Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

A juicy jump in the Alexander Forbes dividend (JSE: AFH)

Yet the market clearly expected more, as the share price fell 11.8% on the day

Alexforbes reported results for the six months to September 2023 and they reflect growth in operating income of 13%, with acquisitions (like TSA Administration) doing their bit to help. There were also encouraging signs in the core operations, like client retention and higher average asset balances. The other major acquisition in the pipeline is for 100% of OUTvest from OUTsurance Holdings, with that deal currently going through regulatory approvals and thus not in these numbers.

Profit from continuing operations was up 66%, driven not just by the operating income performance but also by higher investment and other income.

Due to substantial once-off losses in the base from discontinued operations, HEPS from total operations increased by 96%. HEPS from continuing operations was up 68%.

These financial services groups are complicated, so it’s sometimes better to just follow the cash. The interim dividend is up 33% year-on-year to 20 cents. This is obviously a more modest increase than we’ve seen at earnings level, which might explain why the market didn’t seem to like the numbers. I can’t really see what else the market could’ve been upset about. The share price closed 11.8% lower at R5.07.

Aspen agrees to a switcheroo with Sandoz (JSE: APN)

In a game of pharma trading cards, Aspen acquires a business in China and sells one in Europe

Acquisitions and disposals aren’t uncommon events in the market. It’s rare to see a deal like this though, in which Aspen is acquiring a 100% stake in Sandoz China and selling the rights and IP to four anaesthetic products currently sold by Aspen in the European Economic Area to Sandoz.

It’s not a straight swap in terms of value, though. The acquisition price is EUR 92.6 million, with EUR 18.5 million being contingent on the performance of the pipeline products in China. The disposal price in Europe is EUR 55.5 million, with EUR 9.3 million contingent on sales performance. The cash difference will be funded from existing debt facilities.

These transactions are at vastly different revenue multiples. The Chinese acquisition adds R1.8 billion in annual sales to Aspen and the European disposal takes away sales of just R280 million. It’s therefore not hard to see why Aspen describes this as being part of its volume-based procurement strategy. It’s also an important strategic foothold in China, with the simultaneous benefit of allowing Aspen’s European management to focus on its remaining products in the region.

The entire deal (both legs) is dependent on the Chinese competition authorities giving the green light. That is expected to be achieved in the second quarter of 2024.

Sandoz was recently spun off from Novartis and is separately listed on the SIX Swiss Exchange.

The deal is not categorised under JSE rules and this is a voluntary announcement. In other words, there’s no shareholder vote.

Capital Appreciation’s EBITDA has had a wobbly (JSE: CTA)

Technology margins are taking strain

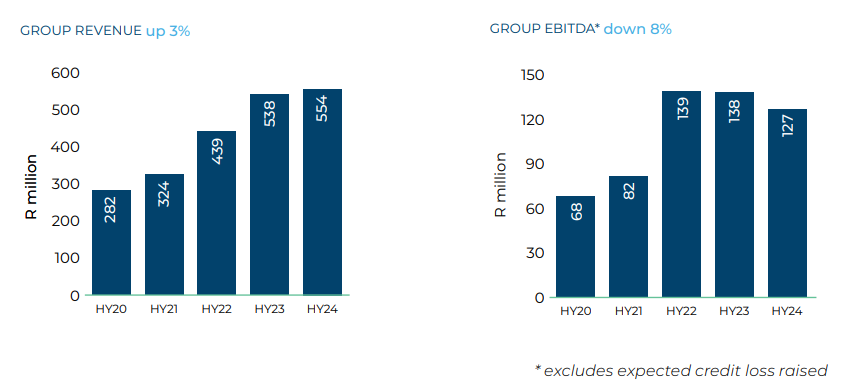

It’s more than slightly interesting to compare Capital Appreciation to PBT Group, which I wrote about yesterday. Although they have only small overlap in their businesses, this relationship between revenue and EBITDA over the past few years is remarkably similar:

The Software division is feeling the worst of the margin squeeze, as revenue on new projects was delayed and there was a period in which the group had increased capacity for those projects and incurred expenses. In Software, revenue was up from R220 million to R288 million, yet EBITDA fell from R46 million to R40 million.

