Adcock Ingram shareholders give a resounding yes to the Natco Pharma deal (JSE: AIP)

No major surprises here

In July, Adcock Ingram announced that Natco Pharma wants to acquire all the outstanding shares in the company. The circular went out in early September and the shareholder meeting has now taken place. The deal was approved by 98.66% of shareholders in attendance.

I’m genuinely not sure what outcome the small number of dissenting shareholders were hoping for. The Natco Pharma offer of R75 per share is approximately 50% higher than where the share price was trading before the bid came to light, as shown on this chart:

There are still some outstanding conditions for the deal, but getting through the shareholder vote is a major milestone. The company will announce updated dates in due course.

A significant change of approach at MAS (JSE: MSP)

The new board is in no rush to pay dividends – or even to buy more properties!

With the dust having settled at MAS after a battle for control of the company, they’ve released an update to shareholders regarding the capital allocation plans going forwards.

Firstly, there are no guarantees that they will stick to Romanian real estate – or even real estate at all! The company is happy to move beyond the country and possibly even the sector, so that’s going to make it quite difficult for institutional investors to feel good about owning the shares. The individuals running the show at MAS are astute allocators, but that doesn’t mean that investors will be happy about a potential transition from property company to investment holding company. This is something to keep a close eye on, with MAS looking to sell properties that are expected to deliver lower returns than other opportunities.

On the balance sheet, MAS is repaying its 2026 bond ahead of schedule. The Development Joint Venture (DJV) has also redeemed €75.9 million of preferred equity, so cash has moved up the structure, but the DJV retains the right to recall this amount by notice.

Here’s another big change: the strategy is no longer focused on resuming dividend payments. Instead, MAS will look to optimise long-term shareholder value on a per share basis. This means share buybacks are much more likely than dividends.

There must be no shortage of churn on the shareholder register at the moment, as this is a huge change in strategic direction. MAS isn’t a REIT, so they aren’t forced to focus on dividends. They aren’t even forced to remain a property company!

Newpark REIT hit by negative reversions at the JSE building (JSE: NRL)

This is the problem with a highly concentrated portfolio

Most REITs on the market have a reasonable spread of properties in the portfolio, as the appeal for investors is that they can buy diversified property exposure. Newpark offers no such benefit unfortunately, with a portfolio of just four properties. This will soon be down to three properties, with the fund in the process of selling the property in Crown Mines.

This will leave them with two buildings in Sandton (the JSE and adjoining 24 Central) and a property in Linbro Business Park. Those Sandton properties might be iconic, but that doesn’t mean that Newpark has much negotiating power.

When a lease has been running for many years with escalations above market levels, then the expiry of that lease is an opportunity for the tenant to bring things back down to earth. That’s unhappy news for the landlord of course. This is exactly what happened at the JSE building, which is why Newpark’s results for the six months to August look so poor.

Revenue dipped 7.3% and funds from operations per share tanked by 24.5%. The loan-to-value ratio has increased from 43.1% to 44.5%. The good news is that at least the weighted average cost of debt has come down nicely from 9.3% to 8.9%.

The interim dividend of 26 cents per share is 13.3% lower than the prior year.

In terms of the outlook, the company originally expected funds from operations per share to be between 39 and 46 cents for the year ending February 2026. They’ve revised this higher to between 41.50 and 48.50 cents.

There’s just about no liquidity in the shares, so this is most useful as a cautionary tale around concentrated portfolios and the risk of negative reversions.

SA Corporate Real Estate is keen to own more residential property (JSE: SAC)

This is buy-to-let at scale

Residential property isn’t a popular choice among REITs. They far prefer owning shopping centres and industrial properties, while trying to do the best they can with problematic office portfolios. At SA Corporate Real Estate though, they are no strangers to residential property or the resilient underpin that this asset class can provide when you have a large enough portfolio of apartments.

The residential investments are typically made through Adhco Holdings, so SA Corporate has a dedicated structure in place for them. The latest deal is the acquisition of Parks Lifestyle Apartments at Riversands for R1.68 billion. Talk about buy-to-let at scale!

The development is near Steyn City and comprises 1,960 residential units from bachelor to three-bedroom apartments. R31 million of the purchase price is deferred until the final block of 40 units is built, taking the total development to a juicy 2,000 units.

The plan at SA Corporate is usually to buy large portfolios and then drip feed them into the market while earning rentals on the remaining properties. They believe that they can offload these units at yields under 8% and they can sell other residential units within the broader residential portfolio for yields under 8.5%.

Or, put differently, buying residential apartments is a really bad investment when you buy just one apartment, but it’s not bad if you can get your hands on them in bulk and then sell them off slowly.

Even then, the net operating income on this portfolio is expected to be R159.6 million in the year ending December 2026. That’s a forward yield of 9.5%. Once you take off the expected cost of debt, the expected profit before tax is R80.5 million. They are expecting to do the deal on a loan-to-value ratio of 57%, so the equity outlay is R719 million. This means an expected return on equity in 2026 of 11.2% excluding the benefit of selling any of the units.

