion in the lease for the JSE building. Much as I’m sure the JSE really wants to be where they are, the truth will always be that it’s easier to move a business than a building. In a market with oversupply, like in Sandton offices, this creates a recipe for negative reversions i.e. the renewed lease being at a lower rate than the old lease.

This is why Newpark guided for a nasty year-on-year decrease in earnings this year of between 38.1% and 47.1%. This is actually updated guidance that is slightly better than before, with Newpark trying to mitigate the negative impact through strategies like decreasing the operating costs at the properties. They also have escalations at the other properties to offset some of the impact of the JSE building.

For the six months to August, they expect funds from operations per share to decrease by 24.5%. The dividend for the period is expected to be 13.3% lower. It looks like they are front-loading the interim dividend when you compare it to the guidance for the full year.

SA Corporate Real Estate to sell Bluff Towers (JSE: SAC)

The fund is reducing its retail exposure to KZN

SA Corporate Real Estate announced the disposal of Bluff Towers Shopping Centre for R544.6 million. The price is very similar to the June 2025 independent valuation of R545.1 million. With net property income of R44.7 million for the year ended December 2024, that’s a trailing yield of 8.2%. The recent income would hopefully be higher due to the benefit of inflation, but it gives you an idea of the yields at which large retail properties are changing hands.

SA Corporate Real Estate has disclosed that the net asset value attributable to the property was R358 million as at the end of December 2024. I assume that this is net of debt, as that’s way below both the recent valuation and the selling price.

This deal is effectively a disposal of an asset that has been redeveloped to maturity, something that is reflected in the attractive price that SA Corporate Real Estate has achieved here. The fund will probably look to reallocate the capital to opportunities with higher potential returns. This is a Category 2 transaction, so shareholders won’t be asked to vote on the deal.

Nibbles:

- Director dealings:

- The CEO of Fortress Real Estate (JSE: FFB) increased the number of shares pledged for a loan facility, as the facility limit has increased from R26 million to R34 million. This is nothing unusual in the property sector, with many executives entering into leveraged trades to acquire shares in the funds that they run.

- MAS (JSE: MSP) recently announced a tender offer to reduce its debt in the market. That’s a big deal if you’ve followed the fund over the past few years, as full focus has been on trying to prepare the balance sheet for debt redemptions. The tender offer was made to holders of €300 million in notes due 2026. Almost €120 million was tendered under the offer, with holders of the remaining notes clearly keen to keep them until expiration.

- Barloworld (JSE: BAW) announced that the standby offer closing date has been extended from 15 October to 7 November. They are obviously trying to get as many acceptances as possible.

- Salungano Group (JSE: SLG) is catching up on its financial reporting. They’ve now released financials for the year ended March 2024, with the auditors flagging a material uncertainty about the group as a going concern. The headline loss per share increased from 58.65 cents to 111.91 cents. It’s a mess.

- Southern Palladium (JSE: SDL) has lodged the environment guarantee in relation to the Bengwenyama PGM project, which is an important milestone related to the mining right application with the Department of Mineral and Petroleum Resources. The mine development plan for the Definitive Feasibility Study is on schedule. In junior mining, it’s all about ticking the milestones off the list.

- The Saltzman family continues to reduce their influence on the group that they founded, with Saul Saltzman (son of the founders) resigning as an executive director of Dis-Chem (JSE: DCP). He will stay on the board as a non-independent, non-executive director. Dis-Chem has been an incredible example of founders creating a legacy business and then trusting professional managers with it.