In Payments, revenue actually fell sharply from R318 million to R265 million (mainly due to lower sales of terminals), but EBITDA was incredibly resilient at R118 million vs. R120 million. This talks to the annuity income base in that business.

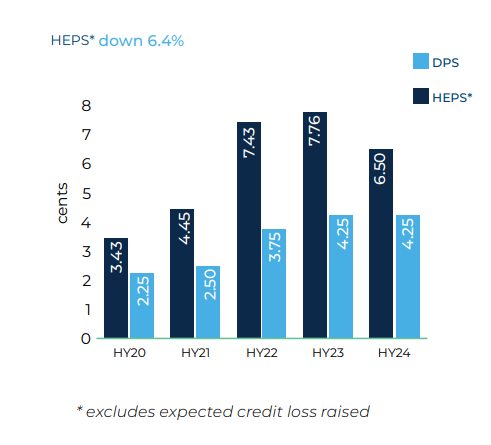

Excluding the expected credit loss raised in the base period, HEPS is down by 6.4%. In this chart, you can clearly see how they were conservative with the dividend per share relative to HEPS, allowing for a steady dividend despite a drop in profits:

I must highlight the 21% growth in international revenue to R77.3 million, providing further evidence that South African skills can compete globally. Of course, our professionals are also a far cheaper resource than their counterparts in places like the US and UK. This business is structured as a small team in the Netherlands, supported by resources in South Africa.

One of Capital Appreciation’s party tricks is a debt-free balance sheet that has R500 million worth of cash for acquisitions and organic growth opportunities.

Capitec has taken the step to write its own funeral policies, terminating the agreement with Sanlam (JSE: CPI | JSE: SLM)

This is a significant show of intent by Capitec

Capitec, Sanlam and Centriq Life Insurance have been co-operating since 2017 on the sale of life insurance policies. Capitec has elected to terminate the agreement once it reaches the end of its 7 year term in October 2024. This will trigger a payment of R1.9 billion to Sanlam in the form of a “reinsurance recapture” amount for its 30% participation in the product agreement.

Capitec Life, a newly licensed insurer in the Capitec group, will take over the administration of the in-force book and will write new business on its own license. Policies in-force on termination date will remain in the Centriq cell captive and will be transferred to the Capitec Life license at a later date.

This is a significant step forward for Capitec and not one that is without risk. I suspect that Sanlam will be upset about this one, as the distribution power of Capitec gave Sanlam the ability to participate in policies that it would’ve struggled to sell otherwise. This is exactly why Capitec would’ve seen the opportunity to bring that economic profit pool in-house.

Datatec takes a bigger stake in Mason Advisory (JSE: DTC)

If the name sounds familiar, it’s because this was spun out of Analysys Mason some years ago

If you’ve followed the Datatec story in any degree of detail, then you’ll know that the group disposed of a business called Analysys Mason. Long before that disposal, Analysys Mason unbundled a business called Mason Advisory in 2014. This group services clients that are consumers of IT rather than providers or regulators. Datatec has held a 40% stake in Mason Advisory ever since.

Datatec clearly likes the business, as the group is acquiring a further 40% in it, taking its holding to 80%. The stake is being acquired form the management team. With over 100 employees, the business is big enough that Datatec can feel comfortable about having a less aligned management team.

The deal value hasn’t been announced as this is a voluntary update. All we know is that it will be funded from existing cash resources.

Ellies finally gives an update on the Bundu Power deal (JSE: ELI)

This transaction is probably the saviour of the company

Way back in February 2023, Ellies announced a deal for the acquisition of Bundu Power for up to R207.6 million. In June, there was talk of a rights offer of R120 million. Then, things became uncertain.

It seems as though Ellies has been hustling in the background to try and raise capital, as the surprising news is that the entire acquisition is being funded by debt. There is no longer going to be a rights issue!

