Boxer enjoyed stronger sales growth in the past couple of months (JSE: BOX)

Momentum into the end of a period is what investors want to see

If you speak to any successful entrepreneur, they will tell you that they carefully manage the numbers every single month. If there’s any kind of slowdown or acceleration, they want to understand exactly why.

Listed companies are no different, but investors don’t get to see that level of detail. Instead, we see reports that cover six months at a time, making it difficult to see when things are accelerating or decelerating. This is why I’m a big fan of quarterly reporting in the US!

Sometimes, companies allow us to take a look at more granular numbers. Of course, they usually only do this when there’s a happy story to tell. That’s how minimum disclosure tends to work in practice: companies only go above and beyond when it’s in their interest to do so.

Other times, companies take the approach of giving more regular trading updates regardless of performance. I appreciate this, as more information is always better for investors than less information.

At Boxer, they previously indicated sales growth for the 17 weeks to 29 June 2025. They’ve now released a trading statement dealing with the 26 weeks to 31 August 2025, representing the first half of the financial year. Things got better in July and August, lifting like-for-like sales from 3.9% to 5.3%. Note that 5.3% is for the full 26-week period, so the final two months must’ve been really good to achieve that overall uplift. This is particularly impressive when you consider that food inflation for the 26-week period was -0.7%, so they managed this purely from volumes.

Boxer’s broader store rollout plan is still alive and well, with total turnover growth of 13.9% for the 26-week period. The difference between total growth and like-for-like growth is attributed to the increase in the number of stores.

The picture is very different at HEPS level, mainly due to the IPO structure that led to many new shares being in issue. There are also the incremental costs of being a separately listed entity. This will be in the base going forwards, so year-on-year growth should normalise.

For now though, headline earnings will move by between 0% and 9% because of the cost impact. Once you take into account the additional shares and look at HEPS, you get an ugly move of -28% to -34%.

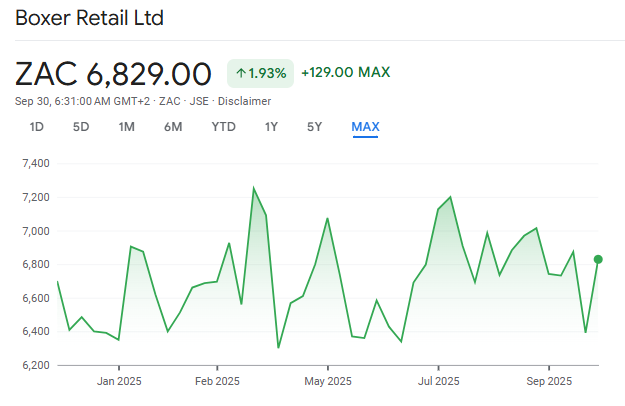

The share price performance has been remarkably choppy, so this is something that traders could consider looking at. It might rip your face off, but at least you’ve got volatility to work with:

CMH is expecting a significant jump in earnings (JSE: CMH)

The company seems to have adjusted to the popularity of Chinese cars on our roads

Combined Motor Holdings, or CMH as it is more commonly referred to, released a trading statement dealing with the six months to August 2025. They expect HEPS to increase by between 20% and 25%, an excellent result in a difficult environment.

Keep an eye on this share price on Tuesday morning, as the trading statement came out just before market close and the share price is still slightly in the red year-to-date. It’s hard to see how it will stay in the red with numbers like these!

Emira is on track to achieve its goals this year (JSE: EMI)

But the underlying portfolio is dealing with some struggles

Emira released an update for the four months ended July 2025, giving investors a helpful update before interims come out in November. The overall summary is that the fund is “on track to achieve its objectives” this year. Of course, that’s not the same thing as “the fund is killing it out there” – not every property portfolio is doing well at the moment.

The South African commercial portfolio (i.e. everything other than residential) enjoyed an improvement in vacancies, but negative reversions of -6.3% are worse than in the prior year (-5.6%).

If we dig deeper into this, retail vacancies increased from 4.2% to 5.1% and negative reversions were -3.3% vs. -1.2% in the prior year. That’s unfortunate negative momentum in the portfolio of 12 retail properties, most of which are grocer-anchored neighbourhood shopping centres. I wonder to what extent on-demand fulfilment from grocery stores is hurting footfall at these centres.

