BHP had a solid quarter and is on track for guidance (JSE: BHG)

Copper, iron ore and steelmaking coal are among the highlights

BHP has released their review for the quarter ended September. Copper gets mentioned first of course, as that’s the commodity that everyone is in love with at the moment. Production increased by 4%. There are other highlights, like steelmaking coal up 8% and WAIO having a record quarter in terms of material mined, even if that didn’t lead to an increase in iron ore production due to planned maintenance.

Average realised prices were up for copper and iron ore this quarter both year-on-year and sequentially. Steelmaking coal and energy coal rose sequentially, but both were down significantly year-on-year. This is why diversification is important for mining groups.

BHP’s production guidance for FY26 is unchanged. The same is true for unit cost expectations across the board.

Metair’s investor day delivers deep insights into how the group thinks (JSE: MTA)

There are almost 100 slides to dig into!

Metair is such an interesting business. The group focuses on automotive components and has substantial exposure to the OEMs operating in South Africa. The significant disruption in the automotive industry forced them to execute a turnaround. They also decided to take a risk on the acquisition of AutoZone, which means taking a big step into aftermarket parts.

I think that it makes a lot of sense strategically, which is why this is such good story to follow if you want to learn about corporate strategy and turnarounds.

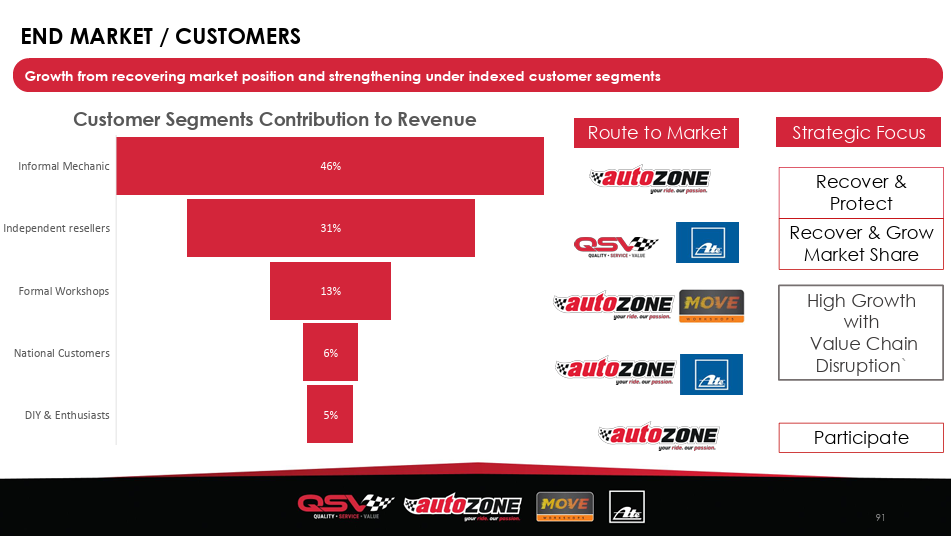

Metair hosted an investor day and made the presentation available. It includes slides like this banger about market segmentation:

Across nearly 100 slides, Metair goes into detail on the entire business. If you’re invested here, I highly recommend you check out the preso. Even if you aren’t, it’s a great example of how corporate strategists operate!

Oasis Crescent is delivering inflation protection for investors (JSE: OAS)

This is an example of how to do property without debt

Oasis Crescrent Property Fund is a Shari’ah-compliant structure, which means that the fund doesn’t make use of debt. Now, as we know from the broader property sector, debt is a feature of REITs rather than a bug. It tells you a lot about the structurally high nature of interest rates in South Africa that Oasis Crescent has managed a total return (NAV growth plus distributions) of 11.1% per annum since inception. That’s more than double inflation.

The six months to September 2025 saw a modest 2.3% increase in the NAV per unit and 5.2% growth in the distribution. So, more of the same really. The fund is incredibly illiquid, which I think is how they convince investors to reinvest distributions at NAV even though the fund is trading at a discount.

Reinet’s underlying fund NAV is trending slightly positive (JSE: RNI)

It looks like a flattish quarter

As a precursor to releasing the net asset value (NAV) per share of the holding company, Reinet releases the NAV movement in the underlying wholly-owned subsidiary, Reinet Fund. This isn’t exactly the same as the holding company, as there are balance sheet items that are outside of the fund. Still, it’s always a good indication of the direction of travel.

The NAV as at September 2025 was €38.87, just 0.85% higher than the NAV at June 2025. It was therefore a fairly flat quarter, although annualising that number would still give low single-digit growth in euros.

The Sirius Real Estate investor day gave plenty of insight into their strategy (JSE: SRE)

Buy low, sell high – and actively manage along the way

Sirius Real Estate hosted an investor day at the Hartlebury Trading Estate in the UK. They bought this property in August for £101.1 million, growing the BizSpace platform in the UK by 18% in square feet and the gross asset value by 20%.

