An unplanned temporary management change at ASP Isotopes – and a purchase order from a US company (JSE: ISO)

The company kept SENS busy on Tuesday

ASP Isotopes announced that CEO and co-founder Paul Mann will be taking a temporary leave of absence from his duties. This is because of an orthopaedic surgery in the US that has led to some post-operative complications and an inability to travel for the next few months. This makes it impossible for him to adequately fulfil the CEO role at the moment. He will therefore step into the Executive Chairman role on a temporary basis, with Robbie Ainscrow (current COO and co-founder) moving into the Interim CEO role.

In further leadership news, Michael Cunniffe has been appointed as the CFO of Quantum Leap Energy in preparation of that company being separately listed. He is highly qualified and experienced in both finance and cell and gene therapy, so that tracks with the overall story at ASP Isotopes regarding the sheer bench strength of professional staff. I think you’ll find more PhDs at ASP Isotopes than at the average university!

In commercial news, ASP announced a purchase order for enriched Barium-137 from a US company, with a delivery date of Q1 2026. This is one of the key ingredients in building large-scale quantum computers. There’s a lot of talk around quantum computing at the moment, so that bodes well for future demand of this material.

Assura’s trading update matters for Primary Health Properties shareholders (JSE: AHR | JSE: PHP)

Assura’s listing will be suspended from 3 October

As a last hurrah before the listing is suspended and then terminated in the wake of the highly successful offer by Primary Health Properties, Assura has released a trading update for the six months to September 2025. This is of course very useful for Primary Health Properties shareholders who now indirectly own this asset.

Assura achieved like-for-like rental increases of 5.6% and undertook considerable expansion activity in the portfolio to drive future growth. The development pipeline is core to the story over the next couple of years, alongside the opportunity to enhance lease income through renewals and other activity.

Active portfolio management has led to a valuation uplift of the underlying properties, so the balance sheet is also heading in the right direction. As market farewells go, this is about as positive as they get.

Lesaka Technologies achieved solid adjusted EBITDA growth (JSE: LSK)

The exit velocity is encouraging, although impacted by acquisition timing

Lesaka Technologies follows a style of disclosure that will be very familiar to anyone who is used to reading updates by global tech companies. If you only read local announcements though, you’ll be surprised at how strong the focus is on adjusted EBITDA rather than local favourite HEPS.

You also might be wondering what I meant by “exit velocity” above. This just means that the fourth quarter of the year saw a stronger growth rate than the full year, which means they have positive momentum going into a new financial year. I don’t usually use these terms, but I would rather expose you to the kind of stuff you might see in global tech earnings calls.

Speaking of the growth rate, full year net revenue growth was 38% and adjusted EBITDA was up 33%. There’s some margin pressure there, but they achieved their guidance for adjusted EBITDA. The Merchant Division is where you’ll find the margin dilution, with net revenue up 46% and adjusted EBITDA up 20%. The Consumer division was good for 35% growth in net revenue and an 83% jump in adjusted EBITDA!

As you’ll find in any growth company that is making acquisitions, there are distortions in the numbers that are important to understand. For example, Lesaka finalised the acquisition of Adumo in October 2024. This means that Adumo was in the current period for nine months and not in the prior period at all, which impacts comparability. Despite these limitations, it’s still worth noting that the fourth quarter achieved net revenue growth of 47% and adjusted EBITDA growth of 61%.

There’s also plenty of noise between adjusted EBITDA and the net loss, mainly due to non-cash charges related to the sale of non-core asset MobiKwik. There are also very large impairment losses and once-off transaction costs.

This mixed bag is probably why the share price is down 6% over the past 12 months. It’s certainly not for lack of growth in the core business, with substantial progress made in acquisitions and in growing adjusted EBITDA. Guidance for FY26 suggests adjusted EBITDA growth of over 45% at the mid-point. Importantly, this excludes the Bank Zero acquisition that is requires various regulatory approvals.

Netcare had a much better year in FY25 (JSE: NTC)

It doesn’t take much revenue growth for hospitals to get on the right side of operating leverage

Netcare has released a voluntary update on the trading performance for the year ended September 2025. Revenue was up by between 4.5% and 4.7% and whilst that may not sound overly exciting, it’s enough to send EBITDA higher by between 6.5% and 8.5%. For investors looking for inflation-beating returns from a defensive industry, that’s ticking the box.

Adjusted HEPS is expected to be up by between 16% and 19%. That’s firmly in growth stock territory, but I would suggest waiting for the details of the adjustments before getting too excited. Investors will hope that this move is thanks to high quality reasons like the positive impact of share buybacks.