The office portfolio saw a slight uptick in vacancies (8.8% vs. 8.4%) and negative reversions of -7.8% (vs. -9.3% in the prior period). Across the 10 properties, most of which are P- and A-grade (i.e. of the highest quality), Emira is struggling to achieve much improvement.

The industrial portfolio saw a substantial improvement in vacancies from 7.9% to 2.0%, a typically lumpy move where one tenant takes up a large warehouse. Negative reversions were -7.1%, worse than -9.9% in the prior year. Emira has 19 industrial properties of varying sizes.

It’s concerning that not a single sub-category in the South African portfolio is achieving positive reversions. But it’s hard to know for sure what the impact on earnings will be this year, as many funds are currently in a similar boat and yet are still achieving earnings growth ahead of inflation because of the escalations in the underlying leases.

Moving on, the residential portfolio is down to 2,248 units (vs. 3,347 units as at March this year). They reckon another 289 units will transfer by December 2025 as they follow a value unlock strategy.

Emira also has a US-based portfolio of 11 investments in open-air centres. Vacancies increased from 4.6% to 6.2% due to an underlying tenant failure. The portfolio is performing in line with Emira’s expectations.

Bringing the portfolio review to a close, Emira has a 45% interest in DL Invest, a developer and owner of properties in Poland. This means that DL Invest has a valuable land bank for future development, as well as a portfolio of 39 income-generating properties. Poland continues to be a strong story, with vacancies down from 3.1% to 2.9% and strong support in the European debt markets for this business.

Finally, the loan-to-value ratio as at the end of August was 37.1%, which is higher than 36.3% at at March.

It feels like a mixed set of numbers overall. I’ll reserve judgment until we see the net impact on distributable earnings, as reversions aren’t the best indicator of overall current performance. My biggest worry would be the disappointing performance of the local retail portfolio at a time when many property funds are doing well.

HCI is jumping through hoops to help SACTWU (JSE: HCI)

This deal is getting more complex by the day

With HCI’s share price down 34% in the past year, the market isn’t exactly falling over itself to own these shares. The underlying exposure to the gaming industry is causing a lot of concern, particularly as part of a portfolio that includes assets that are cash hungry and more developmental in nature.

Ideally, when sentiment has soured, companies should be doing everything possible to simplify things and manage shareholder relationships. It therefore only adds to the concerns in the market that HCI is giving so much headspace to the cash flow needs of SACTWU as the B-BBEE shareholders.

There’s a lot of history here between the HCI management team and the union. This leads to a situation where other minority shareholders find themselves in the position of frustrated kids in the back of the car, while the adults in front are trying to navigate difficult country roads that were unnecessary in the first place vs. just staying on the highway.

As is the case with many detours, the road is getting more treacherous by the minute. HCI has been trying to figure out a way to repurchase shares from SACTWU and sell them a bunch of properties, thereby putting an ongoing revenue stream in the hands of the union and avoiding ongoing selling of shares in the market. In theory, that’s probably a decent outcome for HCI shareholders, but it doesn’t make the journey in the back of the car any less disconcerting.

A further detour is now necessary, as HCI has now come to the conclusion that this deal is too painful for HCI’s B-BBEE credentials, which are critical to the underlying business licences. They are uncomfortable with losing so much Black Ownership at listed company level.

To try and solve the puzzle, they are reworking the deal in such a way that SACTWU will have a controlling stake in Squirewood (the entity that holds the HCI properties that were being sold to SACTWU) and Squirewood will in turn hold around 25.3% of the issued shares in HCI. The details will come out in the circular, but the TL;DR is that instead of offloading the properties in SACTWU in exchange for shares in HCI (a decent outcome for shareholders), they are now only partially executing that deal.

It sounds to me like it’s a good day to be the attorneys billing for this deal, as it keeps getting more complicated and thus costly. As for the HCI share price, it barely moved in response to the announcement, possibly because it took the market the remaining few hours of the trading day just to wade through the content!

It’s not every day that you’ll see a gross loss, yet here we are at MC Mining (JSE: MCZ)

Naturally, things only get worse further down the income statement

A company making a loss is nothing new of course, but a gross loss (i.e. sales minus cost of sales) is highly unusual. In theory, this means that the company should rather have just stayed in bed for the period and incurred only its fixed costs!

