Assura will formally respond to the revised Primary Health Properties offer later this month (JSE: AHR | JSE: PHP)

Assura’s board has a duty to keep assessing the offers

The latest attempt by Primary Health Properties to get the Assura board to back its offer at least has some chance of success, as Assura has committed to fully review the revised terms of the offer. I’m pretty sure that the sticking points will still be around the risks facing the merged entity, rather than the exact share ratio that Primary Health is willing to offer.

The Assura board has committed that by 27 June, they will have sent a response circular to shareholders that deals with its views on the Primary Health Properties offer.

Although this could still go either way, my view remains that cash is king in these deals and that puts KKR and Stonepeak at the front of the queue.

Astoria’s sale of ISA Carstens has been completed (JSE: ARA)

Diamonds are anything but sparkly right now, but Goldrush and Leatt are on the up

Astoria is an investment holding company with a diversified portfolio. This means that the constituents of the portfolio have varying performance at any point in time, with the overall direction of travel for the portfolio hopefully being up.

A significant change to the portfolio saw the sale of Astoria’s 49% in ISA Carstens Holdings for R71.0 million (cash and loan accounts), with that deal having now met conditions precedent and closed accordingly.

Elsewhere in the portfolio, the ongoing pressure on diamond prices has wreaked havoc on Trans Hex. With debt providers in Trans Hex having called for an equity injection to support the balance sheet, Astoria has elected not to participate in this round or to provide further funding. Thankfully, Astoria has not provided any guarantees either. The value of the investment in Trans Hex has been written down to zero.

In much happier news, the share prices of the two listed investments (Goldrush and Leatt) have increased significantly since 31 March 2025, the date of the last quarterly results. Goldrush is up 56% and Leatt is up 17%.

Gemfields seems happy with the latest ruby auction results (JSE: GML)

As always, comparability is very limited

It’s difficult to form a view on how Gemfields is performing in each auction, as the underlying mix of rubies (or emeralds, as the case may be) changes from one auction to the next. This leaves us largely reliant on management’s commentary about the auction, which isn’t a great position to be in as management is obviously at risk of giving a biased view.

To their credit, Gemfields isn’t shy to talk about the tough stuff in the market. The current economic and geopolitical backdrop isn’t exactly favourable to shiny stones. Despite this, Gemfields notes that pricing of fine-quality rubies is strong and that secondary-type rubies (recovered from a newer area of the MRM mine in Mozambique) found support with buyers.

The gems come out the ground in all shapes and sizes, with this auction including a 36-carat fine-quality ruby that achieved a high price.

This auction achieved an average price of $461.48 per carat and revenues of $31.7 million. This is a much higher average price than in other recent auctions, but that number was skewed by the mix of lots that actually sold at the auction, as well as the lack of small-sized rubies in this auction.

A point of concern here is that the total revenue of $31.7 million makes this the smallest ruby auction (and by quite some margin) of the past couple of years. Only 78 of the 90 lots offered for sale were sold. The market is clearly still struggling with weakness.

Powerfleet is growing rapidly – but where are the profits? (JSE: PWR)

The SA market isn’t very receptive to “adjusted EBITDA” as a metric

The US market is filled with eternal optimists who firmly believe that adjusted EBITDA will eventually lead to huge net profit growth and great rewards in the share price. Conversely, the South African market is filled with realists who want dividends above all else. As usual, somewhere in the middle is the truth.

But just where does Powerfleet lie on that spectrum? With the primary listing in the US, you can be sure that terminology like adjusted EBITDA is all over this thing. I would’ve loved to be a fly on the wall in the meeting where the concept of HEPS was introduced to them and how it deducts things like stock-based compensation, which most tech companies incorrectly view as a quasi-expense at best.

Like all US growth companies, most of the announcement is dedicated to talking about revenue. For the year ended March 2025, they bought plenty of revenue through acquisitions. The MiX Telematics deal closed right at the start of this year, so don’t treat metrics like revenue growth of 169% and adjusted EBITDA growth of 882% as being remotely sustainable numbers. The group reports numbers adjusted for the MiX deal, reflecting revenue growth of 26% and adjusted EBITDA growth of 65%. Now, those are still strong numbers of course, but is adjusted EBITDA worth focusing on?

