Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Covid didn’t kill this radio star (JSE: AME)

African Media Entertainment is bouncing back strongly

Although we were all forced to stay home and stay safe during the pandemic, it actually wasn’t a good time for radio stations. Many of the smaller stations are dependent on being part of the events ecosystem of their hometowns. During the pandemic, there were no events to be part of!

Things have thankfully improved tremendously for African Media Entertainment, with the six months to September reflecting revenue growth of 11% and operating profit growth of 34%. Headline earnings is up 27%. Even better, HEPS is up 39% to 207.3 cents.

Despite all this, the dividend is flat at 100 cents per share.

I always pay attention to the commentary around Moneyweb for obvious reasons. Digital and radio revenue is higher than the previous year, with that business looking at alternative business strategies to achieve revenue growth.

It’s worth highlighting that the company also has an indirect economic interest of 29.9% in Kaya FM, achieved through a 100% economic interest in Mokgosi Holdings.

City Lodge shows signs of life in its pricing (JSE: CLH)

The food and beverage strategy also continues to pay off

Earlier this week, I wrote about Southern Sun and how I prefer the leisure-style offering to a more business-focused offering, while also acknowledging the solid job done by City Lodge in pivoting the business in response to consumer changes.

A voluntary operating update by City Lodge shows that those management interventions are starting to really bear fruit. The comment that surprised me is a note that both leisure AND corporate travel have recovered to pre-Covid levels. The three months to September 2023 saw occupancies rise to 62%.

Now, occupancy is one thing, but pricing is quite another. It’s easy to fill rooms at a low price, which has been the issue plaguing City Lodge in the post-pandemic recovery. It’s good to see that average room rates in South Africa are 9% above the prior comparative period, after increasing 12% in FY23.

I like the 44% increase in food and beverage revenue for the quarter. I also like the net cash position, with R100 million in the bank and R70 million in debt. There are substantial undrawn facilities. The balance sheet is important, as there is significant reinvestment needed in the hotels, particularly after the pain of the pandemic and deferred projects.

Importantly, the group generates 16.3% of its energy requirements from solar renewable energy. And, not to scare you, but a water resilience strategy is a key focus area!

Unsurprisingly, the market liked this update.

Delta Property Fund sells a Port Elizabeth property (JSE: DLT)

This makes a very, very small dent in the debt

Delta has agreed to sell a property in Port Elizabeth known as Cape Road for R33 million. It has a 69.3% vacancy rate and was last valued at R36.6 million. Despite the vacancy rate, it was generating an operating income of just over R1 million.

Delta is trying to sell assets to reduce its loan-to-value ratio. This sale barely touches sides, with the loan-to-value down by 20 basis points from 61.4% to 61.2%. Vacancy levels will decrease by 20 basis points from 32.9% to 32.7%.

Transfer will hopefully be completed by March 2024.

Frontier Transport Holdings is a lesson in cost control (JSE: FTH)

Here’s a perfect example of how modest revenue growth can do big things

Frontier Transport is one of those companies that never seems to be on the radar for retail investors. Operating a bus service isn’t exactly a swashbuckling way to make money, yet here we are with Frontier reporting a jump in EBITDA of 42.6%. Most impressively, that’s been achieved off revenue growth of 6.9%.

How, I hear you ask? Expenses only increased by 1.1%, which really is an impressive outcome. Once you factor in net finance income and profit from the N2 Express service (which is equity accounted), there’s a 62.9% increase in attributable profit.

Perhaps the most important thing about Frontier is the role it plays in the transport infrastructure. The reality of the situation is that this is the only viable alternative to taxis in the broader Cape Town region. On top of that, Frontier has businesses that play in adjacent transport verticals like luxury coach tours.

Notably, the increase in the dividend has been far more modest than the 64% increase in HEPS. The dividend is up by only 10% to 24.2 cents.

KAL Group shows excellent cost control (JSE: KAL)

Like-for-like growth is hard to come by, though

This period saw the inclusion of a full year of performance at PEG Retail Holdings (the fuel business) being included in KAL Group’s results. In the prior period, it was only included for three months. This obviously limits comparability.

Instead of looking at revenue growth of 42.7%, I would focus on like-for-like growth of just 5%, which shows that things aren’t easy out there in the agri space. I did find it impressive that gross profit is up 45.7%, reflecting higher gross margin despite the lower margin fuel revenue playing such a role. This talks to improved margins within the retail business.

The real win is like-for-like expenses falling by 2.1%. They also calculate this metric excluding load shedding, in which case it fell 3.7%. That’s really impressive.

