Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Despite the Canal+ deal, MultiChoice isn’t sitting still (JSE: MCG)

Sanlam (JSE: SLM) is partnering with MultiChoice to drive an insurance strategy into the user base

The insurance game is all about distribution and reaching large client bases through clever partnerships, especially when you’ve reached the size of Sanlam. Writing one new policy isn’t even a drop in the ocean at Sanlam. But accessing millions of potential customers? Different story.

Sanlam will acquire a 60% stake in MultiChoice’s insurance business called NMS Insurance Services. Even though nobody ever talks about this operation within MultiChoice, it’s clearly not small. The up-front payment for the 60% is R1.2 billion and there’s a potential earn-out that could take it to R1.5 billion. Before the deal, NMS will declare a pre-acquisition dividend to MultiChoice of R59 million.

NMS has been operating for the past 20 years, writing policies related to device, installation, funeral, subscription waiver and debt waiver insurance products. Of course, there are much bigger plans with Sanlam involved. There are 21 million households across 50 countries, so this is a huge potential market. The question is whether NMS will successfully convince a DStv subscriber to take out insurance for things that might not be related to the DStv subscription itself.

The number of in-force policies increased 19% year-on-year in the 2024 financial year. There are 3.3 million in-force policies. Profit after tax was up 51% for the year to R296 million, so you can see how they’ve gotten to that valuation.

I like this transaction for many reasons. Sanlam is taking control of the insurance business with this 60% stake, which makes perfect sense as Sanlam (not MultiChoice) are the insurance experts. For MultiChoice, retaining a 40% stake in a growing business is significant. Goodness knows the up-front cash doesn’t hurt either, as MultiChoice is investing heavily in its business at the moment as it grows in digital streaming.

These are Category 2 transactions for both companies, so shareholders of Sanlam and MultiChoice won’t need to vote on the deal. There are a number of conditions to be met though, with a fulfilment date of January 2025.

Sephaku flags much higher earnings (JSE: SEP)

The share price closed 25% higher in appreciation of these numbers

Sephaku Holdings released a trading statement for the year ended March 2024 that tells an excellent story for shareholders. You won’t often see a year-on-year move like this, although there’s a significant base effect here. The underlying story is that the group’s businesses have returned to a level of performance seen two years ago.

Still, there will be no complaints from shareholders about HEPS jumping from 9.98 cents to between 24.5 cents and 26.0 cents. The share price closed 25% higher at R1.35.

Southern Palladium has completed its drilling campaign (JSE: SDL)

The results are described as consistent and robust

For an early-stage mining group, it’s all about working through milestones on the project and getting it closer to production. There are a number of important steps along the way, like a Mineral Resource Estimate and a Pre-Feasibility Study. As each milestone is reached, value is created for investors.

This means that there is drilling along the way. Lots of drilling. The initial drilling campaign has now been completed by Southern Palladium and the company seems happy with the results, with the goal being to release an Indicated Mineral Resource in the third quarter of 2024. This will facilitate the planning for the Pre-Feasibility Study.

So far, so good then.

Stor-Age could only manage flat dividend growth this year (JSE: SSS)