As you can see, the returns on residential property aren’t amazing even when you can do deals at this scale. The problem is that property prices in Joburg show very little capital growth, so investors are reliant on yields. But with the market happily buying SA Corporate Real Estate shares on a yield of just 7.5%, they can do deals like these to create shareholder value.

Facing a perfect storm for the balance sheet, Sappi is digging for every coin between the couch cushions (JSE: SAP)

You won’t be seeing a dividend this year

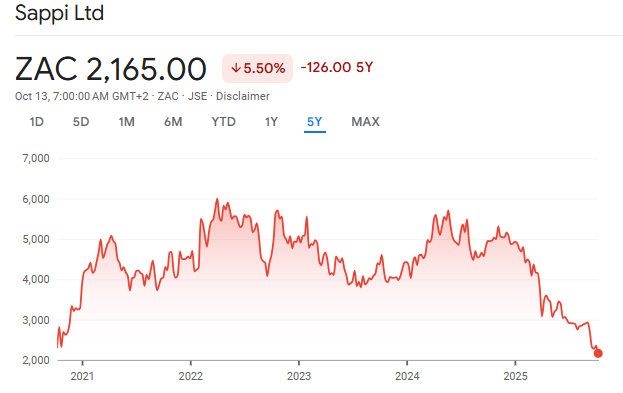

Sappi’s share price is down a rather spectacular 56% year-to-date. You know it’s bad when you would’ve been better off buying a new car on 1 January than buying shares in Sappi. At least you can drive the rapidly depreciating car, which is a lot more fun than watching your Sappi position implode.

In a situation that isn’t unfamiliar to regular readers, we have a classic case of a company that ran the balance sheet too hot before the market washed away from them. This often leads to a rights issue to plug a hole in the balance sheet, as we saw recently at the likes of Gemfields (JSE: GML). Although Sappi doesn’t make mention of the words “rights issue” (companies rarely do unless they are out of options), they are certainly doing everything possible to avoid landing up in that situation.

They have a few obvious levers to pull, like suspending the dividend for FY25. They’ve also adjusted their capital expenditure for the next two years, with no expansionary capex planned. That makes sense, as expanding into a weak market doesn’t seem smart.

It’s a good start, but the real key is having the support of the banks. Sappi has access to $800 million through existing cash and revolving credit facilities, but debt covenants are a problem because of the poor operating environment and its effect on earnings. The banks have agreed to increase the leverage covenant levels for the next year, so that’s a temporary solution. Sappi is also looking to extend the revolving credit facilities and to “term-out” a portion of debt with a new 5-year term facility.

The share price closed 5% higher on the day, so the market appreciates the efforts. Still, it takes a brave soul to buy this chart:

Nibbles:

- Director dealings:

- Jan Potgieter, the ex-CEO of Italtile (JSE: ITE), sold shares worth R4.6 million. His long journey with the company has come to an end as he is also leaving the board, so I’m not overly surprised to see some share sales from him.

- The CEO of ADvTECH’s (JSE: ADH) resourcing business sold shares in the group worth R3.4 million.

- The company secretary of Growthpoint (JSE: GRT) sold shares worth R1.6 million.

- Des de Beer is back at it with Lighthouse Properties (JSE: LTE), buying shares worth R1.4 million.

- Harmony Gold’s (JSE: HAR) acquisition of MAC Copper in Australia has become legally effective, which means that Harmony will be the proud owner of the mine with effect from 24 October.

- Back in February 2025, Merafe (JSE: MRF) announced that its joint venture with Glencore (JSE: GLN) had entered into an enhancement under the legacy agreement with Sibanye-Stillwater (JSE: SSW). The plan was to accelerate the delivery of contracted chrome volumes and for the joint venture to take operational control of the majority of chrome recovery plants at Sibanye’s local PGM operations. The latest update is that the Competition Tribunal has granted unconditional approval to the consolidation of management of various plants that are currently separately owned and operated by the joint venture and Sibanye.

- Standard Bank (JSE: SBK) confirmed that the SARB’s Prudential Authority has approved the appointment of David Hodnett as the CEO of Standard Bank South Africa. His appointment is therefore effective 10 October 2025 i.e. immediately.

- The format of disclosure on the Australian Stock Exchange means that it isn’t the easiest thing to follow the details of the current capital raising efforts at Orion Minerals (JSE: ORN). The company has issued A$1.26 million in shares and has secured further commitments for A$4.4 million. But if you go back a couple of announcements, they previously indicated that the raise had been increased to $8.6 million, so I presume that this is still the total planned amount. Just to add an additional announcement into the mix, the company confirmed that Ratel Growth, which currently has an 8.3% stake in the company, acquired additional shares for A$2 million. I can only assume that this is part of the capital raise.

- Mondi (JSE: MNP) announced the results of the dividend reinvestment plan. Across the UK and South African share registers, holders of a total of 4.26% of shares in Mondi elected to reinvest the dividend. When you consider how severely the share price has dropped, it’s quite amazing that more holders didn’t choose to average down at these levels and reinvest their dividends.