Headline earnings increased by 20.7% and recurring headline earnings grew by 14.7%. HEPS was only up by 11.1% though and the dividend for the full year was 7.1% higher. The difference between headline earnings growth and HEPS growth isn’t because of a change in the number of shares. It’s actually because of a large increase in non-controlling interest year-on-year. HEPS is calculated based on headline earnings attributable to ordinary shareholders of KAL Group.

Overall, KAL Group has done well, but the announcement sets out the many challenges being faced in the agri environment. The PEG fuel business is doing well, with the company showing a mature approach by disinvesting from four underperforming sites that don’t meet return on invested capital requirements.

The market liked it, with the share price closing 5.9% higher.

Mahube Infrastructure: powered by the sun and the wind (JSE: MHB)

A trading statement drove a jump in the share price – but watch the spread

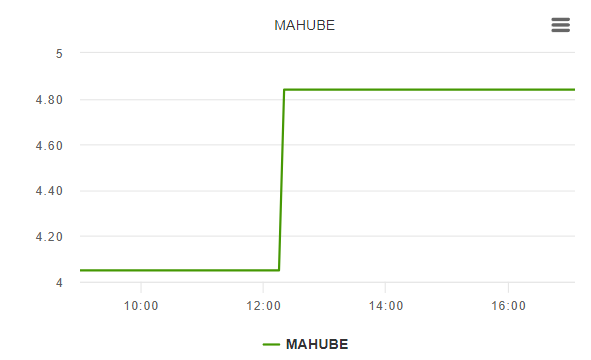

Whenever you see a big jump in a small cap, make sure you check the intraday chart to see whether there were various trades or just one. Here’s the intraday Mahube Infrastructure chart from Moneyweb:

As you can see, it’s not the most liquid chart around. When it looks more like a tetris piece than a worm, you need to tread very carefully. The best bid is R4.03 and the best offer is R4.85.

This lack of liquidity is despite HEPS for the six months to August moving higher by between 56.6% and 73.1%, driven by higher dividends from the solar businesses in which Mahube is invested, as well as a positive fair value movement linked to the wind power plant investments. That move is based on an upward revision in long-term assumptions around the project.

I would give the dividend a lot more weight than the fair value moves.

Detailed results are due to be published on 30 November.

Read the Mr Price numbers very carefully (JSE: MRP)

This period was all about the inclusion of Studio 88 in the numbers

Whenever a group has executed a major acquisition, you need to be really careful with how you interpret the growth rates. Companies can literally buy growth in revenue etc. through acquisitions. That doesn’t tell you anything about how the rest of the group is performing.

For example, in the 26 weeks to 30 September, Mr Price’s revenue is up 26.4% including Studio 88 and just 3.5% without it. Comparable store sales fell 0.8% despite being in an inflationary environment, which means volumes were sharply negative.

There’s another nuance here. When a company makes acquisitions for cash, then headline earnings per share should be boosted by the acquisition, although funding costs can offset that benefit. When an acquisition has been paid for with shares, the rubber hits the road at headline earnings per share level, as there are more shares in issue. And of course, there’s still the core group business to consider and how it performed in the same year as the acquisition.

Mr Price paid for Studio 88 using existing cash resources, so one would expect to see a jump in HEPS because earnings have been bought for cash rather than shares. Instead, we see HEPS down by 9.3%. That’s a really poor outcome.

Reasons for this range from load shedding through to a highly promotional environment that hit gross margin. Mr Price also notes that Studio 88’s revenue is seasonal and weighted more towards H2. Another important point is that Studio 88 is a lower margin business than the rest of the group, contributing to a drop of 170 basis points in gross margin. If we exclude Studio 88, we see gross margin down 100 basis points for this period. It was a tale of two quarters, down 350 basis points in Q1 and up 190 basis points in Q2 as excess inventory was cleared.

Perhaps the gross margin trend is what the market liked about these results, as I can’t see much else to like. The fact that expenses excluding Studio 88 grew by 6.1% certainly doesn’t help.

Perhaps the market took some heart from the Apparel segment growing retail sales by 5.1% excluding Studio 88, although comparable sales only grew 0.5%, so that’s really clutching at straws. The Homeware segment saw sales drop 1% and comparable retail sales fall 5.5%, with the only real highlight being Yuppiechef with double digit growth because that business has strong market positioning. The rest of the players in this market are a dime a dozen, with ever-increasing levels of competition.

Another headwind is that Mr Price funded the deal using existing cash, so the net finance expense is up 88.3% to R336 million.

And on top of all this, there are huge issues at the ports that are likely to cause supply challenges over the festive season.

Despite all this, the market decided to put 10% on the Mr Price share price in morning trade. I’ve learnt enough hard lessons in the market not to ignore the price action. I just for the life of me cannot see the good news story here.