This is despite strong growth in property net operating income

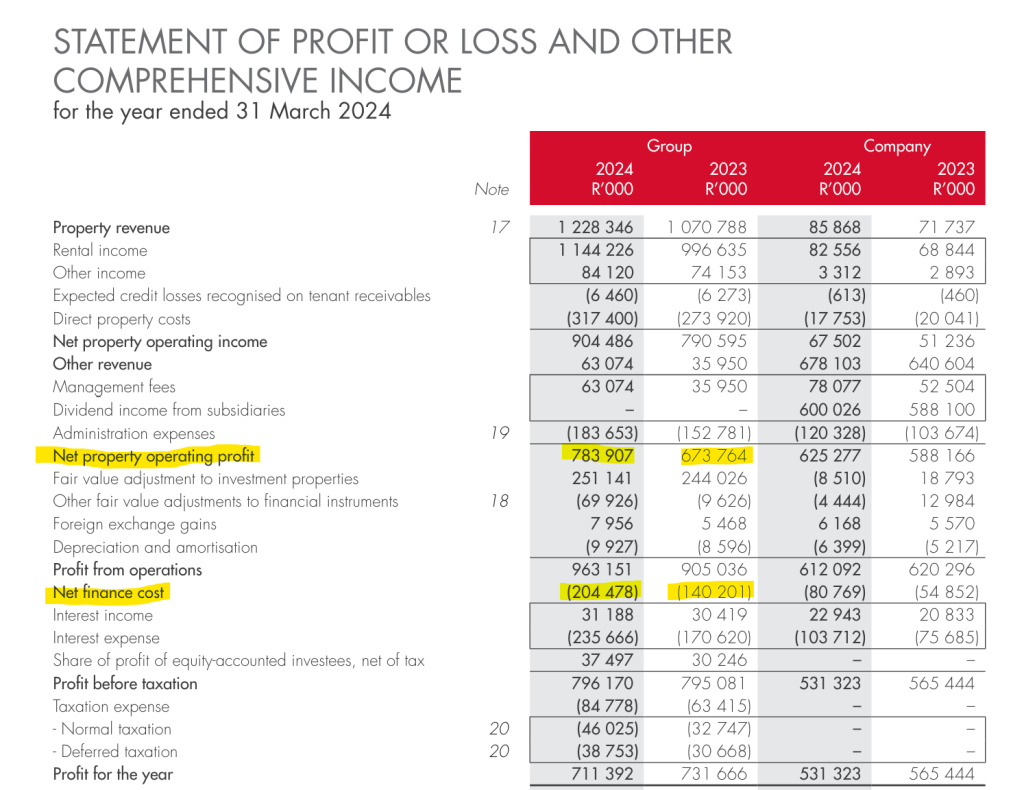

When it comes to property funds, the main thing to think about is whether the benefits of growth will be going to the banks or the shareholders. At Stor-Age, the growth in the year ended March 2024 was eaten up by finance costs, as this income statement shows:

This is a cyclical thing obviously, as it depends on what happened to interest rates and the levels of debt relative to the prior year. Stor-Age is such a solid operation that most of the performance really is attributed to the cycle rather than any surprises from the business. They are trying to be less impacted by finance costs over time through entering into third-party management agreements for properties. The benefit is that fees are earned off properties owned by other funds, like Hines.

Rental income was up 12.7% in South Africa and 3.0% in the UK. Net property operating income increased by 13.9% and 1.1% respectively in those markets. Once finance costs ate up the benefits, distributable earnings increased by 0.4% and the dividend per share was practically identical to the prior year at 118.17 cents.

The outlook for FY24 is distributable income per share of between 122 and 126 cents. There’s quite a change to the dividend policy though, with Stor-Age considering a move away from the historical approach of a 100% payout ratio. They are considering a decrease to 90% – 95% of distributable income as a dividend, so be careful of this in your dividend expectations from the fund.

At just over R14 per share, Stor-Age is on a trailing yield of 8.4%. This low yield is a reflection of how strong the underlying model is.

Things are looking a lot better at Telkom (JSE: TKG)

The move in HEPS is particularly exaggerated

Telkom’s top-line numbers don’t look like anything special. Group revenue increased by only 1.6% for the year ended March 2024. Within that, next-generation revenue (i.e. everything that isn’t dinosaur technology) increased 7% to R34.4 billion. For context, group revenue was R43 billion.

Group EBITDA increased by 5.2% on a normalised basis (excluding non-recurring restructuring costs in the base period), with margin expanding to 23.2%. A 15% cut in headcount at Telkom obviously helped drive this improvement.

Things get a little crazy after that, with HEPS roughly tripling from 124.8 cents to 376.0 cents! This clearly warrants a deeper read.

The next sanity check is always to look at free cash flow. This improved dramatically from an outflow of R2.7 billion to an inflow of R424 million.

In the Mobile business, total external revenue increased by 4.5%. This forms part of the broader Telkom Consumer stable, which improved EBITDA margin by 280 basis points thanks to operational efficiencies. On the fibre side, Openserve increased external channel revenue significantly by 10.7% and also improved its EBITDA margin by 280 basis points as the benefit of energy investments came through for that business.

BCX unfortunately saw revenue decline by 2.3%, with EBITDA margin contracting 370 basis points as cost initiatives were not enough to offset the sharp decrease in revenue from legacy services within BCX.

Swiftnet is still shown as part of the group while the proposed disposal is going through regulatory approvals. Revenue growth was just 1.3% in that business, impacted by terminations from two customers. Despite this, EBITDA was up by 10.4% in the business as tower costs were optimised.

The group is targeting FY25 as the first year-end to consider paying a dividend. This shows how far things have come at Telkom. The policy is to pay 30% to 40% of free cash flow after capex investments. I’m not sure why they specify that, as free cash flow is generally understood to be a measure net of capex.

It does feel like Telkom is finally on a solid footing with a much-improved trajectory.

Earnings take a dive at Thungela thanks to lower coal prices (JSE: TGA)

In what is effectively a single commodity group, earnings can be very volatile

After winter energy demand in Europe and Asia was below expectations, the coal market struggled with reduced demand and thus lower prices. There are various benchmark prices that are relevant to Thungela, which now has operations in both South Africa and Australia. Wherever you look though, the benchmarks are down.