The presentation was about the entire Sirius portfolio though. It goes into immense detail regarding the portfolio and the key metrics. There’s even a chart on the number of enquiries vs. viewings!

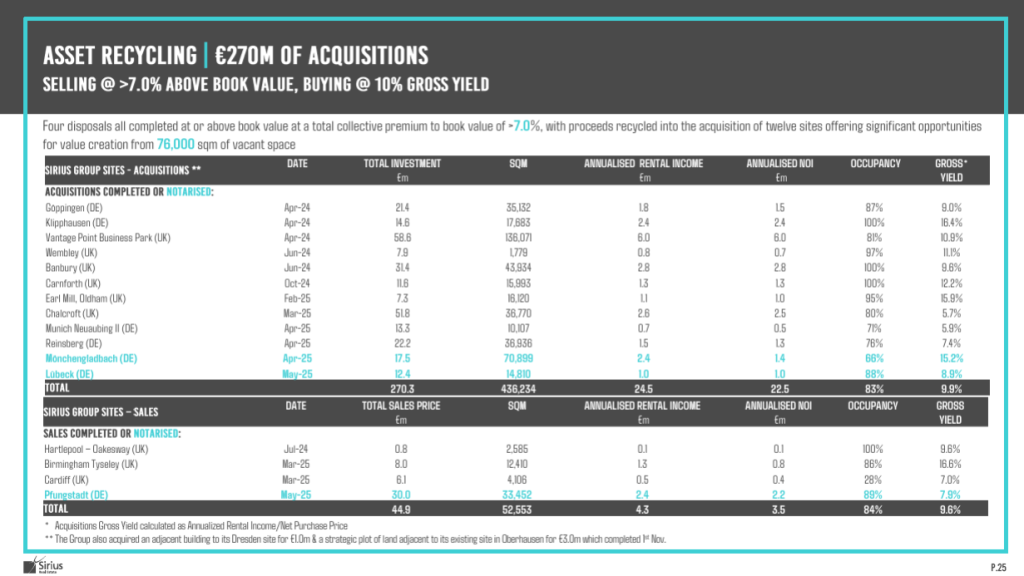

This is a busy slide, but that’s because Sirius is a busy company. Just look at the number of recent acquisitions vs. sales:

In the outlook statement, this comment makes it pretty clear why Sirius has been focusing on the defence sector in Germany:

“New pro-business German Government proposing an expected c. €900 billion fiscal stimulus, including c. €400bn in defence spend, over the next 10+ years”

Those defence businesses will need space and Sirius is only too happy to oblige.

South32’s quarterly update reflects unchanged production guidance for FY26 (JSE: S32)

Copper and manganese are among the highlights

South32 released the quarterly report for the period ended September. They are feeling good about the world, with a 12% increase in copper equivalent production at Sierra Gorda and a 33% uplift in manganese volumes thanks to the initiatives at Australia Manganese.

It was also a quarter of heavy investment, with net cash almost halving to $64 million as the group invested in Hermosa and experienced a temporary increase in working capital. It’s nothing unusual to see volatility in balance sheet numbers when viewed through a quarterly lens.

It’s not all roses out there of course. As a reminder, the current state of play at Mozal Aluminium is that operations will only run until March 2026. They cannot lock in an electricity supply at an economically viable price despite months of negotiations with the Mozambique government, HCB as the hydroelectric project and our very own Eskom.

Overall, with one quarter out the way thus far this financial year, their production guidance for FY26 is unchanged.

The Foschini Group had a truly horrible day (JSE: TFG)

The share price was thrown around like a rag doll

If you’re a shareholder in The Foschini Group and you haven’t looked at the market in the past day, I suggest you brace yourself. The share price closed 16.6% lower on the day. About the only happy news I can give you is that things were even worse in mid-afternoon trade, so it actually clawed back some ground heading into the close.

This takes the year-to-date share price performance to a rather spectacular drop of around 40%. It ain’t pretty:

The catalyst for the drop was the release of a trading statement for the six months to September 2025.

Before we dig into the numbers it’s important to remember to exclude White Stuff from the growth rates. This is the UK acquisition that is beyond my comprehension. I’ve written many times about the tough battles that TFG needs to fight in its home market and the risks of further distraction offshore, particularly in the context of the highly ambitious capital markets day they recently held, yet the group continues to stretch itself too thin across these markets.

Excluding White Stuff, group sales were up just 3.5%. Combined with gross margin pressure, that can only lead to a nasty drop in profits. The really bad news is the jump in finance costs of 14.5% thanks to the White Stuff deal and the extra pressure this puts on the balance sheet. This is why HEPS is expected to fall by between 20% and 25% for the six months. It’s also why the share price followed suit.

