A mega jump in profits at Adcorp (JSE: ADR)

And off such modest revenue growth, too

Adcorp has released results for the year ended February 2025. Revenue increased by 2% and gross profit was up 3.5%, with the fireworks happening below those lines – operating profit jumped by 33.3% and HEPS was substantially higher at 134.5 cents, a 61.6% increase. Nice!

With the final dividend more than doubling to just over 50 cents, there’s solid cash quality of earnings and management is clearly feeling more confident.

This isn’t an easy business to run, with the workforce solutions provider industry under pressure. Achieving any revenue growth at all is commendable, with Adcorp having to focus on cutting costs and seeking out the highest margin opportunities.

The balance sheet is now in a strong position, with a net cash balance of R442.1 million. The market cap is R665 million, which means that approximately one-third of the market cap is attributable to the operations. The Price/Earnings multiple of Adcorp is thus very misleading, as the truth is that roughly two-thirds of the share price of R6.50 is attributed to cash. The remaining ~R2.20 per share can be compared to HEPS of 134.5 cents, which means the P/E is more like 1.6x!

And yes, I have a small long position here.

There’s renewed optimism at African Media Entertainment (JSE: AME)

The radio assets remain the highlight

After such a rough time during COVID for radio assets, it’s great to see that African Media Entertainment has continued to recover. A huge part of the revenue in this space comes from events organised by radio stations, hence why COVID was such a problem.

For the year ended March 2025, revenue increased by 9%. Although operating profit was higher, there were impairment reversals at play in both periods. As always, I therefore prefer to look at headline earnings per share, particularly as this also considers financing costs that moved higher in this period. The revenue growth wasn’t sufficient for HEPS to head in the right direction, with a 4.9% drop in HEPS. The total dividend for the year was steady at 450 cents per share.

Algoa FM did particularly well, with the aforementioned initiatives like events coming in as a positive contributor. I was also very pleased to see that Moneyweb achieved growth in revenue. I’ve been partnering with Moneyweb for roughly a year now on a podcast called Supernatural Stocks and it really has been a joy to work with the team there.

The group is now stable and has a reasonable foundation off which to build.

AYO Technology’s loss has worsened (JSE: AYO)

As a reminder, Sekunjalo is looking to take the company private

AYO Technology has released results for the six months to February 2025. They expect the headline loss per share to further deteriorate to 45.09 cents.

Because maths (and apparently proofreading) is hard, they go on to suggest that this is a difference of between 26% and 46% vs. the comparable period. Obviously, they meant to give a range for the headline loss instead of a point estimate. 45.09 cents is smack in the middle of that guided range, so someone wasn’t concentrating.

Much as they like to blame the media and everyone else for their issues, perhaps they should consider whether the share price drop is at least partially due to their headline losses and general lack of care?

Delta Property Fund is still just treading water (JSE: DLT)

The loan-to-value ratio just will not budge

Delta Property Fund has a portfolio of 83 properties across South Africa. This is very much a polony portfolio, consisting of a mish-mash of undesirable things that roll up into something that is barely edible and unlikely to be good for you.

Last year, they had 89 properties. The fund is doing its best by trying to sell off what it can, making tiny dents in the debt along the way. The problem is that the loan-to-value ratio has actually ticked up slightly from 59.4% to 59.5%, so these efforts are proving to be futile at the moment.

There are some green shoots. Although rental income fell 1.9%, net operating income increased by 10.3% thanks to cost optimisation and selling off some of the really bad properties. Although there’s a net loss of R104.2 million for the year, this was due to non-cash fair value losses of R222.5 million. This is also why the loan-to-value remains stubbornly high, as the value is going the wrong way. Funds from operations per share did come under pressure though, decreasing by 19.3%.

The vacancy rate improved from 33.4% to 31.9%, helped by the disposal of six properties that had few or no tenants. Getting the tenants who are in place to pay is another problem, with a collection rate of only 95.1% of billings.