In a business that relies on telematics devices and the associated working capital that gets tied up, I definitely wouldn’t look at EBITDA. Instead, I would look at the operating loss that worsened considerably, or the headline loss per share that came in at $0.43 (better than a loss of $1.14 in the comparable period).

In terms of exit velocity for the year, the fourth quarter net attributable loss was $0.09 per share (this isn’t the same as the headline loss but is certainly a lot closer than adjusted EBITDA and other fairy tale numbers).

Here’s the interesting thing though: the attributable fourth quarter loss is only better than it was a year ago because of a change in the capital structure. Instead of a large attribution of value to preference shareholders, we now have losses spread across more ordinary shareholders. If we just look at the net loss before tax (instead of on a per-share basis), it climbed from $1.4 million in Q4’24 to $12.7 million in Q4’25.

My final comment is on the cash flow profile of the group and the related debt. Net cash from operating activities was an outflow of $3.3 million in the year ended March 2025 vs. an inflow of $26.3 million in the prior year. They invested $137 million in acquisitions and had to raise long-term debt of $125 million to do it, along with a private placement of equity of $66.5 million. The excess proceeds from the placement were used to redeem the preferred shares mentioned above. Total cash at the end of the period is down at $49 million vs. $137 million the year before.

In summary, this is a heavily indebted technology company that is very focused on telling an American story. The problem is that the Americans aren’t exactly forming an orderly queue for the stock, as evidenced by the Nasdaq chart (note: this includes a few years before the recent acquisitions):

The market didn’t love the lower payout ratio at Stor-Age (JSE: SSS)

Being less of a cash cow than before leads to churn on the share register

Stor-Age released results for the year ended March 2025. The focus in the market is on the dividend per share, which decreased by 6.3% to 110.72 cents. This is despite distributable income per share increasing by 4.1%. The payout ratio has dropped from 100% to 90%.

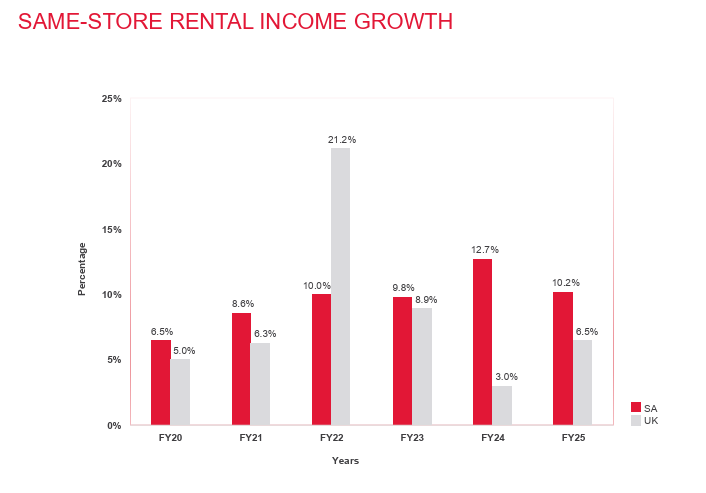

Net property operating income grew by 11.1% in South Africa and 5.0% in the UK. Here’s a great slide for those who like to argue that the UK is a stable operating environment compared to good ol’ sunny South Africa:

In terms of the balance sheet, the loan-to-value ratio sits at a solid 31.3%. That’s almost identical to the prior year and well in line with where it needs to be. Stor-Age is a solidly managed business.

There’s a great slide in the investor presentation that tells the story of the past decade. Over 10 years, the distributable income per share grew at a compound annual growth rate (CAGR) of 4.9%, whereas net property operating income increased by 27.8%. Note that the former is a per-share metric and the latter is not. Another useful way to see this distinction is that investment property value grew at a CAGR of 27.8%, while the net asset value per share grew at 6.6%. This tells you that there are far more shares in issue than a decade ago, with Stor-Age taking full advantage of its listed structure to grow the group.

Speaking of the NAV per share, they are currently at R17.04, up 5.6% in the past year. The share price closed 3.6% lower at R15.86, so there’s a fairly modest discount here by REIT standards.

With a lower payout ratio, the group is focusing on NAV-accretive initiatives for the next chapter in its growth. To justify the retention of capital, they will need to be some interesting things.

They are also busy with joint ventures aimed at boosting return on equity, with the idea being that Stor-Age earns management fees on a portion of the portfolio that is paid for using that most illustrious of banking concepts: Other People’s Money. The management fees are still small in the group context (R71 million), but 70% of the fees are classified as recurring and I think we will see significant growth in this metric.

