AH-Vest is finally set to be taken private (JSE: AHL)

This is one of the most obscure listings on the JSE

AH-Vest is a very good example of the kind of company that should be taken private. There is no reason for such a tiny business to be in the listed space, with zero liquidity and all the regulatory costs along the way. Thankfully, this situation will soon be resolved, as Eastern Trading is swooping in to acquire all the shares that the company doesn’t already hold.

The deal is at 55 cents per share and the total acquisition price is just R2.4 million. Although this is an outrageous premium of 1,833% to the current traded price of 3 cents per share, you can see that we are talking about tiny amounts here overall. This is because Eastern Trading already owns 95.7% of the issued share capital.

This deal is long overdue.

Assura has now decided to back the Primary Health Properties offer (JSE: AHR | JSE: PHP)

You could get motion sickness from how quickly they change direction at Assura

After much to-and-fro, it looks as though Primary Health Properties managed to convince the Assura board that the revised offer is a better bet for shareholders than the KKR and Stonepeak cash bid. I am rather surprised to be honest, as the cash deal looked more compelling to me.

The latest version of this offer is 0.3865 new Primary Health Properties shares for each Assura share, along with 12.5 pence in cash. Assura shareholders would also be entitled to a special dividend of 0.84 pence per share. Based on 20 June 2025 market prices, this values Assura at 53.3 pence per share, which is 5.8% higher than the 50.42 pence per share cash offer from KKR and Stonepeak. That’s a whole lot of deal implementation and post-merger risk for just a 5.8% premium, including the raising of a vast amount of debt to get the deal done.

Notably, both offers would’ve allowed Assura shareholders to retain the April dividend entitlement, as well as the dividend due to be paid in July. These dividends have been excluded from the above numbers.

The bidding war has been lucrative for Assura shareholders, as the price including the April and July dividends (55.0 pence per share) is a 45.6% premium to the 3-month volume weighted average share price.

To give you an idea of the relative size of the two groups, Assura shareholders would have 48% in the enlarged entity. Those who want to get a higher proportion of cash vs. shares will have the ability to do so via a “mix and match” facility.

The last offer from KKR and Stonepeak was called a “best and final” offer. We will now see how serious those words actually are.

Goldrush releases its inaugural trading statement in its post-investment entity era (JSE: GRSP)

As an operating company, the focus is now on HEPS and EPS

Investment entities focus on measures like net asset value (NAV) per share, whereas operating entities use headline earnings per share (HEPS) and earnings per share (EPS) as their key performance metrics for trading statements. Goldrush has moved on from investment entity accounting, so the focus is now on HEPS and EPS.

This means that the trading statement for the year ended March 2025 isn’t comparable to the prior period at all, as HEPS was calculated completely differently across the two periods. Instead, it’s best to just look at the range in the trading statement rather than the year-on-year move. The expectation is for HEPS to be between 130 and 150 cents. For reference, the share price is currently trading at R8.80.

Harmony has met guidance for the year ending June 2025 (JSE: HAR)

With the gold price doing the things, Harmony is delivering on what it can control

Harmony’s share price is up 65% year-to-date. The gold price keeps delivering wonderful opportunities for the mining houses that can make hay while gold is shining. Harmony certainly ticks that box, with a pre-close update indicating that the company will meet production guidance for the year ending June 2025.

This means total production of between 1.4 million and 1.5 million ounces, while all-in sustaining costs will be between R1,020,000 and R1,100,000 per kg. Underground recovered grades were better than guidance. As the icing on the cake, capex was slightly below the guided R10.8 billion.

Looking ahead, the major next step is the acquisition of MAC Copper in Australia. They are looking to complete that deal in the second half of this year. There are also several extension projects at existing assets.

Results will be released in August.

Everything is looking better at Naspers / Prosus (JSE: NPN | JSE: PRX)

Even the Prosus dividend has doubled

I couldn’t be happier with my position in Prosus, as evidenced by another 3.3% rally in the share price on Monday in response to the release of results. The reason I own Prosus and not Naspers is that I want cleaner exposure to the international assets rather than South African assets like Takealot and Media24. It’s much of a muchness really, with Prosus up 33.5% year-to-date and Naspers up 31.5%.

In my opinion, the most interesting reason to look through the Naspers results is to see how Takealot is doing. Takealot.com grew revenue by 19% in dollars, with the number of orders up 15%. Mr D grew by 11%, with immense growth in groceries in particular. Adjusted EBIT at Mr D was $4 million, but Takealot ran at negative adjusted EBITDA of -$16 million. They attribute this to increased investment in response to competitive pressures from new international entrants. This probably means Amazon, but could mean the Chinese platforms as well. Either way, the expectation is for Takealot and Mr D to generate positive adjusted EBIT in FY26 on a combined basis.

Focusing on Prosus for a moment, revenue increased by 12.8% and they swung from an operating loss of -$546 million to profit of $173 million. HEPS almost doubled by 132 US cents to 256 US cents. Free cash flow more than doubled from $422 million to $1.02 billion. And finally, the divided did in fact double, from 10 Euro cents to 20 Euro cents per share. The Naspers numbers are different but the direction of travel is much the same.

