City Lodge’s momentum is interesting (JSE: CLH)

Meanwhile, the share price has gone the other way

We begin with a year-to-date chart for City Lodge Hotels, reflecting a rather sad and sorry tale of a market that stopped believing in SA Inc:

Some of the metrics looked pretty bleak in the interim earnings, like occupancy rates. But with the release of full-year earnings, there’s been a significant improvement in the second half of the financial year. Even more importantly, the first couple of months of the new financial year are telling a much better story.

For the year ended June 2025, City Lodge increased revenue by 3% thanks to pricing increases that offset a 200 basis points decrease in the occupancy rate to 56%. HEPS for the year was down 0.3%. Adjusted HEPS, which takes out the impact of things like forex, was up 9%. As always, the dividend is a better indication of which HEPS number to focus on, with no increase at all in the dividend for the year.

This was a year of significant investment in refurbishments of hotels, as well as a refreshed website that they must be very proud of because it made the cut as a highlight of their capex programme in the announcement! I don’t think I’ve ever seen that before. Presumably, the website wasn’t cheap. More importantly, they took advantage of the weaker share price by repurchasing shares worth R30 million.

The refurbishments do take some rooms out of commission, but I somehow doubt that this is the reason for the dip in occupancy. There’s still a demand problem, especially as City Lodge doesn’t really appeal to international inbound travellers in the same way that Southern Sun (JSE: SSU) does. The important thing is that occupancy was down 400 basis points for the first half of the year, so ending the year down 200 basis points reflects a decent recovery in the second half.

The food and beverage part of the business has been a major strategic push in recent years and the company has done a great job in that regard. This segment grew revenue by 8% for the year and now accounts for 20% of total revenue (up from 19% in the prior year).

With a tough revenue story, it’s really valuable that the company managed to keep cost growth at just 4%. This did wonders for protecting profitability.

We now get to the particularly good news: July and August 2025 saw an uptick in occupancy of 400 basis points year-on-year. Food and beverage revenues jumped by 16% and 14% for July and August respectively. To add to this, the group is now debt free.

Perhaps it’s time for that share price chart to start heading back into the green?

An ugly day for the Discovery share price (JSE: DSY)

And this was despite strong earnings

The market can be such an unforgiving place. Discovery tanked 9.5% on a day in which it released earnings that showed HEPS growth of 30% for the year ended June 2025. But how can that be?

The concern definitely isn’t a metric like annualised return on opening embedded value, which increased from 13.2% to 15.7%. The final dividend per share was up by a juicy 31%, so it isn’t that either. And as we already know from Discovery’s detailed recent trading update, Discovery Bank achieved breakeven in the second half of the financial year, which is ahead of plan.

A particularly fun fact about Discovery Bank is that 65% of their new clients don’t have any other Discovery products. This isn’t just a cross-sell model. If anything, it’s a helpful funnel to bring new clients into the broader group.

Word on the street is that expected future profit from insurance contracts could be the issue for the share price, with a concern around margins going forwards. I’m certainly not an expert on this sector, so I can’t say for sure whether this is what drove the drop in the share price. Something that did jump out at me is a decline in new business in Discovery Life, a key source of bringing new clients into the Discovery ecosystem.

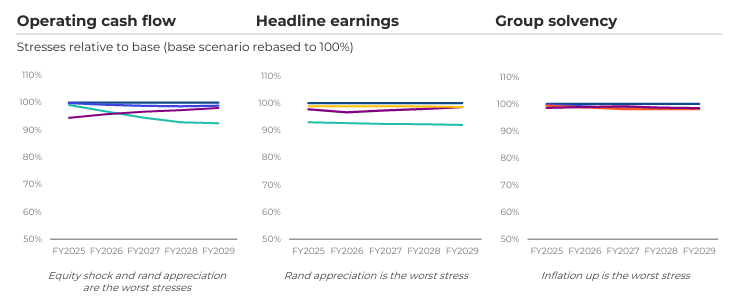

Despite this, the group’s growth ambition is earnings growth of 12.5% – 17.5% per annum in Discovery South Africa from FY25 to FY29, along with 20% – 30% per annum in Vitality over that period. Those are lofty goals, helped along by Discovery Bank now being on the exciting part of the J Curve.

If there’s any criticism to be levelled here, it’s that whoever did these charts needs a tough talk about the use of the y-axis:

Either that, or it’s done on purpose to make the volatility seem much lower than it actually is. I’ll let you decide whether this is a happy accident or a deliberate distortion of the charts.