The good news is that major bankers have renewed the group’s facilities out to April 2026 and in same cases to June 2027. The banks are enjoying themselves at this carcass, helping to keep it alive and earnings juicy interest payments along the way.

This patient is still in ICU, but has been stabilised at least. It’s now about the recovery process and avoiding any major setbacks.

Deneb needs to get out of its property portfolio (JSE: DNB)

The otherwise decent operating results are being obscured

Deneb Investments, part of the HCI stable (you’ll see that a lot in Ghost Bites today), grew revenue by 6.3% and improved gross margin by 50 basis points. To add to the happiness of gross profit growth of 8.5%, they kept operating costs to an increase of just 5.9%. But underneath all this, it gets a lot more interesting.

The property segment saw revenue fall by 11% and operating profit by 24%. They refer to this as a “little disappointing” but I think we can all agree that it’s a lot worse than that. Although one of the factors here is the disposal of properties, they also have a major vacancy to contend with and a provision for bad debts.

The question that springs to mind is: why? Why do they own a property portfolio in the first place, which is a completely different risk/reward setup to the operating businesses?

Speaking of the operating businesses, the branded product distribution segment was good for revenue growth of 4.4% and impressive operating profit growth of 21%. The manufacturing segment grew revenue by 8.4% and operating profit by 21.1%.

Deneb has owner-occupied property worth R302 million and investment property worth R957 million. This balance sheet is screaming for a restructure and value unlock. Mothership HCI isn’t scared of property exposure though, so one wonders if Deneb would be allowed to get out of that space even if they wanted to.

eMedia laments the local “advertising cake” (JSE: EMH)

But at least they enjoyed a largest slice of it

eMedia, part of the HCI group and the owner of the various e.tv (and other) businesses, grew revenue by 3% in the year ended March 2025. This is despite national television advertising revenue decreasing for the year, which means that eMedia increased its market share of the “advertising cake” that they refer to.

They have the highest market share in local prime-time audience viewing at 34.4%, above DStv at 30.5% and SABC at 26%. You can only show Anaconda so many times (yes, even you e.tv), so they have to spend a fortune on local content to maintain a prime-time audience that wants to enjoy South African storytelling. This pressure on content costs led to a drop in profits, as there just isn’t enough advertising growth to support the underlying increase in content spend.

So, with all said and done, HEPS fell by 10% to 45.63 cents. They make it clear that the dividend is important (HCI is very focused on upstreaming cash at the moment), so the dividend was only 6.3% lower at 15.00 cents. The low payout ratio is an indication of how capex-intensive this business is.

Frontier Transport’s debt costs dragged earnings lower (JSE: FTH)

It’s expensive to upgrade the fleet

Frontier Transport is also part of the HCI stable. This is a solid business with a strong reputation for being an excellent operator of bus companies. This makes it quite a capex-intensive business though, particularly during a period of heavy investment in the fleet. They commissioned 19 electric buses into active service in the year ended March 2025 and those don’t come cheap.

The underlying business is doing well, with revenue up 16.5%. Operating costs increased by even more though, leading to EBITDA being only 10.9% higher – still a decent outcome.

The problem is that debt levels have shot up, leading to much higher net finance costs. This results in HEPS being down 3.5% for the period.

Despite the levels of debt and the pressure on earnings, the total dividend for the year was 30.4% higher. It’s hard to believe that this is the best thing for Frontier’s balance sheet as opposed to the best thing for HCI’s balance sheet further up. HCI holds roughly 82% in Frontier.

HCI’s hotel investment is the highlight (JSE: HCI)