As a reminder, the focus on profits doesn’t mean that the group is no longer doing deals. Quite the contrary, actually. Recent transactions include the acquisition of Despegar in Latin America, expanding the regional reach to over 100 million customers across several verticals. They also acquired Just Eat Takeaway.com, with the plan being to use AI to turn that European food delivery business into a growth story

The integration of AI into the business is the crux of the Prosus strategy. They highlight use cases ranging from efficient route generation in logistics through to automated customer support, fraud prevention and detection of “bad content” in a trust and safety context.

The best way to think about the group these days is that they are focused on building regional ecosystems that become powerhouses through offering a variety of services to a large user base. This is “superapp” thinking, although in many cases they aren’t trying to do everything through one app. It’s more about driving user engagement, feeding that data into AI models and creating a stronger ecosystem overall. This graphic of the ecosystem in India tells the story with an extreme example of how many platforms can fit into this strategy:

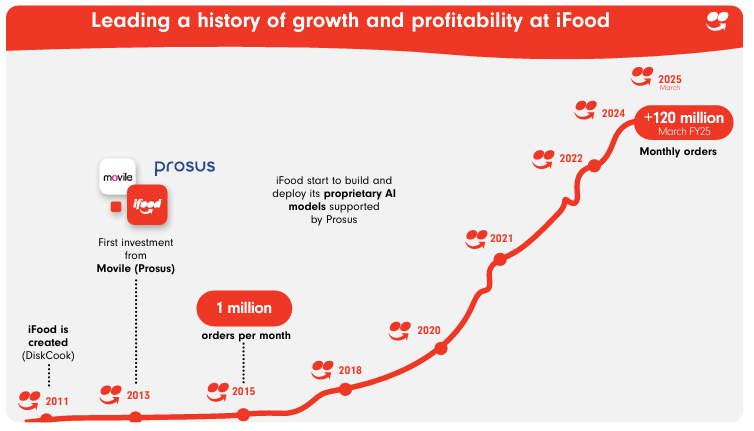

The difference these days at the group is that Fabricio Bloisi is a proper operator who has walked this scale journey before himself. He’s not just a desktop capital allocator. This chart on iFood in Latin America shows what is possible in these platforms:

I’m long Prosus and have absolutely no plans to change that. Onwards and upwards we go!

Nibbles:

- Director dealings:

- Here’s something that worries me as a shareholder in ADvTECH (JSE: ADH): the top exec in the resourcing business and his spouse sold shares worth a total of R25.2 million and a senior exec in the tertiary education business sold shares for R2.6 million.

- An associate of two directors of Astoria (JSE: ARA) entered into a CFD trade with a value of R21 million.

- A director of Stor-Age (JSE: SSS) has borrowed R10.7 million from Investec and has pledged shares worth R28.6 million as security for that loan. It’s not hard to see why the bank felt comfortable with extending this credit.

- Christo Wiese is back on the bid for Brait (JSE: BAT) shares, buying shares worth nearly R1.6 million through Titan Premier Investments.

- Des de Beer bought shares in Lighthouse Properties (JSE: LTE) to the value of R659k.

- Equites Property Fund (JSE: EQU) announced that GCR Ratings has affirmed its credit ratings with a Stable outlook. This is important in the context of how Equites is shifting exposure from the UK market back to the South African market.

- As I’ve noted many times, junior mining is all about consistent access to capital to support resource development activities. In this regard, Orion Minerals (JSE: ORN) has announced than an entity related to company chairman Denis Waddell has provided an unsecured loan facility of up to $0.5 million to the company. This will be used for working capital and carries a cost of 10% per annum. The amount is repayable by the end of September 2025, or upon the conclusion of a funding transaction that enables the repayment of this amount, or at a later date as agreed between the parties. This is the type of thing that you typically see in private companies rather than listed companies. It’s a show of faith by the chairman in the company’s prospects.

- The process of extracting the value from MTN Zakhele Futhi (JSE: MTNZF) and unwinding the structure continues, with the latest update being that MTN has repurchased around 50.6 million shares from MTNZF in full settlement of the notional vendor funding balance of R6.4 billion. The latest guidance from MTNZF is that the net asset value (NAV) per share of the structure is between R20.00 and R22.50. As there is still a holding in MTN shares, its important to keep in mind that this amount can fluctuate.

- Here’s some good news from Wesizwe Platinum (JSE: WEZ): the processing plant has completed two months of cold and hot commissioning after the rectification plan and is now operating smoothly.

- Omnia Holdings (JSE: OMN) has received exchange control approval for the payment of the special dividend of 275 cents per share.

- Momentum (JSE: MTM) has been busy with a share repurchase programme, repurchasing 3.02% of issued share capital since the AGM in November 2024. This is an investment of R1.32 billion in the company’s stock at an average price of R31.22 per share. The current share price is R33.30, so that’s been a successful process.