FirstRand’s UK issue is but a scratch m’lord (JSE: FSR)

Group earnings grew by 10% and guidance looks fantastic

FirstRand has been dealing with a nasty headache in the UK motor finance industry. There’s been a lot of regulatory noise around commissions paid to dealers. FirstRand recognised a provision of R3 billion in the prior year and they’ve increased that provision by R2.7 billion in the year ended June 2025. They’ve also spent R253 million in legal and professional fees on the matter in the past year (an actual cash outflow, not just a provision).

Despite this significant cost, FirstRand still managed to grow normalised earnings and HEPS by 10%. Normalised return on equity was 20.2%, which means they are still one of the best performing financial services groups in South Africa and certainly the pick of the legacy banks in terms of underlying business quality, which is why FirstRand has been trading at a premium valuation for as long as I can remember.

Cash quality of earnings is strong, with the dividend up 12%.

There was a small uptick in the credit loss ratio, attributed to various factors including “early emerging strain” in the SME book within FNB Commercial. Those interest rate cuts really need to come now, although the retail book actually seems to be in good shape.

Surprisingly, the rest of Africa wasn’t great for FirstRand in this period, bucking the trend we’ve seen elsewhere. FNB Africa grew earnings by 5% and RMB was down 2% as reported, or up 8% and 5% in constant currency respectively.

The star performer was WesBank, with earnings up by 20%. It only contributes 6% of group earnings though. RMB was also solid, with earnings up 10% and a contribution to the group numbers of 26%. If you look through all the segments, the major source of earnings uplift was at the centre, which means areas like endowment and group capital management. Banks are complicated things.

We see this come through again in the note on net interest income, which increased by 6%. The capital endowment benefit was up 14% thanks to the asset and liability management strategies that they use, while they also increased both deposits and loans to customers. Interestingly, they note subdued demand for mortgages, with growth up just 3%. South Africans are buying cars, not houses. Further bucking the trend in the sector, net interest margin also improved (by 6 basis points) thanks to the mix effect of underlying loans.

On the non-interest revenue side, income grew by 6%. Insurance was a particular highlight, up 9%. Unsurprisingly, as we’ve seen everywhere else in the sector, short-term insurance was the major driver.

In RMB, it was advisory fees that really did well, along with realisations of private equity assets. Trading income fell by 27%, so again the benefit of having various sources of revenue is on full display.

Looking ahead to the new financial year, FirstRand expects high single-digit growth in net interest income, which is impressive. The credit loss ratio is expected to remain at the bottom of the through-the-cycle range. Non-interest revenue growth is expected to be in the low- to mid-teens, which would be excellent. They expect cost growth below inflation, which then translates into normalised earnings growth in the “high mid-teens” in their words. Return on equity is expected to be at the upper end of the range of 18% to 22%.

It’s little wonder that the share price closed 6.4% higher based on such strong guidance!

Lesaka Technologies guides a strong FY26 (JSE: LSK)

They just have an awkward accounting restatement to deal with

The unfortunate thing about the markets is that people don’t always read properly. When an announcement talks about an accounting restatement, far too many people just panic and head for the exit as sentiment deteriorates. At Lesaka Technologies, there is indeed a restatement of the past few quarters, but revenue will go up in that restatement rather than down. This relates to agent vs. principal accounting and the split between revenue and cost of goods sold. The TL;DR is that there’s no impact on net profit, so my read is that it’s really just a storm in a teacup that is more a function of accounting complexities than anything else.

If we focus on the fourth quarter earnings that bring FY25 to a close, we find that net revenue was up 47% and adjusted EBITDA increased by 61%. That’s encouraging margin expansion, although the same isn’t true for the full year where revenue was up 38% and adjusted EBITDA increased by “only” 33%.

If you look at the net loss without adjustments for the year, you’ll find a gigantic loss of $87.5 million. This is primarily because of $49.3 million in post-tax negative charges related to the sale of MobiKwik. Adjusted profits are a better way to assess maintainable performance, but investors also shouldn’t gloss over situations where assets were sold at a loss, even if they were considered non-core.

Looking ahead, the guidance for FY26 is adjusted EBITDA growth of at least 35%. They are also introducing adjusted earnings per share as a metric (like all technology companies love to do), with an expectation for this to at least double. Notably, the guidance excludes the Bank Zero acquisition.

The market didn’t love this, perhaps because of the revenue restatements. The share price closed 6.9% lower on the day, taking the year-to-date drop to 23%.