As we’ve seen in recent years, demand for mental health care remains strong, while other areas like medical and dental visits are under pressure. It’s also important to remember that although Netcare is in a defensive sector, there are still lumpy contracts that can lead to significant percentage moves in the numbers. In Primary Care, revenue fell by between 7% and 8% due to a major contract.

Detailed results are expected to be released on 24 November.

Orion Minerals needs capital – and this time, they aren’t asking retail investors (JSE: ORN)

The chairman and a group of professional investors will plug the gap

Orion Minerals has historically been very good with giving retail investors a fair chance to participate in capital raises. It does take longer to do this of course, with the added challenge of lack of certainty around exactly how much will be raised.

Under normal circumstances, this type of raise is still manageable. But right now, Orion cannot afford to get anything wrong as it looks to cement the Glencore (JSE: GLN) funding and offtake deal. This is probably why they’ve gone the route of raising around R57 million from “sophisticated investors” i.e. from selected parties rather than broadly.

One such party is the chairman, Denis Waddell. The issue of shares to his associated entity will require shareholder approval. As for the rest of the investors, it falls with the authority that the company already has to issue shares to unrelated parties without further approval.

Here’s the bad news for recent punters though: the raise is priced at around R0.17 per share, which is well below the recent level of around R0.23 per share. To be fair, the share price is up more than 50% in the past month thanks to the Glencore deal, so only those who bought the very top of that move will complain.

No helium production at Renergen this quarter, but at least they sorted out Springbok Solar (JSE: REN)

Remember, the ASP Isotopes (JSE: ISO) deal isn’t a guarantee until all conditions have been met

Renergen has released an update for the past quarter. This may seem pointless to you based on the merger activity with ASP Isotopes, but it’s very important to remember that a deal is always capable of falling over until the very last condition is met. As things currently stand, Renergen is an independent company. The deadline for the fulfilment of the remaining offer conditions has been extended to 28 November 2025.

At least the Springbok Solar issue is out of the way. As previously announced, Renergen entered into a coexistence agreement with Springbok Solar and earned a public apology from them for their behaviour. There is a financial settlement payable to Renergen’s subsidiary, but the announcement doesn’t indicate the value.

If we look at Renergen’s underlying operations, we find the same narrative that has plagued the story in recent years. LNG production fell from 1,311 tons in the previous quarter to 987 tons in this quarter, which Renergen attributes to maintenance that was brought forward. On the helium side, there was absolutely no helium production in this quarter as the additional wells need to be tied in to make it viable.

Roll on the ASP Isotopes era…

The trees are looking greener at York Timber (JSE: YRK)

But what does it take for them to make a profit excluding fair value moves?

York Timber operates in a tough industry. The share price reflects this, with a choppy profile and a negative move of -11% over the past 12 months. It’s difficult for the share price to establish any kind of consistent trajectory when the numbers tend to be all over the place.

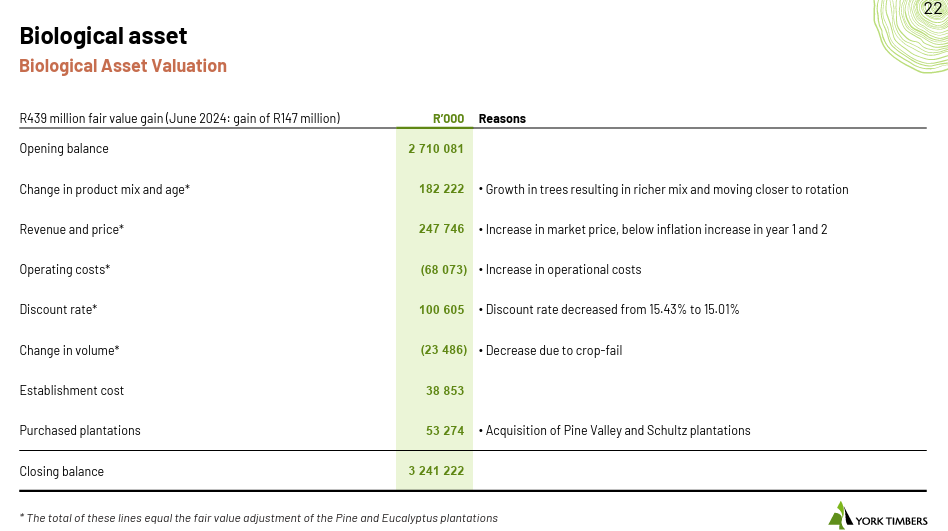

One of the biggest contributors to the earnings volatility is of course the fair value changes in the biological assets themselves. York Timber is required to estimate the future value of the trees and then adjust for those forecast movements in its financials. This is why they also report core earnings per share, which strips out the fair value moves.