And smaller oil and gas losses, if you can call that a highlight

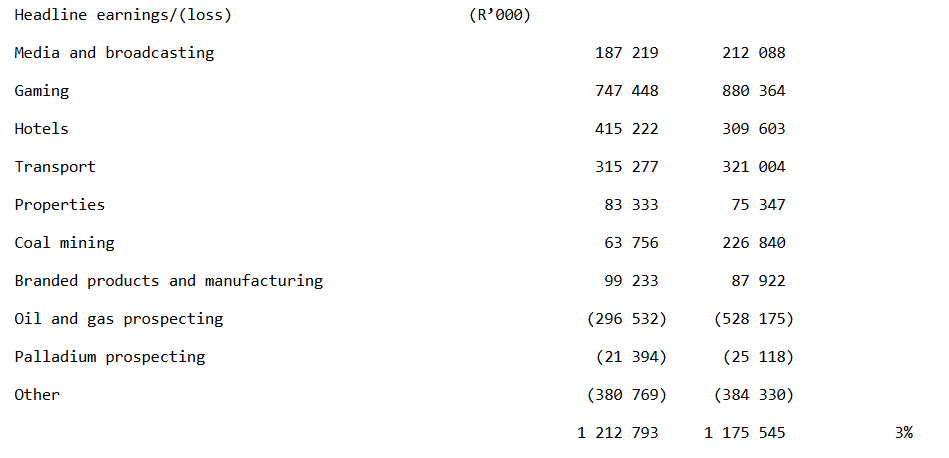

As you’ve probably noticed by now, Hosken Consolidated Investments (HCI) holds a number of listed and unlisted investments. The best way to reflect this is to just show you the numbers from the horse’s mouth. You can’t see it on the screenshot, but the numbers on the left are for the year ended March 2025 and are therefore the latest numbers:

As you can see, earnings were down in media and broadcasting, gaming (a major worry), transport (only slightly though) and coal mining (another major worry). The hotel investments were without a doubt the highlight, along with a much smaller loss in oil and gas.

The listed companies of relevance here are Tsogo Sun, Southern Sun, eMedia, Deneb and Frontier Transport Holdings, all of which have separately reported. Montauk Renewables is also a small contributor, along with Platinum Group Metals Limited and African Energy Corp. I’m not going to rehash each of those here.

Essentially, HCI finds itself in a situation where the gaming revenue (casinos) is at serious risk. The trajectory in that sector is a problem, evidenced by large impairments recognised on the underlying assets. Although the hotels offset most of that drop in this period, I would argue that gaming has further to fall than the hotels have to gain. Once you add on cyclical exposures like advertising (in media and broadcasting) and especially coal mining, you have a less-than-ideal base off which to be funding risky investments in oil and gas prospecting.

Head office non-current borrowings have jumped from R778 million to R2.6 billion. Combined with the pressure being put on the underlying businesses to maintain or increase their dividends, you would therefore expect to see the dividend at HCI being flat at best. But despite HEPS being just 3% higher, the HCI dividend for the year is up 70%. Yes, they have a very low payout ratio, but is this really the best use of capital when the share price is down almost 20% over 12 months?

These Lewis numbers are spectacular (JSE: LEW)

Is this a fluke or are they really a growth stock now?

For the longest time, Lewis has been a value investor favourite. They’ve done all the right things in terms of capital allocation, using share buybacks as a way to juice up returns to shareholders from otherwise modest revenue growth.

But now, as the results for the year ended March 2025 show us, Lewis is looking more like a growth stock. Revenue increased by 13.5%, gross profit margin was up 30 basis points to 43.4% and operating profit jumped by 66.9%. HEPS was up 60.3% to R14.83 per share, capping off a wonderful year. As icing on the cake, cash quality of earnings is evidenced by a 60% increase in the dividend.

Interestingly, return on equity is now at 15.4% vs. 9.3% in the prior period. This shows you that the group was previously earning sub-economic returns, which would’ve been the major reason for the subdued valuation. Even at 15.4%, I think they are still below their true risk-weighted cost of equity. Their medium-term target is 15%, which in my view is too low given the cyclical nature of the underlying business and the risks that it faces.

Credit sales were the growth driver here, up 12.1% vs. cash sales up 3.4%. Although some have pointed to the two-pot system to try and explain the recent Lewis numbers, the credit sales growth puts this argument to bed once and for all. Two-pot withdrawals would’ve boosted cash sales, not credit sales.

The debtors book looks healthy, with satisfactory paying customers at record levels as a percentage of the total book.

