Burstone’s local growth was partially offset by flat numbers in Europe (JSE: BTN)

They remain committed to building a large platform in South Africa

Burstone Group released results for the six months to September. Distributable income per share was up by 3%, but the more interesting story can be found in the segmental analysis.

In South Africa, like-for-like net operating income was up 5.3%. Negative reversions were 2.5%, an improvement on negative 8.4% in the prior period. Vacancies in South Africa also went the right way. Unfortunately, due to higher vacancies in Europe that offset positive rental reversions and indexation, like-for-like net operating income was flat in that market.

With the strategic focus on building property platforms and earning fees using that most wonderful concept of OPM (Other People’s Money), Burstone’s fee income is now 14.1% of group distributable income per share. It grew by 70.6% year-on-year!

Building on the success achieved in offshore markets (including the deal with Blackstone in Europe that will hopefully pay off in years to come), Burstone is still looking to build their SA Core Plus platform that will be seeded with around R5 billion in retail and industrial assets.

For now though, investors have to be patient. The interim dividend is only 3% higher, which seems rather tame in the context of all the excitement around these platforms.

Mid-single digit growth at Life Healthcare – provided you look at maintainable performance (JSE: LHC)

The numbers are complex thanks to various recent corporate actions

Life Healthcare released a trading update for the year ended September 2025. The company recently sold the Life Molecular Imaging business and distributed billions to shareholders in the past year. With large corporate deals always distorting the comparability of numbers, it’s important to know which percentages to focus on.

Paid patient days increased by 1.1% and tariffs were up 5.1%, with an expectation for overall revenue growth of between 5.5% and 6.5%. The blemish on the performance is the healthcare services business, where revenue fell by 7.5% due to the loss of two government contracts.

Normalised EBITDA was up by between 4.5% and 5.0%, or between 6.6% and 7.1% on a like-for-like basis. One of the pressure points here is the margin-dilutive nature of the renal dialysis business acquired from Fresenius Medical Care, with initiatives underway to improve the margin.

Life does get cheeky in their announcement here, with disclosure around what the growth would be if you exclude “assets in the portfolio that form part of an optimisation plan” i.e. all the bits that aren’t working. I’m all for normalised numbers if they tell a fair story, but this attempt is straight out of the “if my grandmother had wheels, she would’ve been a bicycle” bucket. Every company on the JSE would love it if investors only focused on the good stuff.

Speaking of normalisation, the best metric to focus on is probably normalised earnings per share from continuing operations, up by between 7% and 12%. This gives you a good idea of how the underlying business is doing (including the uglier bits). HEPS is severely impacted by the contingent consideration payable to Piramal for the Life Molecular Imaging business though, so treat all these numbers with caution.

The market saw something that it didn’t like, with the share price down 7.3% on the day on strong volumes.

Most of Momentum’s numbers are heading in the right direction (JSE: MTM)

Value of new business is being impacted by mix changes

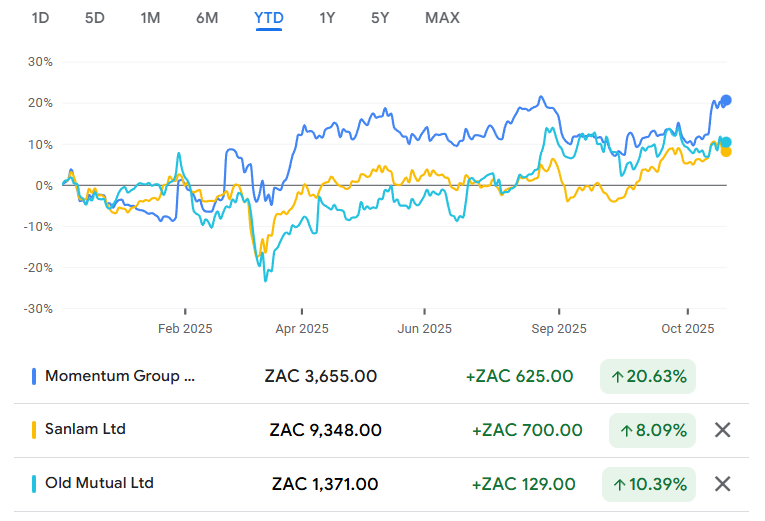

Momentum released an update for the three months to September 2025. It’s interesting to see this come out so soon after the Old Mutual (JSE: OMU) update, where growth seems to be hard to come by. Momentum’s numbers look more inspiring, with mid-single digit growth across a number of important metrics. The solid performance is coming through in the share price this year, with Momentum outperforming Old Mutual and Sanlam (JSE: SLM) in 2025:

