Deneb is acquiring 80% in Dawning Filters (JSE: DNB)

This is a very good example of the types of deals and pricing you see locally

Deneb is involved in the manufacturing and distribution of industrial products. As is typical for companies in this space, they are open to acquisitions to expand the overall product offering.

As the name suggests, Dawning Filters supplies all kinds of filtration products to customers across multiple industries. The company has distribution offices in Joburg, Durban and Cape Town, with manufacturing done in Durban.

Deneb is paying R80 million for an 80% stake in the company, so you don’t need to get the calculator out to know that the implied value of the entire company is R100 million. Profit after tax for the year ended February 2025 was R15.7 million, so the earnings multiple is 6.4x.

Importantly, there’s a pathway to a 100% stake in the form of a put option that becomes exercisable after four years for a six-month window period. But there’s no call option, so Deneb cannot force the issue to get to 100% – the sale of the final 20% is at the option of the sellers of the business. The maximum consideration that could be payable to the sellers is R120 million, so Deneb has wisely included a cap on the option. The basis of the calculation for the put option price is 6x average annual profit.

This is a category 2 transaction, so Deneb shareholders won’t be voting on it. There are various other conditions though, so it will no doubt take a few months to close the deal.

Discovery’s financial year is off to a good start (JSE: DSY)

The medium-term plan calls for mid-teens growth

Discovery presented at the UBS South Africa Financial Services Conference this week. Hylton Kallner, CEO of Discovery South Africa and Discovery Bank, led the presentation. I think it’s fairly obvious how the succession planning is shaping up at Discovery. You’ll find the presentation here.

The group had a very strong FY25 and took the opportunity to remind attendees that normalised headline earnings increased 30%. That’s always a nice way to set the scene!

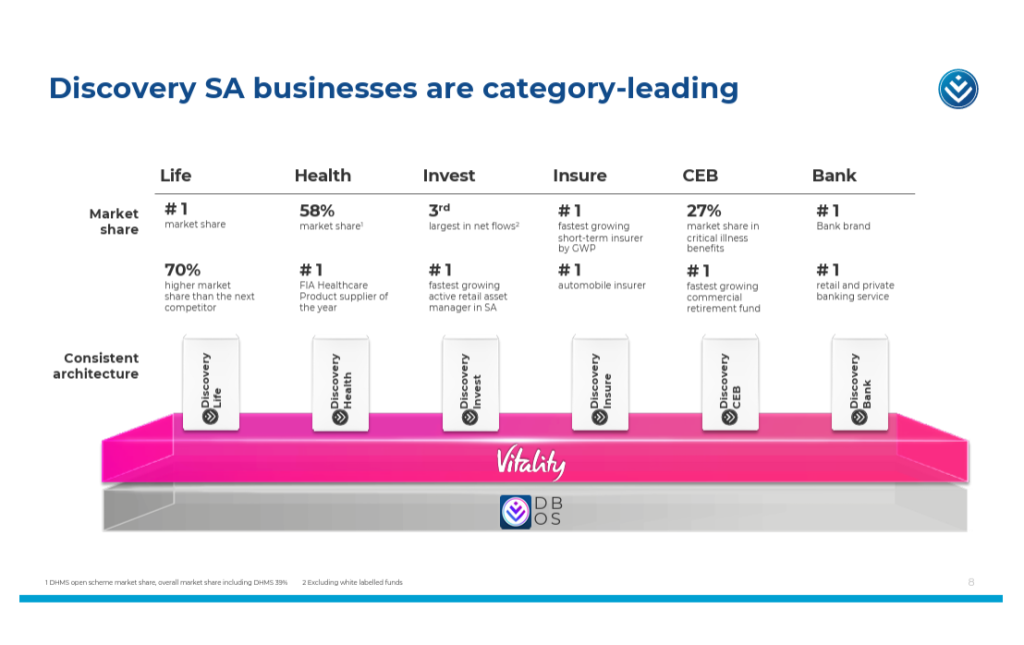

There’s a very cheeky slide in which they talk about Discovery being number 1 in every category they play in locally. But the metric changes each time e.g. for Discovery Life they use market share and for Discovery Bank they use “number 1 bank brand” – market share is what counts, in which case they are very far from being number 1 across a couple of verticals. I’m not sure why they dilute such an objectively excellent year with such an obviously skewed way of explaining their market positioning:

There are also some very interesting slides on the data they have on things like sleep duration and how this affects health and overall risk of vehicle accidents etc. This is of course the Vitality data that they’ve been building for years now, with the AI era making it even more powerful (and valuable) than before.

The five-year growth ambition for the group is a CAGR of 15% to 20% in profit from operations. Although the South African business is the most mature part of the group, they expect it to achieve a CAGR of 12.5% to 17.5%. Yes, the ecosystem will need to work very well for this to be achieved, but they are firmly on that path.

The presentation also included an update on trading for the first quarter of the new financial year. They are calling it a strong start, with decent new business growth numbers and favourable claims and persistency experiences vs. embedded value expectations (that’s good for profits).

The share price went through a significant recent sell-off, but seems to have positive momentum once more.

Equites Property Fund remains far more bullish on SA than the UK (JSE: EQU)

That’s just as well, as they’ve taken significant steps to bring capital home

Equites Property Fund released results for the six months to August. The narrative tells a more positive story about South Africa, although they note that a “broad-based recovery has yet to take place” despite the recent optimism. That’s a lot better than the UK, with 10-year gilt yields (government bonds in the UK) at historically high levels and the UK logistics property market stuck in a state of low growth.

Equites has made it clear that they are reallocating capital from the UK to South Africa and they’ve already done some significant transactions to make that happen. The narrative simply confirms that nothing has changed regarding that strategy.

