Solid numbers at MAS, but watch that footfall (JSE: MSP)

eCommerce is a trend worth watching

Whenever a retail-focused property fund releases earnings, one of the first things I look at is footfall. The trend is clear across multiple geographies: people aren’t going to malls as often as they used to. In some cases footfall growth is still positive (driven by trends like urbanisation), but not by much. When footfall turns negative, then the only thing driving higher tenant sales will be the average basket size and the extent to which landlords can participate in omnichannel sales that are fulfilled by stores in the mall.

Long-term concerns aside, MAS Real Estate put out solid numbers for the year ended June 2025. With so much focus on the shareholder register and the board recently, it’s great to see that the underlying business is doing well. Distributable earnings per share jumped by 27.7% year-on-year and valuations were up 7.3% on a like-for-like basis. The loan-to-value ratio has improved from 26.3% to 23.2%. It all looks good.

As alluded to when I started this section on MAS, footfall isn’t the major driver of growth here. In the MAS retail portfolio (excluding the DJV joint venture), it was up 3.3% for the full year, but footfall only increased by 0.8% in the second half of the year. That’s a huge deceleration. The good news is that sales per square metre grew 6.9% for the full year and 6.3% in the second half, with higher rent reversions in the second half helping to blunt the impact of lower footfall.

The DJV retail portfolio did a lot better on key metrics, with sales per square metre up by 18.8% on a like-for-like basis and footfall up 4.2% for the full year. Rent reversions were a meaty 24%.

The tangible net asset value per share is 186 euro cents (roughly R38.40 vs. the current share price of R21.00). The market has been more focused on the dividend – or lack thereof – than the capital value recently. With the dust having settled on the shareholder register and with Prime Kapital (the joint venture partner) having given an undertaking to prioritise distributions of available profits over new investments, the hope is that dividends will soon return.

Costs are running too hot at Northam Platinum (JSE: NPH)

And this means that margins have suffered

Northam Platinum has released results for the year to June 2025. Despite a modest production increase in own operations of 0.7%, operating profit has dropped sharply from R4.8 billion to R3.6 billion. Operating profit margin has contracted from 15.7% to 10.9%. That’s clearly a problem.

We can’t even point to a poor sales result to explain this, as sales volumes were up 5.9% and sales revenue increased 6.9%. That really isn’t a bad result, but it wasn’t enough to offset the cost pressures in the group. The cash cost per equivalent refined 4E ounce increased by 8.1%.

If we dig deeper into the operations, Booysendal as the largest operation suffered a 14.4% decline in operating profit to R3.9 billion. This operation also required 11.7% more capex, so that’s quite a squeeze on free cash flow. At Zondereinde, they managed to grow operating profit by 5.5% to R570 million despite a deterioration in the cash margin per refined 4E ounce. Capex was 7.7% lower at Zondereinde, which also helped. Unfortunately, Eland more than offset the good news at Zondereinde. In fact, Eland more than offset Zondereinde full stop, with a 31.3% deterioration in the operating loss to R768 million! To add insult to considerable injury, capex was 31.9% higher at Eland.

Although Northam enjoys significant headroom on its facilities, it’s also worth noting that net debt increased from R3.1 billion to R5.1 billion. The net debt to EBITDA ratio more than doubled from 0.50x to 1.04x.

In terms of guidance for FY26, the unit cash cost per 4E ounce is expected to be between R27,500 and R28,500. The FY25 number was R25,728, so the cost pressure seems to be relentless. Even if PGM prices do well, it all seems very risky to me.