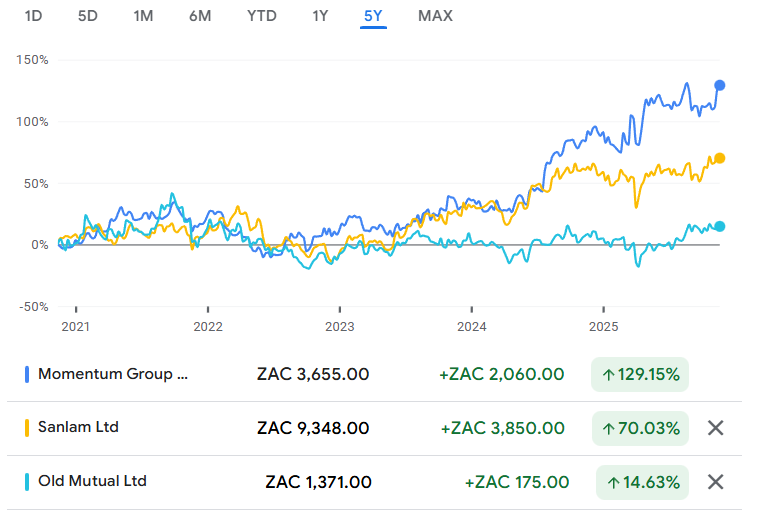

But here’s the chart that might really impress you, with Momentum as comfortably the best of the three over a 5-year period as well:

If we look at the three months to September, we find growth of 8% in recurring premiums and 5% in single premiums. The metric they place much importance on is the present value of new business premiums (PVNBP), up by 8%. In this complicated sector, the value of new business (VNB) is also an important metric, dropping by 26% in this case due to lower life annuity sales in Momentum Investments that were only partially offset by improvements elsewhere.

If we look segmentally, the largest segment (Momentum Investments) grew its PVNBP by 9%. This segment contributed 61% of PVNBP in this period. The other segments are quite an even spread in terms of size, with Momentum Africa growing rapidly (up 58%) and Momentum Life having a tough time (down 9%). In the Africa business, Namibia features prominently as a source of growth across the corporate and retail businesses.

Another interesting nugget from the segmental analysis is that the Indian business is still scaling towards profitability. They hope to break even under Indian GAAP (their accounting system in India) in the latter part of FY26.

In terms of expenses, group direct expenses increased by 5% thanks mainly to pressure on regulatory and IT spend. The group has already realised savings of R389 million and is looking for another R500 million. The latter part of FY26 is expected to see more of this benefit coming through.

Overall, Momentum is growing in most areas and delivering on their promises to shareholders. There are some underlying focus areas of course, as is the case for any business of this size.

NEPI Rockcastle has reaffirmed guidance (JSE: NRP)

Due to acquisitions, it’s important to look at like-for-like growth

NEPI Rockcastle has released a business update covering the third quarter and thus nine months ended September. Net operating income was up by 12.3%, but you have to remember that NEPI Rockcastle has been active in acquisitions. It’s therefore critical to focus on like-for-like growth as the best indication of how the underlying portfolio is performing, with growth of 4.4% in that metric.

Tenant turnover was up by 3.5% on a like-for-like basis, with footfall down 0.6% and average spend per visitor up 4.6% excluding the recent acquisitions in Poland.

The company is pushing the renewable energy narrative pretty hard, noting double-digit returns in their energy business. They raised a €500 million green bond in September in an offering that was more than 8x oversubscribed! This will support the significant construction pipeline.

The loan-to-value ratio as at the end of September was 31.4%, below the 35% strategic threshold. In other words, the balance sheet is healthy. It’s worth mentioning that this is based on June 2025 values of the properties, as they are not revalued for the September quarter.

The group has affirmed guidance for distributable earnings per share growth of 2.5% to 3%.

International volumes are the big headache at RFG Holdings (JSE: RFG)

At least the second half was much better than the first half in this regard

RFG Holdings released results for the year ended September 2025. Remember, this is the group that Premier (JSE: PMR) is looking to acquire in a share-for-share deal. I’ve written about it quite a bit, including my concerns about the strategic fit and whether these businesses actually belong together.

RFG’s results give us insight into some of the volatility that the business needs to navigate. Group revenue was up just 1.6%, but the underlying story is that the Regional segment (i.e. local) was up 4.1% and International fell by 7.9%. The good news is that the Regional segment is 81% of group revenue, so the bulk of the exposure is to the less volatile segment.

In the International segment, the currency is responsible for a 1.3% dip, with a 6.8% decline in volumes as the biggest reason for the segment going the wrong way this year. The trouble lies in global oversupply of deciduous fruit products. It seems as though the situation is improving at least, as International volumes were down 11.7% in the first half of the year and only 3.7% in the second half. Operating profit margin in the International segment more than halved from 11.4% to 5.7%. Ouch!

In the Regional business, fresh foods were up 7.4% despite volumes decreasing by 0.5%. In Long life foods, revenue was up just 2.1% due to volumes pressure in canned meat in particular. Alas, Regional operating profit margin was down by 170 basis points to 8.9% as reported (which includes an impairment to the meat operation), or down 20 basis points to 10.4% on a normalised basis (excluding the impairment). Margin compression isn’t what investors want to see.