Also, they’ve managed to defer some of the purchase price, with tranches of R26.3 million due within 60 days of the end of February 2024 and 2025. This means that roughly 25% of the purchase price has been spread out, although I would remind you that February 2024 is actually around the corner.

My concern here is that the purchase price of Bundu Power isn’t exactly at a bargain multiple, as profit after tax was R32.4 million for the year ended February 2023. Before you wonder if there is incredible growth in profits thanks to load shedding, the profit after tax for the year ending February 2024 is R33.94 million. That’s a pretty flat performance.

We don’t know yet what the debt cost is, but I suspect that there isn’t a huge amount of daylight between profits and interest costs. If anything goes wrong in the deal, Ellies can get into huge trouble, especially as the sellers of Bundu Power have been granted a call option to repurchase the shares if Ellies fails to pay any amounts due.

This is a Category 1 transaction, so shareholders will need to vote on it and a circular is expected to be distributed by 31 January 2024.

The simple reality is that this deal is do-or-die for Ellies. If it goes wrong, I believe that this is the end for the group and there will need to be a rights issue (or worse – business rescue). By funding it with debt, they are rolling the dice one last time.

For those who enjoy high-risk speculative plays, this makes Ellies interesting.

Glencore closes the Alunorte and MRN deals (JSE: GLN)

These deals were first announced in April 2023

Corporate transactions take a while to close. Mining deals can take even longer, depending on the underlying regulatory environment.

After announcing these transactions in April 2023, Glencore has closed the deals that sees it invest alongside Norsk Hydro ASA to acquire 30% in Alunorte S.A. and 45% in Mineracão Rio do Norte S.A. (MRN).

Although Glencore will not be the operator of either assets, it will have offtake rights for the life of mine in respect of its pro rata share of production.

Lighthouse is on track to meet earnings guidance (JSE: LTE)

This pre-close update deals with the year ending December 2023

You’ve seen the name Lighthouse Properties come up a million times in the director dealings section in Ghost Bites, as Des de Beer buys shares on a regular basis and other directors also dip in from time to time. For once, this update is about the company rather than transactions in the shares!

A pre-close update gives us insight into how the group is performing. In France, footfall is up 13.3% and sales are up 10.1%. It sounds like the letting environment is positive. In Slovenia, footfall is up 8.1% and sales are up 8.9%. In Spain, the group has entered into exclusivity for the acquisition of a shopping mall. If all goes well, that deal will close in February 2024.

That deal will be funded by a mix of debt and the proceeds of the sale of Hammerson shares. The loan-to-value after that acquisition will increase from 15.1% to 24.4%. Speaking of the Hammerson disposal, since H1 2023 Lighthouse has raised EUR 63 million in cash from selling shares. The holding in that company has been reduced from 22.05% to 17.98%.

The board has reaffirmed its distribution guidance of EUR 2.70 cents per share for the 2023 financial year.

In a separate announcement, Lighthouse announced the sale of a further R936 million worth of shares in Hammerson. I worked back through recent announcements and it feels like this is in addition to the sales referenced in the pre-close announcement. I’m just not sure why they didn’t simply bundle these sales in with the rest that were disclosed!

The naira knocked Nampak – and so did the kwanza (JSE: NPK)

Forex issues in Africa remain a huge concern

Fresh from its equity capital raise to save the group, Nampak has released results for the year ended September 2023. They reflect a 2% drop in revenue and a 2% increase in trading profit.

None of that really matters, as the big story is in forex losses and net interest costs.

Trading profit of R1.6 billion disappears quickly when forex losses in Angola and Nigeria come to R1.2 billion. Operating profit before impairments was just R276 million. After impairments, there’s a loss of nearly R2.6 billion.

It gets even worse, as we haven’t considered funding costs yet. They come to R1.2 billion, more than double the prior year thanks to outrageous refinancing advisory costs of R335 million. Although the advisory costs are a once-off, it’s still a ridiculous number. The group raised R1 billion in rights offer and spent R40 million on the costs of the rights offer and then another R335 million on refinancing advisory costs.

