Alexander Forbes marches on (JSE: AFH)

Results for the year ended March will be in line with expectations

Alexander Forbes has released a trading statement for the year ended March. From continuing operations, they expect HEPS to grow by between 5% and 15% – decent growth overall. There was much higher growth in the discontinued operations (due to a successful legal claim related to a subsidiary that was sold ages ago), leading to total group HEPS increasing by between 10% and 20%.

This is in line with the group’s expectations, with the key drivers being higher average AUM, solid client retention, inflationary increases in fees and higher than expected two-pot claims volumes, which are a revenue driver for the group. The timing of consolidation of previous acquisitions also made a difference here.

Ethos Capital is enjoying a higher valuation of Optasia (JSE: EPE)

As they are planning an exit of that investment, they hopefully aren’t overcooking their expectations

Ethos Capital focuses on measuring its performance using net asset value per share. All investment holding companies should do this of course, but that doesn’t mean that they actually do.

The company has given a voluntary update on growth in that metric. Net asset value per share is up 3.2% over the past quarter and has increased 23.1% since June 2024 (excluding the effect of the unbundled Brait shares).

The increase is mainly due to the higher valuation of Optasia, which they indicate is thanks to its last-twelve-months EBITDA increasing to $84 million. They are implying that they haven’t increased the valuation multiple. Still, as they are looking to go to market with this asset (including via a potential IPO), I hope that their valuation expectations are in line with the feedback they are getting from potential investors. With a recent growth rate of roughly 47% for both revenue and EBITDA, it’s clearly an interesting growth asset.

This is all part of the broader strategy of returning capital to shareholders. With a net asset value per share of R8.10 and a share price of just R5.55, you can see that the market is still pricing in a hefty discount.

Gemfields has released the rights offer prospectus (JSE: GML)

Although the fully underwritten offer is a foregone conclusion at corporate level, it’s still important for shareholders to make a decision

The beauty of a fully underwritten rights offer is that from the company’s perspective, they are definitely going to get the capital that they need. This allows the management team to move forward with the all-important strategies to get things back on track. But for each existing shareholder, they have to decide whether to follow their rights or to try and trade their nil paid letters in the market.

To help with this decision, Gemfields has released a prospectus in line with the strict regulations that govern the capital raising process for public companies. It includes a wealth of information on the company, including an overview of the risks. As the disruption by lab-grown diamonds has fascinated me (regular readers know this), I couldn’t help but look at the extent to which this is noted as a risk for emeralds and rubies. The answer is that although the company does mention that they exist, it’s only raised as part of a narrative that diamonds have suffered to a far greater extent than coloured gemstones that have different supply and demand dynamics. In other words, they are heavily downplaying it. To be fair, lab-grown gems are nothing new and if rampant disruption was going to happen, it probably would’ve already. Still, consumer tastes can be fickle – just ask De Beers.

The prospectus deals with the four key issues facing Gemfields at the moment (on page 50 of the document, for those who want to read in detail). These include the oversupply of Zambian emeralds, the lower production of rough rubies in Mozambique, prevailing uncertainty in the luxury goods and gemstone market (including in China) and general risks in Mozambique related to civil unrest and other issues. With all these issues experienced against a backdrop of heightened capital expenditure, the balance sheet buckled under the pressure.

The risks aren’t over yet, particularly regarding the waiver of covenants under debt facilities. Banks aren’t in the habit of switching the lights off for companies that still have support from equity investors, but stranger things have happened and the underlying operations in Africa are risky.

You’ll find the full prospectus at this link. If you’re a shareholder or if you’re thinking of becoming one, I strongly suggest you read it.

Nutun gives full details of its earnings – and the market didn’t like it (JSE: NTU)

The share price closed 12% lower

Nutun is the debt and business process outsourcing business that used to be part of Transaction Capital. After that group imploded thanks to SA Taxi and cut WeBuyCars loose to go off and flourish without the contamination of the rest of the group, Nutun was left behind like the ash at the bottom of the braai. Even with a new name, there’s a lot of rebuilding to do.

In South Africa, Nutun acts as both principal and agent when it comes to unsecured non-performing loans. They also have international clients, in which case they act as a business process outsourcing solution for a variety of services from customer acquisition and retention through to collection and recovery services. This is essentially a fancy way to say that they are a call centre.