HEPS fell by 10.3% and the total dividend per share for the year followed suit, down 10.4%.

These aren’t exactly the kind of numbers that can easily justify the significant premium being offered by Premier.

Southern Sun: highest October occupancy since FIFA ran our country in 2010 (JSE: SSU)

But adjusted HEPS is flat year-on-year

Southern Sun released interim results for the six months to September. Income growth was 5%, boosted by South Africa’s performance (up 8%). Offshore had a tough time, down 29% due to refurbishments and weaker trading in certain African markets.

The South African hotels saw their occupancy rate improve from 59.4% to 60.6%, accompanied by a 6% increase in average room rates. Operating expenses were up 7%, with pressures from IT and energy costs among others. Despite this, EBITDAR was up 6% to R827 million. That’s certainly a lot better than in the offshore business, where EBITDAR swung from a profit of R39 million to a loss of R9 million. And no, EBITDAR isn’t a typo – the hotel industry has a nuanced take on the more commonly observed EBITDA.

There was a significant decrease in net finance costs, but there was also a substantial jump in amortisation and depreciation. This is a good reminder that a lot still happens between EBITDAR and HEPS. Although HEPS as reported was up 2%, adjusted headline earnings was flat at R334 million.

Unsurprisingly, the coastal regions were the highlight – the Western Cape was up 9% on revenue and 14% on EBITDAR, while KwaZulu-Natal’s revenue increased by 7%. Alas, EBITDAR in KZN fell by 2%. In Gauteng, revenue was up 4% and EBITDAR fell 6%, with one of the issues being water outages. Poor governance has a cost.

Nibbles:

- Director dealings:

- Richemont (JSE: CFR) doesn’t give you much to work with when it comes to director disclosure, so all we know is that an executive director sold share awards worth over R50 million. There’s no indication of whether this is the taxable portion or not.

- A senior exec at Nedbank (JSE: NED) sold shares worth R5.2 million.

- Christo Wiese’s Titan Premier Investments bought shares in Brait (JSE: BAT) worth R4.5 million.

- There’s been a purchase of shares in Lighthouse Properties (JSE: LTE) by a director, but not Des de Beer for once! Instead, it was the independent chairperson who bought shares worth R3.6 million.

- A senior exec of Standard Bank (JSE: SBK) sold shares in the company worth R1.9 million.

- The chairman of Afine Investments (JSE: AFI) bought some shares with his lunch money – a whopping R725. And no, I didn’t leave out any zeroes. Jokes aside, I suspect that liquidity in the stock is the challenge.

- Merafe (JSE: MRF) has given us another look into just how bad the local ferrochrome market is. The company’s joint venture with Glencore (JSE: GLN) has been investigating ways to try and avoid retrenchments, including through engagement with the South African government. The urgent request is for a competitive energy tariff, something that doesn’t seem to be forthcoming. Retrenchments are therefore set to begin in the coming weeks, with the Wonderkop and Boshoek smelters to be placed on care and maintenance. This will leave only the Lion smelter operational.

- Southern Palladium (JSE: SDL) has completed its share purchase plan, a valiant effort by the company to give retail shareholders an opportunity to invest in new shares alongside institutional investors. The juice is rarely worth the squeeze here, which is why most companies don’t bother and just focus on accelerated bookbuilds to institutions instead. Case in point: Southern Palladium raised A$20 million from sophisticated and institutional investors, while retail shareholders only subscribed for A$65k worth of new shares. They were hoping to raise up to A$1 million from the share purchase plan, so it was way off target. There’s a huge amount of value in retail investors – it’s just a question of reaching them in the right way and with a consistent story that builds up over time.

- Deneb (JSE: DNB) has been trying to dispose of properties recently. In August, they announced the sale of Mobeni Industrial Park in Durban. The good news is that the Competition Commission has given it the green light. The transfer of the property is expected by the end of January.

- Afine Investments (JSE: ANI) released results for the six months to August. There is very little liquidity in the stock, so it just gets a mention in the Nibbles. Revenue was up 11.5% and the dividend per share was up 8.8%. That’s a decent uplift from this specialised REIT that is focused on fuel forecourts.

- Brikor (JSE: BIK) is certainly one of the smaller and more obscure names on the local market, with a market cap below R100 million. In a trading statement for the six months to August, the company has guided a headline loss per share of between 1.7 cents and 2.0 cents vs. positive HEPS of 1.1 cents in the prior period. They give no other details at this stage.

- Shuka Minerals (JSE: SKA) has been trying to get through all the weirdness around cash availability from Gathoni Muchai Investments (GMI). As you may recall, GMI has been very slow to provide the promised capital to Shuka that is necessary for the acquisitions in Zambia. With the initial $300k having come through, Shuka has managed to buy itself some time for the deal with the sellers of Leopard Exploration and Mining. Through various steps, Shuka will receive an initial effective position of 22.2% in Leopard and thus the Kabwe Mine in Zambia. There’s no time to waste though, as the remaining tranches must all be settled by the end of December.