For the interim period, like-for-like portfolio rental growth was 5.1% and valuations were up 4.0%, so that’s a solid combination. The loan-to-value ratio did come in a bit higher at 37.2% (vs. 36.0% in February 2025), but the all-in cost of debt thankfully dropped by more than 50 basis points to 8.3%.

The dividend per share was 3.8% higher, while distribution guidance for the full year has been reaffirmed at growth of between 5% and 7%.

The net asset value (NAV) is R16.93 and shares are currently trading at R16.05. The entire sector has seen a reduction in discount to NAV as prospects have improved.

Hammerson is enjoying decent momentum (JSE: HMN)

A ratings agency upgrade does wonders for debt costs and availability

UK property fund Hammerson had no trouble with a €350 million bond issuance that was 5 times oversubscribed. This issuance is part of the refinancing of the €700 million bonds maturing in 2027. It helps that Fitch upgraded the company’s unsecured debt rating and Moody’s revised the rating to a positive outlook.

Due to the timing of the bond issuance, they now expect full year earnings to be £101 million, ever so slightly down from previous guidance of £102 million.

The announcement also includes a trading update based on the summer months, where UK and French footfall were up by mid-single digits. As one would hope, properties that went through significant redevelopment and repositioning did particularly well. Importantly, they are achieving a significant rent increase in long-term lease agreements.

Pick n Pay’s like-for-like momentum is encouraging, but the group is still making losses (JSE: PIK)

Retail turnarounds are hard

Pick n Pay released a trading statement for the 26 weeks to August 2025. The group is unfortunately still loss-making, so we may as well get that out of the way. The headline loss per share has improved by between 50% and 60%, but it’s still a loss of between -54.31 cents and -67.97 cents. In absolute terms, the headline loss is between -R399 million and -R479 million.

So, there’s a long way to go. The key metric to watch is like-for-like growth in Pick n Pay SA, where they came in at 4.3% for the interim period vs. 3.6% in the 17 weeks to 29 June 2025 (in other words there was a strong acceleration towards the end of the period). In the previous interim period, they only grew 1.1%, so this is a significant improvement.

The franchise supermarkets have been a tough story. They are still lagging, with growth of 1.7% vs. company-owned supermarkets at 4.8%. Franchise also had a really easy base in this period, as the comparable period was a like-for-like decrease of -1.4%!

Clothing standalone stores were up 7.5%, with a soft base effect here as well thanks to growth of just 0.2% in the comparable period.

Total turnover growth for Pick n Pay is below like-for-like growth as they’ve been reducing the store footprint to try and shrink into profitability. This has dire long-term consequences, with key rival Shoprite (JSE: SHP) happily mopping up those sites and increasing their footprint. It’s also clear that Boxer (JSE: BOX) is still by far the best business in the Pick n Pay group.

The Pick n Pay share price remains in the red this year, reflecting how hard a turnaround actually is.

Nibbles:

- Director dealings:

- Three directors of Hyprop (JSE: HYP) have sold shares worth a total of R14.6 million. The announcement notes that this is the first sale in several years and that this is to rebalance portfolio exposures. The company also has minimum shareholding requirements in place for executives. Fair enough then.

- A director of a major subsidiary of AVI (JSE: AVI) received share awards and sold the whole lot to the value of just over R6 million. The company secretary of the listed holding company received awards and also sold all of them, with a total value of nearly R5.8 million.

- The financial director of Pan African Resources (JSE: PAN) bought shares worth R425k. That’s interesting timing, as the gold price is looking pretty spicy at the moment!

- Although Impala Platinum (JSE: IMP) announced dealings by many directors in relation to share awards, I don’t think there was enough of a pattern for us to really read anything into it. Thanks to the recent run in the PGM sector, the share awards ended up being worth meaty numbers for the execs!

- Schroder European Real Estate (JSE: SCD) has had a rough year in its share price and the recent valuation trend won’t do much to improve that. In the quarter ended September, the total portfolio value was up just 0.1% quarter-on-quarter. As you would expect, there are bigger swings at individual property level, mostly driven by the passage of time on existing leases and thus the changes to lease terms.

- After Silchester International Investors had lots to say in the media about the Barloworld (JSE: BAW) offer and the price they would be willing to accept, it turns out that they’ve now disposed of their entire holding in the company. So much for “at least R130 per share” then.

- City Lodge (JSE: CLH) announced that Entertainment Holdings and Tsogo Sun Investments – part of Tsogo Sun (JSE: TSG) – sold shares in City Lodge such that they now hold just 3%. Tsogo had a stake of over 10% that was acquired in 2023, so that’s a particularly interesting move.

- In August, Mahube Infrastructure (JSE: MHB) released a cautionary announcement regarding a potential buyout offer for the company by an existing shareholder. The company has renewed the cautionary announcement, as engagement between the independent board and the potential offeror is continuing. As this stage, there’s no firm intention to make an offer, so caution really is warranted here.

- Dr Leila Fourie is retiring as CEO of the JSE (JSE: JSE) at the end of March 2026, having been in the role since 2019. Valdene Reddy, currently the Director of Capital Markets at the JSE, has been named as Fourie’s successor.

- BHP (JSE: BHG) investors didn’t exactly form an orderly queue for the dividend reinvestment plan. Holders of less than 4% of total shares in issue elected to participate, with the rest happy to receive cash.

- Metrofile (JSE: MFL) announced that there are no longer any put or call option arrangements between Sabvest (JSE: SBP) and an associate of director Phumzile Langeni in relation to the company’s shares. It doesn’t seem like any dealings in shares happened as part of this.

- Labat (JSE: LAB) renewed the cautionary announcement regarding the potential disposal of certain subsidiaries to All Trading. Negotiations are ongoing.