The six months to March 2025 was an unhappy time. Revenue in Nutun South Africa was down 6% and in Nutun International was up 1%. Group EBITDA fell by 17%. Once you take off the amortisation of purchased book debts and the net interest cost, you’re left with a “continuing core loss” off R71 million, which is at least not as bad as R104 million in the prior year.

Is there any good news? Well, they are now focusing on bigger clients, which hopefully means a more efficient business going forwards. Worryingly though, they have an ageing portfolio based on the lack of recent purchases of books, which I interpret to mean that the underlying recoverability of the books is getting worse. It’s fine to have fewer clients, but they need to improve the books they are trying to collect.

To do this, they have funding lines in place until at least September 2027. This should support a renewed focus on acquiring unsecured loan portfolios, as well as the ability to invest in business process outsourcing opportunities.

The group still has a positive medium-term outlook (although practically all executive teams say that). They have indicated that the near-term story is far less ideal, as it will take them a while to rebuild their positioning in the market. The fallout from the association with the broken Transaction Capital balance sheet continues, as Nutun was essentially starved of capital for a while.

There’s no love for this story in the market right now, with the share price down 37% year-to-date. Perhaps this chart of Nutun vs. WeBuyCars tells the story best:

Renergen: throwing cautionaries to the wind (JSE: REN)

The ASP Isotopes deal is very interesting, but the JSE needs to act here

Let me start off by saying that in hindsight, having hosted ASP Isotopes on Unlock the Stock (watch it here) and gotten to know the CEO in that session, I’m not surprised by this deal. Paul Mann is a razor-sharp international dealmaker and he is almost certainly viewing Renergen in the same light that he originally viewed ASP Isotopes: a technical dream wrapped up in a commercial nightmare. This deal is another roll of the dice and if you want to make it big in this world, you better be prepared to keep rolling. I want to make it absolutely clear that there was no (and I mean no) indication in that session of what they were planning regarding Renergen. I was caught by surprise, just like you were.

Here’s the thing that I find astounding: Renergen moved straight to firm intention announcement stage without putting out a cautionary announcement. Now, the technical rule is that you don’t need a cautionary if you can be absolutely sure that no news of the deal has leaked anywhere. Still, it’s good practice to put one out, particularly once you start engaging advisors and the like. And as you’ll see, they are a long way down the road with this deal despite having no cautionary announcement.

I genuinely cannot think of another single example where a company went straight to firm intention announcement without a cautionary. If the JSE doesn’t fully investigate this and make its findings known to the public (regardless of what those findings are), then cautionary announcements have officially become a joke overnight and there’s no point in ever bothering with them again.

I must say, another thing that is on my mind is whether the ASP Isotopes listing on the JSE was always intended to facilitate a deal like this. The official story is that the business is South African and the staff are South African etc. and hence the need for a local listing, but I really can’t help but wonder…

Regardless of the back story, the deal on the table is that ASP Isotopes wants to acquire all the Renergen shares in issue, in exchange for shares in ASP Isotopes. This will be structured as a scheme of arrangement, which means that the board of Renergen is in favour of the deal as a scheme has to be proposed by the board (as opposed to a hostile takeover which is an offer made directly to shareholders). Again, seeing a fully constituted independent director committee and no cautionary announcement is a wildly aggressive application of the rules.

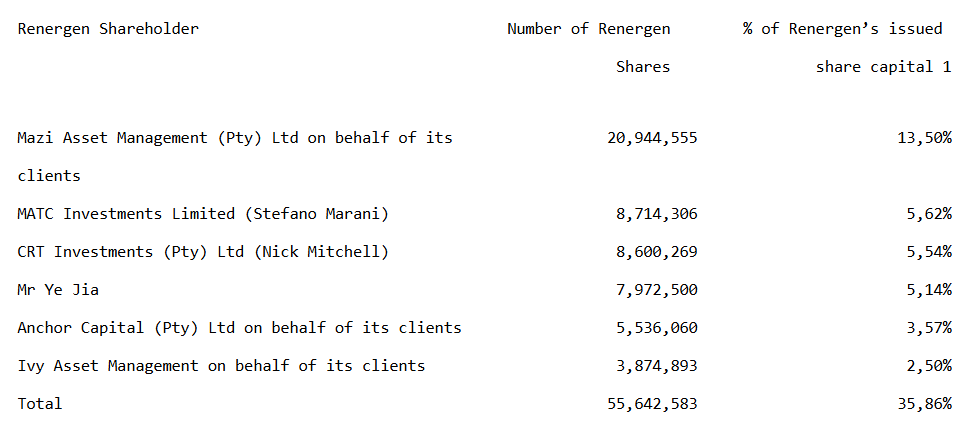

It gets much better (i.e. worse) though. Here’s the list of shareholders who have already given irrevocable undertakings to vote in favour of the deal, once again without a cautionary announcement in sight:

It still gets better. In the absence of any kind of cautionary announcement, Renergen and ASP Isotopes entered into an exclusivity agreement on 31 March 2025 (that’s almost 2 months ago!) that saw Renergen receive an exclusivity payment of R10 million. That was the first step in what has become a bridging loan of $30 million to help Renergen avoid default. The Takeover Regulation Panel has made it clear in this case that they don’t like this element of the deal and this has led to a change in the repayment terms on that loan, otherwise it becomes a coercive element of the deal i.e. a gun to the head of shareholders to support the deal or watch the funding dry up. Oh yes – as you can now see, they’ve also engaged the regulator, sans cautionary announcement.

As for the price, the offer implies a premium of 41.3% to the 30-day VWAP of Renergen. Of course, this premium is going to change every day as this is a share-for-share deal rather than a cash deal. For each Renergen share, 0.09196 ASP Isotopes shares will be issued. The Nasdaq price of ASP Isotopes ($ASPI) will have to be your guide here, as the JSE listing hasn’t been completed yet.

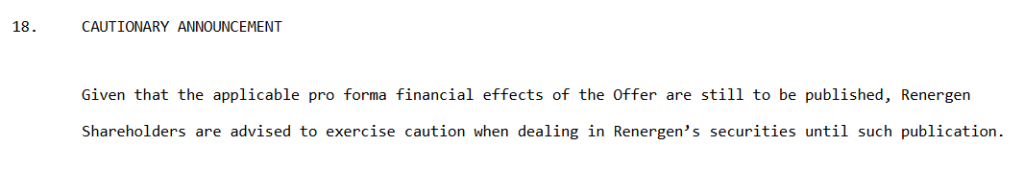

At the very bottom of the firm intention announcement, Renergen thought that it was maybe time to do this:

In the world of corporate disclosure, even Trump and his tariff team would probably describe this as an aggressive approach.

Renergen’s share price closed 38.9% higher, absolutely mutilating any short sellers along the way. And if I was one of those short sellers, I would be all over the JSE’s regulatory department regarding lack of disclosure here. Ditto for any major shareholders who sold in good faith after the release of Renergen’s financials, oblivious to what was really going on. This is how investors lose faith in public markets.

Sasol’s capital markets day is worth a look (JSE: SOL)

This is where the market gets medium-term targets from

A capital markets day is a big deal. This is an opportunity for corporates to allow their management team to shine, while speaking to the medium-term targets that the market will (hopefully) hold them accountable for. Sasol is the latest such example.

Now, a lot of the language becomes pretty consistent when you’ve seen enough of these things, like “resetting the business” as a fancy way of saying “wow this isn’t good, we must fix it” – you get the idea.