The headline loss is R1.6 billion, which is a frightening number compared to headline earnings of R229 million in the prior period.

Nampak is both a going concern and an ongoing concern in my books, as raising R2.7 billion through asset disposals in the next 18 months is key to its sustainability. One wonders what the advisory fees on those transactions will be.

The rights offer was priced at R175 and the share price is at R165, so those who supported the rights offer are already in the red.

Sygnia goes sideways (JSE: SYG)

Despite assets under management and administration up 11.6%, the dividend is flat

Sygnia CEO Magda Wierzycka wastes no time in her report on the earnings for the year ended September. Within the first paragraphs, she gives the media everything they want by lambasting South Africa and calling it “more and more irrelevant” on the global stage. That must do wonders for motivating the South African staff.

Assets under management and administration increased by 11.6% to R318 billion, with the retail business attracting net inflows of just R1 billion vs. R5.3 billion. I think that positive net flows is still a commendable performance in this environment. ETFs among institutional and retail customers experienced net outflows.

For all the complaining about how the government manages its affairs, Sygnia allowed its expenses to grow 7.9% at a time when revenue increased by 4.3%. Weirdly, one of the reasons given is the resumption of business-related travel. How much can you possibly need to travel in this business?

HEPS increased by 4% and the dividend is flat at 210 cents. That’s not a bad performance overall, but I do have questions around that cost growth in what is supposedly a low-fee investments business.

Little Bites:

- Director dealings:

- As the person entrusted with the turnaround of Tiger Brands (JSE: TBS), it’s good to see Tjaart Kruger putting his own money behind it. He has bought R3.8 million worth of shares in the company.

- Here’s a fun one: Neal Froneman exercised a put option to sell shares in Sibanye-Stillwater (JSE: SSW) at a strike price of R45.98. This was part of an equity funding arrangement with a financial institution. The current price is R21, so that put option (the right, but not the obligation to sell shares) was solidly in the money. That sale was worth R218 million. Separately, an independent non-executive director bought shares worth R292k.

- The CEO of Invicta (JSE: IVT) has bought shares worth R363k and Dr Christo Wiese also bought shares to the value of R394k.

- The CEO of RH Bophelo (JSE: RHB) has bought shares worth R393k.

- A director of KAL Group (JSE: KAL) has bought shares worth R184k.

- ADvTECH (JSE: ADH) has announced that CEO Roy Douglas will step down from the board with effect from 29 February 2024. Geoff Whyte has been announced as his replacement, bringing experience gained in organisations as varied as Unilever, PepsiCo, SAB-Miller and Nando’s. This is an interesting appointment of an executive who is clearly an expert in FMCG.

- Unitholders in Oasis Crescent Property Fund (JSE: OAS) were able to choose between a cash distribution and a share distribution. 65.51% of holders elected to receive a cash distribution and the rest were happy to receive more units.

- MAS P.L.C. (JSE: MSP) is working on its balance sheet, inviting holders of the EUR 300 million 4.25% guaranteed notes due 2026 to tender them for purchase by the company. In other words, this is an early redemption at the option of the holder. MAS is either reducing its overall debt or restructuring it.

- City Lodge Hotels (JSE: CLH) confirmed that the odd-lot offer price is R4.7023454, being a 5% premium to the 30-day VWAP as at the close of business on 1 December. The current share price is R4.56. This allows holders of fewer than 100 shares to let them go at a slight premium to the current price, but we are talking less than beer money here. Remember, the default is that your shares will be sold if you own fewer than 100 of them.

- One has to wonder why Telemasters Holdings (JSE: TLM) is bothering with a dividend at all, since the declared amount is 0.001 cent (not cents, but cent) per share. The share price is R0.75.

- Chrometco Limited (JSE: CMO) has renewed the cautionary announcement relating to a material subsidiary of the company.