It really is a sign of the times at Lewis that there were no share repurchases in the second half of the year. But despite the share price being up more than 80% over 12 months, they are still only on a P/E of 5.6x!

Still no sparks at Old Mutual (JSE: OMU)

If you’re looking for excitement, you won’t find it here

Old Mutual released a quarterly update for the three months to March. As is usually the case, they are light on growth.

For example, Life APE sales dipped by 2%, in some respects due to the timing of lumpy corporate sales. On the plus side, gross flows were up 6% thanks to inflows in areas like wealth management and private clients.

Here’s the really ugly number though: net client cash outflow came in at R4.8 billion, a massive negative swing vs. positive inflow of R166 million in the comparable quarter. There was a R6.4 billion outflow from a large offshore investor. Although this is a low-margin indexation flow, it’s still a big number in the wrong direction. They also note R3.6 billion in outflows from the exit of unprofitable business in Old Mutual Corporate. There might be some cleaning of house here, but that’s still a really worrying net number.

Loans and advances were flat year-on-year, with Old Mutual’s cautious approach continuing.

And finally, gross written premiums grew 7%, with Old Mutual Insure as the star of the show with growth of 12% in premiums and an underwriting margin well above their 4% to 6% target range. The African business unfortunately dragged down the overall performance for this metric.

Old Mutual expects to launch its bank publicly later this year. I’m still not sure that South African needs another bank, but perhaps the group will surprise us with something interesting.

Sea Harvest’s earnings are up (JSE: SHG)

It’s anyone’s guess by how much

The rule for a trading statement is that a company must notify the market when they expect earnings to differ by at least 20% to the comparable period. Of course, most companies try and give a much tighter range than that. From time to time though, you see companies give the bare minimum disclosure i.e. that earnings will differ by at least 20%.

The trick here is that Sea Harvest is giving this guidance for the six months ending June. In other words, they are already so far ahead of the comparable period that they feel that they need to give this guidance to the market. As they conclude the period, they will give tighter guidance.

They have attributed this improvement to better catch rates, efficiency gains and sales price increases in the South African fishing business. These are all high quality reasons for growth in earnings, which is why the share price jumped 4% on this news.

SPAR is scaling back and trying to focus (JSE: SPP)

Two of the European businesses are up for sale

It’s been a long and painful post-COVID journey for SPAR. The share price is 36% lower than it was 5 years ago. I must remind you that this means it’s lost more than a third of its value since May 2020, back when the world was rather insane.

Poland was the worst part of the story, sure, but there have been other issues. SPAR has lost ground to the likes of Checkers locally, with Shoprite’s Sixty60 offering posing some serious questions about the relevance of SPAR’s convenience model. I still shop at my local SPAR because it’s quite brilliant really (shout out to the owners of SPAR at The Paddocks in Milnerton). The group level numbers tell a different story though.

To help clean up the group, they’ve decided to sell SPAR Switzerland (I’m not surprised at all) and Appleby Westward Group (AWG) in South-West England. The latter comes as a surprise, but perhaps SPAR has learnt from previous experiences and would rather sell a business that isn’t in dire straits.

This means that the continuing operations consist of SPAR Southern Africa and SPAR Ireland. For the 26 weeks to 28 March 2025, diluted HEPS from these businesses is expected to be between 0% and -15% lower than the previous year. You could also look at comparable earnings from continuing operations, which makes adjustments for the reporting calendar, in which case the expected diluted HEPS range is -5% to 5%. A further read suggests that both the Southern Africa and Ireland businesses saw improved margins and decent top-line performance in this period, with the translation of the Irish earnings into rand as one of the drags. We will have to wait for detailed earnings before jumping to any conclusions.

As for the discontinued operations, they’ve recognised R4.2 billion in impairments in anticipation of selling these businesses. This comes after the loss on disposal of R531 million in Poland. SPAR is essentially drawing a line in the sand here, cementing itself as a great example of disastrous offshore expansion by a local retailer (an ever-growing club) and giving itself a base off which to recover.