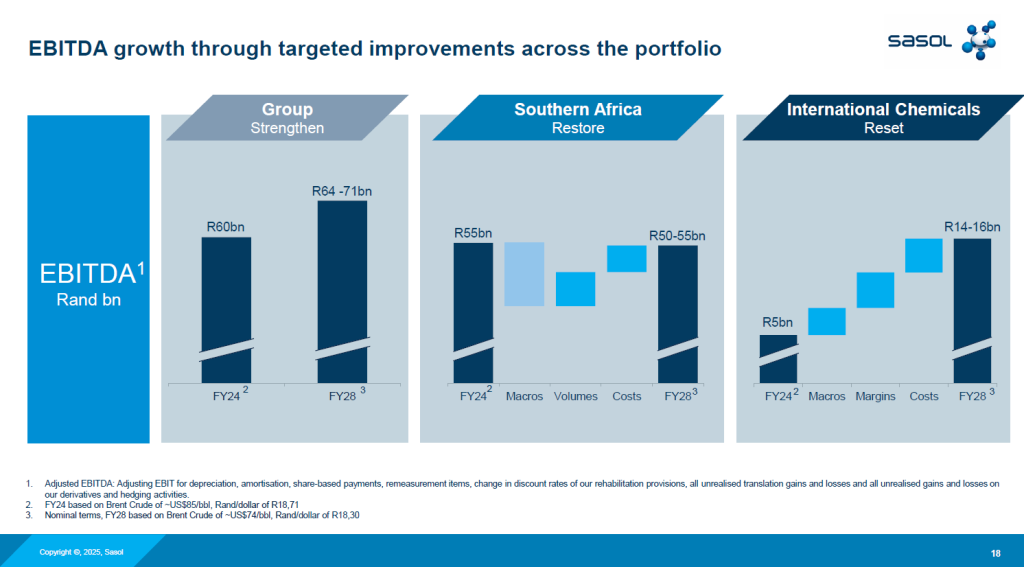

I just focus on the numbers. For example, they are promising an EBITDA margin of at least 15% in the International Chemicals business by FY28. That implies EBITDA of $750 – $850 million. I’ll believe it when I see it, as that part of the business has disappointed people more often than the Proteas in crunch games.

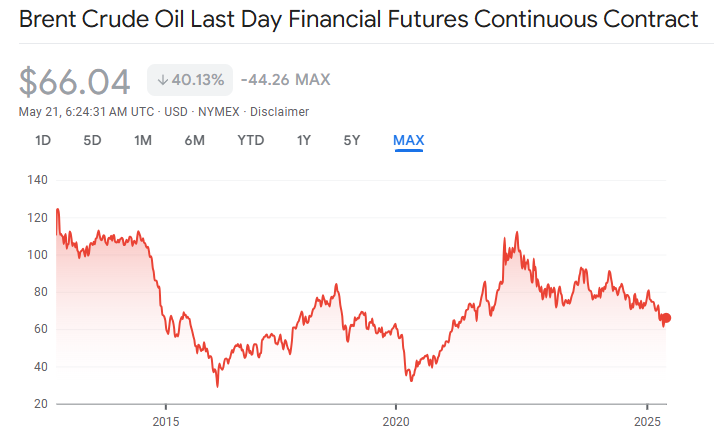

Interestingly, they indicate that the break-even level for the South African value chain is an oil price of $50/barrel by FY28. Now, the bad news is that the oil price hasn’t exactly been a story of steady growth, as you can see:

This shows you the problem for Sasol: like all energy companies, they are ultimately beholden to what happens with global commodity prices. On top of this, they are dealing with major South African risks like local infrastructure challenges. This slide from the deck really tells the story, as it shows that the growth at Sasol is based entirely on the International Chemicals business, with the Southern Africa business expected to go sideways:

If you are interested in getting the full details, then you’ll find the presentation and the transcripts here.

A massive positive swing in profits at Stefanutti Stocks (JSE: SSK)

You won’t see percentage moves like this very often

When it comes to year-on-year moves in HEPS, Stefanutti Stocks isn’t playing around. For the year to February 2025, they expect HEPS from continuing operations to improve by between 2,355% and 2,375%. That’s obviously a daft range, so it’s more useful to tell you that HEPS is expected to be between 124.48 cents and 125.58 cents vs. a headline loss per share of 5.52 cents in the comparable period.

If you look at total operations, which includes SS-Construcoes (Mocambique) Limitada (currently under disposal) and Stefanutti Stocks Construction Limited (held for sale), then HEPS came in at between 77.43 cents and 79.33 cents. This shows you that the discontinued operations are making significant losses. Still, it’s a vast improvement on the headline loss per share from total operations of 55.73 cents in the comparable period.

Notably, despite winning in court in Zambia regarding the Kalabo-Sikongo-Angola border gate road, the recoverability of the R148 million they’ve recognised is so in doubt that they’ve raised an expected credit loss of R109 million in addition to a tax charge of R12 million. Something is better than nothing, I guess.

The share price closed 12.4% higher at R3.71. They expect to release full results on 27 May.