Mantengu looks to acquire New Salt Rock City, giving control of a PGM tailings business (JSE: MTU)

They need to be careful with how they’ve structured this

Mantengu announced the acquisition of 100% of New Salt Rock City, which owns 60% of Kilken Platinum. In turn, Kilken Platinum owns 70% of the Kilken Imbani Joint Venture. In other words, this structure means that Mantengu will ultimately control the joint venture (subject to any unusual terms of that agreement that we aren’t privy to), but will only have 42% economic exposure (60% x 70%).

The Kilken Imbani Joint Venture treats the tailings from the Amandelbult platinum mine owned by Valterra Platinum (JSE: VAL). The joint venture acquires the PGM rich tailings from the mine, processes them and then sells them back to the mine.

For some reason, the announcement says they will issue shares to New Salt Rock City, which doesn’t make any sense as that’s the entity they are acquiring. I’m sure they mean that shares will be issued to the seller of that business, being the Lutzkie Besigheids Trust. It will be done in such a way that the seller will have less than 35% in Mantengu and thus won’t trigger a mandatory offer, which means there’s a cash component as well. There’s no indication yet of how it will be funded.

The price also hasn’t been announced yet, as this will be established during the due diligence. All we have to work with is a valuation from back in 2020 that values the joint venture at R4.4 billion. Inexplicably, the last set of audited financials for the joint venture was from 2019! Sigh.

We haven’t even gotten to the weirdest part yet. The CEO and CFO of Mantengu Mining will be appointed to the board of Kilken immediately upon execution of the term sheet i.e. before any of the deal conditions are met and before the price has even been agreed. They better hope that there isn’t a Competition Commission approval requirement for this deal, as one of the core elements of competition law is that you cannot behave as though the deal is done before it is actually approved by the regulator. I’m no legal expert, but it’s hard to see how a director appointment wouldn’t be in breach of that. Perhaps things have changed since my advisory days a decade ago, but I doubt it.

The due diligence period will last for three months, with the CEO and CFO being directors of a company that they wouldn’t even have done a due diligence on. That’s certainly not a risk I would personally take.

Nibbles:

- Director dealings:

- A non-executive director of two major subsidiaries of MTN (JSE: MTN) – and more importantly, the group COO) – sold shares worth a meaty R14 million. That’s a large disposal after a strong rally in the price.

- A director of SPAR (JSE: SPP) bought shares worth R748k.

- A director of a major subsidiary of PBT Group (JSE: PBG) bought shares worth almost R500k.

- Barloworld (JSE: BAW) updated the market on the standby offer conditions and the acceptance levels thus far. The Namibian Competition Commission approval has now been received, with only the COMESA and Angolan approvals outstanding. It’s always the regulators in the rest of Africa that take the longest. The longstop date has been extended by three calendar months to 11 December 2025 to achieve these approvals. At this stage, the offer has been accepted by holders of 41.1% of Barloworld shares in issue, which would give the consortium and the Barloworld Foundation an effective 64.5% in Barloworld. The offer will be open for 10 business days after the transaction becomes unconditional, so it’s likely there are shareholders out there just keeping their options open until they have no choice but to accept or decline.

- The various resolutions required for the implementation of the Cilo Cybin (JSE: CCC) transactions were all passed by shareholders. The company will be transferring its listing to the main board of the JSE on 29 September.

- Libstar (JSE: LBR) has not exactly been a success story on the local market, with the share price having shed nearly 70% of its value since listing. This is why Libstar has been able to repurchase the shares in its B-BBEE scheme for nominal value. If a share price heads in the wrong direction, then so too will the value in a B-BBEE scheme. As these schemes usually have huge amounts of leverage in them, they can easily end up with no value unless the underlying shares go up in value significantly over time.

- For those who like to get a sense of the cost of debt, Bidvest (JSE: BVT) has priced US$-denominated seven-year bonds at a coupon of 6.2%. The notes are issued in the UK (despite being in US dollars) and are guaranteed by Bidvest, so that’s a solid indication of the group cost of debt in hard currency.

- Although the offer by Primary Health Properties (JSE: PHP) to shareholders of Assura (JSE: AHR) has now formally closed, there is still the compulsory or “squeeze-out” offer to get the rest of the shares. In other words, even for those who didn’t accept the offer in time, they will likely be forced to sell their shares anyway.

You use % in most of your articles so why do you mix % and basis points when writing about City Lodge?.

Did Mantengu acquire 10000 basis points of New Salt Rock City?

Hi Ian. It’s better to use basis points when describing how a percentage has moved. So on an occupancy rate of 58%, if I said that it decreased by 2%, that could mean either (1) by 200 basis points to 56% or (2) by 2% of 58% which is 1.16%, down to 56.84%. It’s therefore always better to use basis points when there’s room for confusion.