I thought I would include the slide dealing with the biological asset valuation so that you can see the key inputs:

For the year ended June 2025, revenue increased by 14% and HEPS jumped quite spectacularly from 13.74 cents to 66.69 cents. But if you look at core EPS (excluding the fair value moves), you’ll find that the loss of 10.74 cents improved to a loss of 0.28 cents. Yes, that’s still a loss.

There are some other highlights beyond the biological asset value increase of 19%. For example, cash generated from operations (perhaps the most important measure of all) increased from R29 million to R148 million. I must note that 2024 was a particularly rough year for cash generation, so there’s definitely a low base effect here.

Lumber sales volume growth was 12%, driven in part by turnaround efforts at the underlying operations. There are still areas of the business that need urgent attention, like the Sabie sawmill that suffered an EBITDA loss of R49 million. I’m sure they will take a lot of heart from the improvements at the Jessivale sawmill, where EBITDA swung from a loss of R3.5 million to a profit of R29.1 million.

One thing about York is that the opportunity for strong positive swings in profitability is there. The challenge is that the opportunity for negative swings is also there!

As we saw last year, there’s no dividend for York shareholders.

Nibbles:

- Director dealings:

- An associate of a director of a major subsidiary of eMedia Holdings (JSE: EMH | JSE: EMN) bought shares worth R3 million.

- The financial director of HCI (JSE: HCI) bought shares worth R1.2 million.

- A director of a major subsidiary of Woolworths (JSE: WHL) sold shares worth just over R1 million.

- A director of a major subsidiary of Sea Harvest (JSE: SHG) sold shares worth R825k.

- A director of NEPI Rockcastle (JSE: NRP) bought shares worth R510k.

- Barloworld (JSE: BAW) announced that competition approval has now been received in Angola for the offer by the consortium to shareholders. The only outstanding regulatory approval is now COMESA. The standby offer will remain open until the earliest of 11 December 2025, or 10 business days after the offer becomes unconditional.

- Tiger Brands (JSE: TBS) announced that the conditions precedent for the disposal of Langeberg and Ashton Foods have been met. This is absolutely critical for Ashton and the surrounding areas, with over 3,000 permanent and seasonal staff. Tiger Brands may have one of the worst overall social records in South Africa (the horrors of listeriosis won’t be forgotten for a long time), but they put in a lot of effort to do the right thing in this case.

- There are some changes to the board at Collins Property Group (JSE: CPP), the most notable of which is KR Collins moving from the CEO role into the chairman role, which of course means that Dr. Christo Wiese will be vacating the chairman role and will remain as a non-executive director. KA Searle, currently the executive managing director, will become the CEO.

- Wesizwe Platinum (JSE: WEZ) finally released results for the year ended December 2024, with the delay caused by a cyberattack at the end of 2024. The group does not have enough cash to develop its key BPM project, which makes them reliant on the ongoing funding support of the majority shareholder. That’s not new news. But what is new is a legal provision of R215 million related to the conclusion of an adjudication process involving a claim by a former mining contractor, China Coal No 5 Construction Company. This is one of the reasons why the headline loss per share increased from 1.55 cents to 11.31 cents.

- Shuka Minerals (JSE: SKA) released results for the six months to June 2025. The company is pre-revenue and recorded a headline loss of around R8.7 million. If you’ve been following the company, you’ll know that they are currently waiting for major shareholder Gathoni Muchai Investments to pay the next tranche of funding, with no particularly good explanation why the payment is delayed. They now expect to conclude the transfer by mid-October. This is hopefully just a “the day is darkest before the dawn” issue, with the company looking ahead to the acquisition of the Kabwe Project from Leopard Exploration and Mining.

- Salungano Group (JSE: SLG) is suspended from trading as they are horribly behind on their financial reporting. They expect to release earnings for the year ended March 2024 (!) by 7 October 2025, with an expected increase in the headline loss per share of between 88% and 94%.

- Speaking of suspensions, SAIL Mining (JSE: SGP) has been suspended since July 2022. They need to publish results for FY22, FY23 and FY24, along with all the interim reports as well. The reason why they are so behind is that there were three subsidiaries in the group in business rescue. They’ve managed to get through this and they are now working to catch up on the financials.

- Conduit Capital (JSE: CND) is also suspended from trading, with the liquidation of CICL underway along with other litigation. Of critical importance is the enforcement of the arbitration award against Trustco. CLL, the insurance business that they tried to sell and were blocked from doing so by the regulator, is currently in run-off mode with no new growth.

- We also find PSV Holdings (JSE: PSV) in the naughty corner, suspended from trading and trying to find a way to recapitalise the company. DNG Energy is expected to make a further proposal to the liquidator this month.

Note: Ghost Bites is my journal of each day’s news on SENS. It reflects my own opinions and analysis and should only be one part of your research process. Nothing you read here is financial advice. E&OE. Disclaimer.