Nibbles:

- Director dealings:

- Although the CEO of CA Sales Holdings (JSE: CAA) and his family members acquired shares worth roughly R3 million in off-market transactions, there was also a much larger sale of R36 million in shares by the CEO in another off-market transaction. Some of this is due to restructuring, but there’s diversification of wealth here as well. The CEO and associates own 2.6% of the company.

- In a share-based incentive deal that goes back to 2015, various Northam Platinum (JSE: NPH) execs received a total cash award of R53.3 million in addition to shares worth a mildly astonishing R553 million (pre-tax). All the execs have chosen to commit 100% of their post-tax shares to a new voluntary incentive mechanism.

- Anglo American (JSE: AGL) will be distributing 110 Anglo American Platinum (JSE: AMS) shares for every 1,075 Anglo American shares. To then provide consistency in the Anglo American share price before and after the demerger, they will proceed with a share consolidation that will see each shareholder have 96 Anglo American shares for every 109 shares currently held. The idea here is to prevent a scenario where the share price drops sharply due to Anglo American Platinum no longer being in the group. They’ve done the maths regarding the reduction of shares in issue to avoid that happening. As for the change of name from Anglo American Platinum to Valterra Platinum, this will be effective from 28 May 2025.

- Southern Palladium (JSE: SDL) has received the environmental authorisation for the Bengwenyama Project from the Department of Mineral and Petroleum Resources (DMPR). This is an important milestone on the path towards being awarded a mining right. They are also working on an updated pre-feasibility study, focusing on a smaller-scale (and thus less capex-intensive operation), with the results scheduled to be announced in June. The last version of the pre-feasibility study came out in October 2024 and reflected an internal rate of return (IRR) of 28%. Basket prices are off 6% since then, so efforts to downscale the planned operations will hopefully keep the expected IRR at appealing levels.

- Wesizwe Platinum (JSE: WEZ) has updated the market on the commissioning of the processing plant at the Bakubung Platinum Mine. A number of defects were identified in the initial test runs in 2023, leading to expert help being brought in during 2024. The good news is that the plant rectification is on track and they’ve commenced with hot commissioning. The teething issues that mining houses deal with seem to be a feature of the industry rather than a bug.

- The seemingly cursed deal for Conduit Capital (JSE: CND) to dispose of CRIH and CLL has finally fallen over. The regulators simply weren’t having it, blocking the deal and leading to a court process. The purchaser eventually reached deal fatigue and elected not to challenge the Prudential Authority’s decision, which means that the deal has lapsed. The parties have no claims against each other as a result of the lapse, so the lawyers on both sides did their jobs properly in the agreements. Of course, this doesn’t help Conduit Capital in the slightest.

- The formal death of Murray & Roberts (JSE: MUR) in its current corporate form has moved a step closer. The holding company is insolvent and the business rescue plan envisages a scenario in which they have no operating companies or prospects to generate cash by the third quarter of this year. Thus, the board is proposing a resolution for a voluntary wind-up of the company to put it out of its misery. Like so many endings, this one is with just a small puff of smoke from the broken remains of an iconic South African company.

Hi. Thanks for all these.

Can you do a S/N podcast on investing waiting for a catalyst.

Like SSK – big turnaround plus major Eskom court case win likely.

Like RBO/ARL – the feed costs just got much lower + Bird flu

SA miners – Transnet coming right, maybe?

CSB/LEW – Interest rates dropping, maybe?

Maybe its the same as value investing or not. But would be interested with practical examples.

Just an idea for you

Some good ideas in there to keep in mind, thank you!

Thank you for shining some more light on the Renergen and ASP Isotope dealings. Out of curiosity, what actions could the JSE take and against who?

ASP isn’t listed here yet, so right now the JSE has no jurisdiction over them. They would need to just include all the Renergen disclosure in their listing docs. So, no harm no foul there – and in any event, I think the Nasdaq would remain their primary regulator. But as for Renergen though, the JSE needs to show that they actually have teeth here. If it’s just a slap on the wrist or a small fine, then the cost/benefit of compliance becomes the main driving factor and it’s often “cheaper” to just suck up the fine than let the share price run before a deal.

Thanks for the elaboration. The saying “it’s easier to ask for forgiveness than permission” springs to mind if fine is small…

Interesting story about the Renergen deal. I especially like the cautionary tale about cautionaries 😅

It’s a bit like a mini reverse listing of Renergen on the NASDAQ.