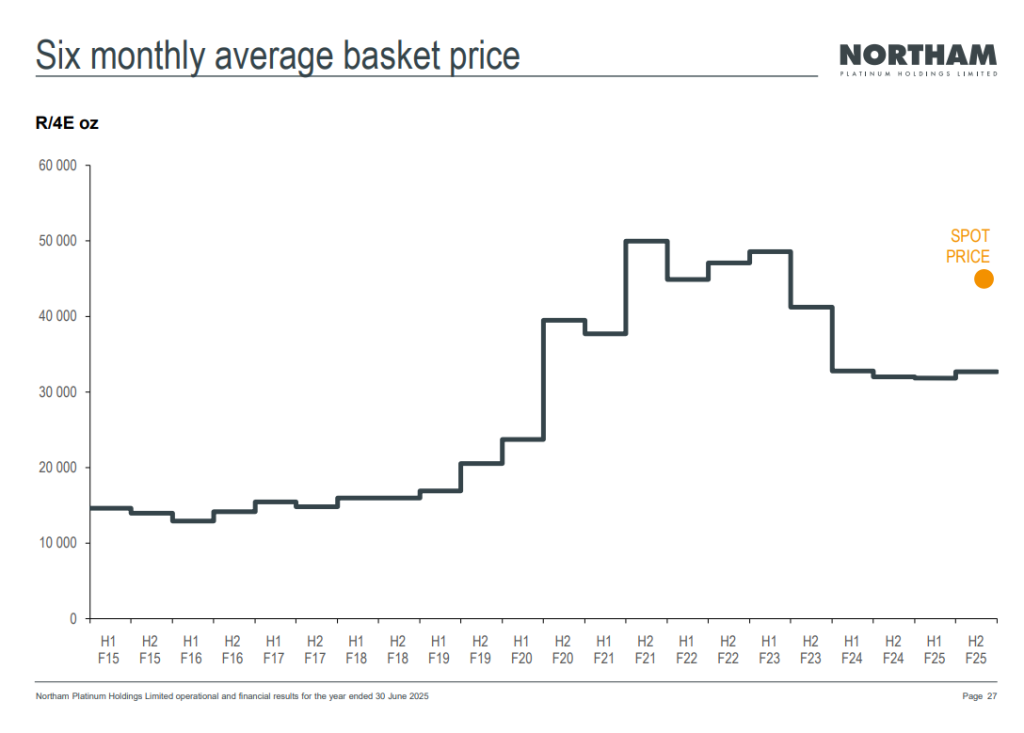

The share price is up 98% year-to-date. It’s cooled off quite a bit though, down 14.5% from its recent 52-week high. To finish off on Northam, I enjoyed this chart in the investor presentation that shows the six monthly average basket price going back over the past decade, along with an indication of where the current spot price is. It shows you why the share price has rallied in anticipation:

Super Group’s continuing operations are struggling for growth (JSE: SPG)

But the balance sheet is in good shape

Super Group released a trading statement for the year ended June 2025. It’s not exactly the easiest time in the world to be running a logistics business with heavy exposure to the European automotive sector, along with an automotive dealerships business that is clearly in that value chain as well.

Despite this, HEPS from continuing operations is expected to move by between -2.3% and 0.0%. They might be in the red, but not by much. This excludes the results of SG Fleet (which was disposed of), inTime (in the process of being disposed of) and the Suzuki, Kia and Hyundai dealerships in the UK (I can’t find any evidence of an announced transaction for this – happy to be corrected if wrong).

If you look at total operations instead of continuing operations, HEPS was up by between 24% and 28%.

Super Group notes that the balance sheet is strong, with debt leverages at “modest” levels and plenty of headroom on their borrowings covenants i.e. the ability to access capital if needed. We will find out for sure on 9 September when Super Group is expected to release earnings.

Nibbles:

- Director dealings:

- A director of Sabvest (JSE: SBP) bought shares in the company worth R7.3 million.

- An associate of a director of 4Sight Holdings (JSE: 4SI) bought shares worth R1.4 million.

- Des de Beer bought another R1.06 million worth of shares in Lighthouse Properties (JSE: LTE).

- An associate of a director of KAP (JSE: KAP) bought shares worth R995k.

- A director of STADIO (JSE: SDO) bought shares worth R298k and a different director bought shares worth R108k.

- A director and an associate of the same director bought shares in Finbond (JSE: FGL) worth R118k.

- A director of Vunani (JSE: VUN) bought shares worth R3.7k.

- Accelerate Property Fund (JSE: APF) has suffered a delay in the release of the circular for the all-important Portside disposal. The JSE has granted an extension for the release of that circular until 15 October 2025. They really need to get that deal done to remove one of the many overhangs on the share price.

- In mid-July, AECI (JSE: AFE) announced the disposal of Schirm USA. The good news is that the deal has become unconditional and has been implemented, with $40 million in proceeds flowing to AECI. The group is executing a strategy that includes focusing on AECI Mining and AECI Chemicals, while divesting from any distractions.

- Shareholders in eMedia Holdings (JSE: EMH) gave almost unanimous approval for all the resolutions required for the transaction with Remgro (JSE: REM). I’m not surprised, as it seems like a solid deal for eMedia.

- Sebata Holdings (JSE: SEB) did not release the results for the year ended March 2025 as expected on 29 August. They have unfortunately not even given an indication of when the results might come out, due to delays in the technical review in the audit of Inzalo Capital Holdings.

- Salungano Group (JSE: SLG) announced that the board can no longer stand behind the previous guidance that the listing suspension will be lifted in mid-November. Due to ongoing delays in financial reporting, they can’t even give an updated timeline at this point.

Note: Ghost Bites is my journal of each day’s news on SENS. It reflects my own opinions and analysis and should only be one part of your research process. Nothing you read here is financial advice. E&OE. Disclaimer.