If you include the discontinued operations, diluted HEPS fell by between -34% and -24%. There’s no way that they could release numbers like this without it being accompanied by a plan to stop the bleeding.

Come home, SPAR.

Nibbles:

- Director dealings:

- The business development director of AVI (JSE: AVI) received share awards and sold the whole lot worth R6 million.

- An associate of the CEO of Spear REIT (JSE: SEA) bought shares worth R71k.

- After 10 years as CEO, Gary Chaplin has resigned as CEO of KAP (JSE: KAP). He certainly guided them through some pretty crazy times, not least of all the collapse of major shareholder Steinhoff. There’s always a mix of good news and bad news at KAP, so this wouldn’t have been an easy decade. CFO Frans Olivier is stepping up to the top job with effect from 1 November 2025. He’s been with KAP for 19 years, so there’s plenty of institutional knowledge there.

- There is minimal liquidity in the stock of Afine Investments (JSE: ANI), a REIT focused primarily on owning forecourts. They have properties across four provinces. Although distributable earnings increased by 13.24% overall for the year ended February 2025, the thing that really counts (the dividend per share) was actually down 0.24% vs. the comparable period.

- Clientèle (JSE: CLI) had to make some tweaks to its funding structure for the Emerald Life acquisition. This necessitated a shareholder vote. The resolutions achieved almost unanimous approval.

- Stefanutti Stocks (JSE: SSK) is still in the process of disposing of SS-Construções (Moçambique) Limitada. As reported in the recent group financials, this is one of the key steps in the financial restructuring of the group. The parties are currently renegotiating fundamental aspects of the deal like the purchase price and payment terms, with the period for fulfilment or waiver of the conditions precedent being extended to 30 June 2025.

- Altvest (JSE: ALV) has published the financials for the Altvest Credit Opportunities Fund, which is the reference asset for the C preference shares (JSE: ALVC). They funded over 30 SMEs and extended over R240 million in structured credit in the latest period. This is an early-stage venture, but I would say that it is the most scalable of all the Altvest projects at the moment. They did at least make a profit before impairments this time around, but they have to get a lot bigger to cover their operating expenses. If you’re interested in what they are doing, you’ll find the report here.

- Cash shell Trencor (JSE: TRE) is finally proposing the resolution for the winding-up of the company and the distribution of value to shareholders. A special dividend of 90 cents per share in anticipation of the winding-up has been declared.

- Supermarket Income REIT (JSE: SRI) has gone through the process of internalising its management company. As part of this, they want to transfer their listing in London from the closed-ended investment funds category to the equity shares (commercial companies) category of the Official List. This may sound like just pushing paper around, but it does impact things like which companies they are compared to and which funds might be willing to hold them. There will also be a genuine cost saving, as there’s an additional regulatory burden that comes with the closed-end investment funds categorisation.

- Tony Phillips has resigned as chairman of Mpact (JSE: MPT) with immediate effect. Sbu Luthuli, currently an independent non-executive director, will be taking his place. This came as a surprise to the company and they have amended the resolutions for the upcoming AGM accordingly.

- Brikor (JSE: BIK) announced that results for the year ended February 2025 will be delayed until mid-June due to circumstances “beyond the board and management’s control” – whatever those might be.

- As part of fixing the sad and sorry state of its balance sheet, Deutsche Konsum (JSE: DKR) has agreed that VBL will swap existing debt exposure of EUR 86 million for the issue of additional shares. There are of course various nuances at play here. They aim to finalise the overall restructuring negotiations by August 2025, with the hope being to reduce the expected property sales until 2027.

- Globe Trade Centre (JSE: GTC), which has close to zero liquidity in its shares on the JSE, released results for the three months to March. Rental revenue was up 9%, but funds from operations as well as profit dipped significantly year-on-year. The net loan-to-value ratio remains high at 52.1%. There’s also been a change in management, with the supervisory board resolving to replace the president of the management board. Corporate governance structures are quite different in Europe. With an upcoming bond repayment of €500 million in 2026, the board has also decided to suspend dividends at the fund. All is not well.