At MC Mining, the year ended June 2025 includes revenue of $17.5 million and cost of sales of $24.1 million. That’s a gross loss of $6.6 million, which manages to be even worse than the gross profit of nil in the prior period.

Although administrative expenses fell by 55% to $6.9 million, there’s no way to rescue the income statement when it starts with a gross loss. There were impairments and finance costs, so the whole thing is just ugly.

Luckily, there’s a silver lining: the Makhado Project, which is really the only reason why MC Mining has a future. They’ve attracted strategic investment from Kinetic Development Group (KDG) for the project, with funding still to flow in various tranches. With all said and done, KDG will own 51% in MC Mining. This has come with a change in management as well.

There’s a lot to be done here, not least of all in stemming the losses at Uitkomst Colliery while they deliver on the big dreams at Makhado.

PSG Financial Services just can’t stop growing (JSE: KST)

The strength of the distribution model keeps shining through

PSG Financial Services released a trading statement dealing with the results for the six months to August 2025. The numbers are strong to say the least, with an expected increase in HEPS and recurring HEPS of between 19% and 22%.

Results will be released on 16 October, so they’ve also done a great job of giving investors a couple of weeks to digest this growth guidance. The share price is up 15% year-to-date and 24% over the past year, reflecting the ongoing strength in the business.

From strength to strength at Vukile, one of the best local REITs (JSE: VKE)

The market can’t get enough of this story

There are many highlights at Vukile, but the support from the debt market is certainly worth mentioning before we dive into the portfolio updates. With a recently upgraded credit rating of AA+(ZA), Vukile’s R500 million bond issuance was 6 times oversubscribed and achieved the lowest margin (i.e. most efficient cost of debt) since the bond programme was launched in 2012. Impressive to say the least and critical for any property fund of course, as debt is such a core ingredient for the business model!

Why are investors so happy with the story? It certainly doesn’t hurt that the first half of the year is expected to see net operating income growth of 10.1% in the South African retail portfolio, ahead of the budgeted 9.1%. On a like-for-like basis, growth is 8% vs. 6.4% in FY24. They are even achieving positive reversions at the moment, with strong demand for space in the township, rural and value centres.

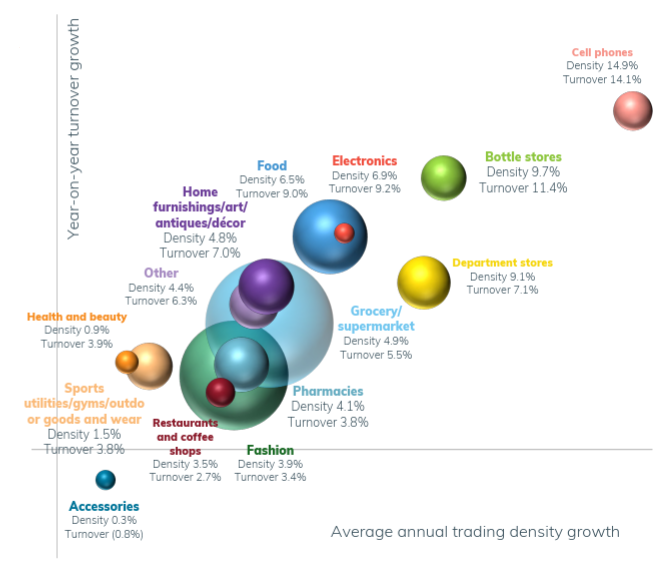

I always really enjoy the bubble chart that Vukile puts out in the pre-close update, showing the relative size and growth of the underlying retail categories:

In a world that keeps talking about a reduction in alcohol consumption, there’s certainly no evidence of that where Vukile operates. And just look at that growth in cell phones!

In the Castellana portfolio in Spain and Portugal, footfall was up 3% and sales increased 5.1%. The group seems to be happy with the underlying portfolio performance, particularly when you make some adjustments like the recovery process at Bonaire SC after flood damage.

Overall, Vukile expects to achieve the current guidance of at least 8% growth in funds from operations per share and the dividend per share. Updated guidance will be given when interim results are released, which suggests that things might be getting even better.

Vukile enjoys one of the strongest valuations in the sector. Despite this demanding valuation, the share price is up 14% year-to-date.