This year at Spar was not Good For You (JSE: SPP)

Hopefully, the worst is now behind them

Spar has released a trading statement for the year ended September 2023. Operating profit has fallen sharply from R3.4 billion to between R1.6 billion and R2.0 billion. Based on that, it’s little surprise that HEPS is down by between -53% and -43%. That’s an expected range of 545.4 cents to 661.5 cents, with the share price at R113 in morning trade.

Aside from the obvious competitive challenges and the state of the South African consumer, there was a disastrous SAP project at the KZN distribution centre. Spar reckons this had an impact of R720 million in lost profits.

Earnings per share is down by between -86% and -76%, with the bigger hit vs. HEPS coming from various impairments, including in the international operations.

And in addition to the operating profit pressures, there was an increase of R433 million in net finance costs due to higher interest rates. The group highlights that financiers are supportive of the group and have agreed to amendments to banking covenants.

When a company makes a comment like this, you know it’s been rough: “At this stage, the Group does not intend to raise any capital from Shareholders.”

Trematon is returning capital to shareholders (JSE: TMT)

The company is frustrated with the realities of being listed

Trematon makes it quite clear in its results for the year ended August that structural issues in the local market mean that investors in JSE-listed investment holding companies will find it difficult to exit at full value. In other words, the discount to intrinsic net asset value (NAV) is an unavoidable problem.

There’s a strong element of truth in this, although most investment holding companies on the JSE have brought these problems upon themselves with high management fees and mediocre performance. Trematon wants to get to the point where all the portfolio companies are self-funding, at which point the annuity income will either improve the market rating or the company will look at other ways to return value to shareholders.

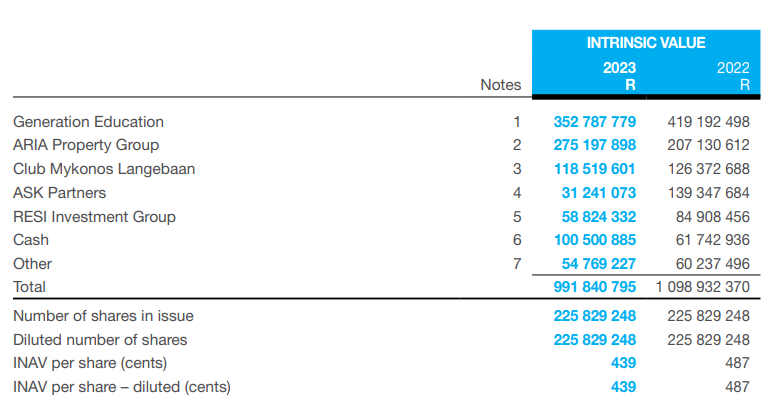

Trematon’s intrinsic NAV is 439 cents and the share price is R3.00. I’ve seen far worse in the way of discounts on the local market. Generation Education and Aria Property Group make up 63% of the group’s intrinsic NAV.

For those interested in the Generation business, operating profit increased from R9.5 million to R17.1 million and the group has acquired a new school in Modderfontein, Gauteng. Despite this, the value of Generation in the intrinsic NAV has fallen based on a more conservative approach to revenue forecasts in the discounted cash flow model.

Unfortunately, much as Trematon may bemoan the structural issues on the JSE, the reality is that intrinsic NAV has fallen from 487 cents to 439 cents. It’s tough out there and investors know it. Here’s the breakdown:

In an effort to try narrow the gap, a capital distribution of 32 cents has been declared, down from 40 cents in the prior year.

Little Bites:

- Director dealings:

- The CEO of MTN (JSE: MTN) has bought the dip in a big way, investing R8.8 million in shares in the company. MTN is now back above R100.

- The CEO of Life Healthcare (JSE: LHC) has bought shares in the company worth R3.5 million.

- The Mouton family has bought more shares in Curro (JSE: COH), this time to the value of nearly R3 million.

- A director of a major subsidiary of Woolworths (JSE: WHL) sold shares worth R1.4 million.

- An associate of a director of Sanlam (JSE: SLM) sold shares worth over R900k.

- Various directors of Richemont (JSE: CFR) have bought shares worth over R580k.

- A prescribed officer of Barloworld (JSE: BAW) bought shares worth nearly R500k.

- An associate of a director has disposed of shares in Wesizwe Platinum (JSE: WEZ) for R132k.

- Mantengu Mining (JSE: MTU) released a trading statement for the six months to August. It reflects a headline loss per share of between 9.5 cents and 10.5 cents, which is worse than the headline loss of 5 cents per share in the comparable period.

- There is yet another delay in the publication of the Tongaat (JSE: TON) amended business plan. It’s been pushed out by a week to a publication date of 29 November and a meeting date of 8 December.

- There’s also an extension for the fulfilment of suspensive conditions for Conduit Capital’s (JSE: CND) disposal of CRIH and CLL. The date has been pushed out to 31 January 2024.