Is there a silver lining in TFG Africa? Not really, with sales up 5.3% as a disappointing outcome after a strong start to the year. Credit sales were up 7.9%, so consumer pressure remains evident as cash sales were clearly weak. Gross margin is perhaps the biggest concern, with a 100 basis points contraction in margins from winter clearance that moderated to 90 basis points by the end of the period. EBIT in South Africa fell by 9.7%, a really nasty story to have to tell in the immediate aftermath of the capital markets day.

TFG London grew sales by just 0.7% excluding White Stuff. There was much improvement in Q2 vs. Q1, but it’s still poor. White Stuff managed to grow its sales by 12.5%, so perhaps this will turn out to be a good deal after all. I just wonder if the market will have enough patience with TFG and the management team to allow that story to play out.

TFG Australia is a huge headache, with sales down 0.5% and EBIT down 18.4%. Down under appears to be the direction of travel for the business, not just its location.

Probably the only highlight in the numbers is online sales, up 55.3% at group level and now contributing 14.7% to total retail sales. This does include White Stuff though. For a cleaner view, TFG Africa online sales were up 40.2% thanks to Bash as an exciting growth engine in the group.

Tough, tough scenes for TFG and its shareholders.

Zeder impacted by valuation pressure at Zaad (JSE: ZED)

The NAV for the six months to August 2025 has dipped (after allowing for dividends)

When you look at the results of an investment holding company that is going through a value unlock strategy, you need to be extra careful. If the company has paid large dividends to shareholders, then this will naturally reduce the NAV per share. The trick is to consider the NAV movements after adjusting for any such dividends.

Zeder’s NAV per share has dropped by 47 cents per share between August 2024 and August 2025, now sitting at R1.68. A significant 31 cents of this drop is attributable to special dividends, so the remaining 16 cents is due to fair value movements.

The pressure is in Zaad, which represents 77% of Zeder’s sum-of-the-parts value. Zaad is a substantial business that focuses on agri-inputs in emerging and frontier markets across Africa, the Middle East and Eastern Europe. That’s clearly a high growth opportunity, but also a difficult business to manage. Zeder controls 97.2% of Zaad and has been following a value unlock strategy that has involved disposals of underlying subsidiaries where it makes sense to do so.

The TL;DR at Zaad is that the seed IP operations suffered a negative valuation move. This is why Zeder’s NAV per share has dipped.

The only other investment in Zeder is in Pome Investments, but the value of R65 million is tiny compared to Zaad at R2 billion.

Zeder’s sum-of-the-parts value is R1.68 per share. The share price is currently R1.26.

Nibbles:

- Director dealings:

- There’s been a meaty purchase of shares by a director of Sabvest Capital (JSE: SBP) worth over R14 million. The trade was effected through an off-market purchase of R11 million in shares and on-market trades for the rest.

- The CFO of DRDGOLD (JSE: DRD) sold shares worth R7.5 million.

- Here’s another sale in the gold sector: the CEO of Pan African Resources (JSE: PAN) sold shares in the company worth a total of over R4.4 million.

- The company secretary of Hammerson (JSE: HMN) sold shares worth around R623k.

- Heaven knows how these things happen in practice, but a prescribed officer of Acsion (JSE: ACS) sold shares worth R595 (yes, steak-and-wine money) without clearance to deal.

- Sibanye-Stillwater (JSE: SSW) announced that the new chrome agreements with the Glencore (JSE: GLN) – Merafe (JSE: MRF) joint venture have been fulfilled. This increases Sibanye’s share of free cash flow due to higher feed and better recoveries from the Marikana Chrome Recovery Plants.

- Pan African Resources (JSE: PAN) has taken the next step in adding a London Main Market listing to the story. The company will be moving up from the AIM, with the hope being to attract more international investors who typically wouldn’t invest in an AIM-listed company. There are no new shares being issued, so the release of a prospectus by the group is purely to meet the disclosure requirements.

- Fortress Real Estate (JSE: FFB) shareholders are hungry for more NEPI Rockcastle (JSE: NRP) shares, with holders of 88.48% of Fortress shares electing to receive NEPI shares as a dividend in specie in lieu of cash. Notably, a number of Fortress execs (including the CEO) elected this option.

- Copper 360 (JSE: CPR) is having a terrible year. The company has shed over 70% of its value year-to-date. I would normally not give much attention to non-executive director appointments, but I’ll make an exception here as Copper 360 has appointed Llewellyn Delport to the board. He has over 30 years of experience in mining and energy, with a track record in turnarounds and early-stage projects He is the former CEO of Trans Hex. His appointment will hopefully play a role in the company finding some positive momentum.

- African Dawn Capital (JSE: ADW) is currently suspended from trading due to failure to publish financials for the year ended February 2025. The company hopes to distribute the financials by the end of November and the annual report by 19 December. They also need to release the interims for the six months to August, which they hope to achieve by the end of November. If they get all of this right, then they will look to have the suspension lifted.