Nibbles:

- Director dealings:

- A director of Richemont (JSE: CFR) sold shares worth R5.2 million.

- A director of Northam Platinum (JSE: NPH) sold shares worth R4.3 million.

- Des de Beer is back at it, with a purchase of shares in Lighthouse Properties (JSE: LTE) worth R4.2 million.

- A director of Sabvest Capital (JSE: SBP) bought shares worth R216k.

- The company secretary of eMedia Holdings (JSE: EMH) bought shares worth R49k.

- Exemplar REITail (JSE: EXP) has given us yet another positive data point in the property sector, with a trading statement for the six months to August 2025 suggesting an increase in distribution per share of between 18.2% and 22.4%. The stock is very illiquid, so there are other far more practical ways to take a view on the sector. Nevertheless, it’s another useful example of positive momentum in the sector.

- Nampak (JSE: NPK) has lifted the lid on its succession plan, announcing that Riaan Heyl will become CEO with effect from 1 February 2026. His most recent role was as CEO of Pepsico SA, which acquired Pioneer Foods in 2020. He knows current Nampak CEO Phil Roux from the Pioneer days, so there will hopefully be a smooth transition.

- Corporates with bond programmes often make use of tender offers. This has nothing to do with Valentine’s Day and everything to do with early redemptions of debt, as the offer is made to holders of the debt to tender their instruments for redemption. It’s a pretty big deal for MAS (JSE: MSP) to be taking this route though, given how much work has gone into managing the refinancing risk for the company. MAS is willing to redeem €120 million of the outstanding principal amount of €172 million on the notes due 2026.

- KAL Group (JSE: KAL) announced the disposal of Tego Plastics as part of the broader plan to simplify the group and focus on other businesses. KAL Group will remain a customer of Tego going forwards. The announcement doesn’t mention the buyer or the purchase price, as the deal is so small that this is only a voluntary announcement rather than a categorisable transaction.

- Hulamin (JSE: HLM) has renewed the cautionary announcement regarding the potential disposal of Hulamin Extrusions. This are still in discussions regarding this possible transaction and nothing is certain at this stage.

- There’s more progress at Orion Minerals (JSE: ORN) in the wake of the company signing an all-important non-binding term sheet with Glencore (JSE: GLN) for funding and offtake to support the Prieska project. Orion has appointed an experienced project director as part of the plan to achieve first concentrate production from the Uppers at Prieska by Christmas 2026.

- Southern Palladium (JSE: SDL) has experienced a sudden jump in its share price, leading to a price query letter from the Australian Stock Exchange. The company had to confirm that there is no non-public information that could explain the move, with the Australian regulators obviously concerned that something important may have leaked.

- Breede Coalitions (Pty) Ltd, a vehicle spearheaded by activist investor Albie Cilliers, now has a stake of 15.04% in RMB Holdings (JSE: RMH). There’s certainly value to be extracted there, but getting it out is anything but easy because of the nature and structure of the underlying property holdings.

- AYO Technology (JSE: AYO) announced that shareholders strongly supported the resolution related to the offer by Sekunjalo and its concert parties of 52 cents per share. AYO is therefore headed for the exit from the JSE.

- If you’re an ESG enthusiast, you might enjoy the latest “governance roadshow” presentation by Exxaro (JSE: EXX). It includes all the typical ESG stuff, along with slides on executive remuneration. You can find it here.

- Penny stock Visual International (JSE: VIS) was in the news recently for a potential share subscription that implies a much higher value than the company is currently trading at. In the meantime, the company has released results for the six months to August 2025. It’s an extremely scrappy story, with going concern commentary that is almost as long as the rest of the director commentary! Property development is very difficult with an insufficient balance sheet, as funding or project delays can very quickly hurt a company or even sink it. Visual is currently seen as a going concern, but one of the reasons is that the remaining creditors are “close to the group” and continue to support it. The business has a small asset base of properties and very little cash. Perhaps the planned capital raising activity will breathe some life into this one. But when the website gave a 404 error when I tried to access it, you know it’s bad.

Note: Ghost Bites is my journal of each day’s news on SENS. It reflects my own opinions and analysis and should only be one part of your research process. Nothing you read here is financial advice. E&OE. Disclaimer.