For example, for the six months to June 2024, the Richards Bay Benchmark coal price is down 18% vs. FY23. The Newcastle Benchmark coal price is down 25% vs. that period. To make it worse, the discount to the Richards Bay Benchmark price increased from 14% to 15%, driven by a mix that included more lower quality export coal. It’s much worse for the Newcastle Benchmark coal price, where Thungela has swung from an 11% premium in the three months to December 2023 to a discount of 6.8% in this period. In addition to the Newcastle Benchmark price, around 20% of Ensham’s sales are exposed to the Japanese Reference Price which hasn’t been settled yet in the market, so they’ve made provisions for the final invoiced amount to be down on 2023 prices.

Export saleable production in South Africa is towards the upper end of guidance on an annualised basis. This has helped the cost per export tonne come in at the lower end of guidance, so Thungela is doing well on the things it can control. Production is one thing, but sales are quite another. This is because Transnet is the link between producing coal and selling it. Sadly, export sales volumes fell 4.8% because of lower rail performance. This was driven by two major derailments.

It’s not hard to see why Thungela was attracted to Australia, where production and sales at Ensham moved higher. Although the hope is that Transnet’s performance will improve from 2025, hope is not a strategy.

This doesn’t mean that Thungela isn’t still investing in South Africa. Quite the opposite, actually, with capex of R1.3 billion in South Africa in this six-month period vs. AUD23 million at Ensham. The South African capex includes R800 million in expansionary capital whereas Ensham is sustaining capex only.

With all said and done, HEPS for the period will be down by between 55% and 69%. The expected range is R7 to R10 for the interim period. Net cash at 30 June 2024 will be between R7.1 billion and R7.4 billion. This includes cash reserved for capex of R1.8 billion.

On the closing share price for the day of R113, the market cap is roughly R15.9 billion.

Little Bites:

- Director dealings:

- A family trust associated with the chairman of The Foschini Group (JSE: TFG) has sold shares in the company worth R42.5 million. That’s a huge number obviously, with the reason given being the portfolio rebalancing of the trust interests of a sibling of the director.

- The CEO of Investec Bank in the UK sold shares in Investec (JSE: INP) worth £532k.

- The company secretary of NEPI Rockcastle (JSE: NRP) has sold shares in the company worth R289k.

- Des de Beer has bought a further R282k in shares in Lighthouse Properties (JSE: LTE),

- Acting through a combination of Protea Asset Management and in his own name, Finbond (JSE: FGL) director Sean Riskowitz acquired R187k worth of shares in the company.

- Vukile Property (JSE: VKE) has confirmed that the dividend reinvestment price is R14.50 per share, which is practically identical to the 30-day VWAP (less the cash dividend per share). It’s important to compare the reinvestment price to the ex-div price on the shares.

- Although it’s not news to the market that Lighthouse Properties (JSE: LTE) is selling down its shares in Hammerson (JSE: HMN), the company must still announce any sales that take it through a regulated threshold. This is why the sale of shares worth R718 million has been specifically announced.

- Yeboyethu (JSE: YYLBEE) made a basic loss per share of R40.04 for the year ended March 2024, driven by a R2.8 billion write-down of the investment in Vodacom. The total dividend for the year was 183 cents vs. 177 cents in the prior period.

- There’s at least some good news for Conduit Capital (JSE: CND), with an arbitration process with Trustco Properties on the other side going the way of Conduit. This relates to a transaction announced back in 2020 in which Conduit would acquire a property development from a wholly-owned subsidiary of Trustco (JSE: TTO). There were conditions related to the valuation of the property, which ended up being less than the threshold that allowed Conduit to cancel the deal. This led to a dispute over the R50 million deposit that Conduit had paid. In rare, positive news for Conduit, the arbitration award is the refund of the R50 million deposit plus interest at 7.75% per annum from December 2020. Conduit now needs to actually enforce the award, so the timing of payment remains uncertain.

- Efora Energy (JSE: EEL) is still catching up on its financial reporting, releasing results for the six months to August 2023. The shares are still suspended from trading. For that interim period, the headline loss per share was 0.74 cents.

- As part of the SENS announcement dealing with the distribution of its integrated annual report, Salungano (JSE: SLG) confirmed that KPMG has now provided the group with a reason for the resignation by the firm as the company auditor. KPMG made the decision as Salungano no longer meets KPMG’s risk criteria. Obviously, that’s exactly what Salungano shareholders don’t want to read.

- Northam Platinum (JSE: NPH) announced the resignation of Temba Mvusi as chairperson of the board as he is moving across to take the role of chair at Sanlam. Mcebisi Jonas has been appointed as the new chair at Northam.