With the payout ratio of 90% now baked in, the outlook for the 2026 financial year is for distributable income per share growth of between 5% and 6%.

Vukile is growing in both regions of focus (JSE: VKE)

This is what investors want to see

When a company has diversified exposure, there’s always a risk to investors that a certain part of the business might drag the entire thing down. Groups are only as good as their weakest link. The good news at Vukile is that there is no weak link right now, with the portfolio doing well in both South Africa and Iberia (Spain and Portugal).

In the year ended March 2025, the South African portfolio achieved like-for-like retail net operating income growth of 6.4%, while enjoying lower vacancies and more efficient operations with a better cost-to-income ratio. The like-for-like retail portfolio value moved 8.5% higher thanks to the stronger metrics.

Over in Spain and Portugal, like-for-like net operating income growth was 6.4%. I must highlight positive rental reversions of 17.3%, as this indicates that new leases are being put in place at much stronger rates than before. The like-for-like valuation increase is only 3.6% though, as the property metrics are dovetailed with broader macroeconomic conditions when assessing the valuation. Recent acquisitions in the area have been at appealing yields, ranging from 7.2% for a flagship centre in Spain through to an interesting, more tourist-focused centre in Madeira for 9.5%. Remember, these yields are in euros.

Although the loan-to-value ratio of 40.95% is perhaps slightly on the high side by large REIT standards, the good news is that only 1.6% of debt is maturing in FY26. The credit rating outlook for both Vukile and Castellana (the subsidiary in Spain) improved from stable to positive. When they do come to market for refinancing in years to come, they are doing so from a place of strength.

The total dividend per share grew by 6.0% for the year. They aren’t offering a dividend reinvestment plan, so that will thankfully limit dilution of earnings for shareholders going forward. For the year ending March 2026, Vukile believes that the dividend per share can grow by at least 8%.

The market loved this, with the share price up 2.5% on the day and more than 20% higher in the past year.

Nibbles:

- Director dealings:

- Here’s a director purchase of shares that is well worth paying attention to: Willem Roos (one of the original founding members of OUTsurance, among many other achievements) is a non-executive director of WeBuyCars (JSE: WBC) and he’s bought shares (via an associated entity) worth nearly R20 million.

- The CEO and another executive director of AVI (JSE: AVI) bought shares in the company worth a total of over R5.2 million.

- There’s some selling of shares by directors and senior execs of Tharisa (JSE: THA). Notably, the CFO sold shares worth nearly R4.5 million. The sales by the company secretary and a director of a major subsidiary came to R1.2 million.

- A prescribed officer of Thungela (JSE: TGA) sold shares worth R2.2 million.

- An associate of an executive director of Trematon (JSE: TMT) sold shares worth R77.5k.

- The company secretary of Alexander Forbes (JSE: AFH) sold shares worth R41k. Although these were related to a share award, the announcement isn’t explicit on whether this is only the taxable portion.

- A director and an associated entity bought shares in Finbond (JSE: FGL) worth just over R30k.

- The director of Italtile (JSE: ITE) who is busy selling pledged shares has sold another R20k worth of shares.

- A non-executive director of Quilter (JSE: QLT) bought shares via a dividend reinvestment plan to the value of around R20k.

- YeboYethu (JSE: YYLBEE) had a much better time in the year ended March 2025. Thanks to a sharp increase in the Vodacom share price that this B-BBEE structure relates to, the net asset value per share shot up from R31.51 to R73.77. The final dividend increased by 5% to 101 cents per share. YeboYethu is trading at just over R26 per share, so the discount to NAV is vast.

- Brikor (JSE: BIK) has released a trading statement dealing with the year ended February 2025. They expect HEPS to be between 0.3 cents and 0.7 cents, which is a nasty drop of between 46.2% and 76.9% vs. the 1.3 cents in the comparable year. They have indicated that detailed results will be out by 20 June (which is particularly relevant as they are late with the release of financials – you’ll see that update further down as part of the broader naughty corner announcement by the JSE).

- Ninety One (JSE: N91 | JSE: NY1) and Sanlam (JSE: SLM) have concluded the transaction related to Sanlam’s UK business that has been acquired by Ninety One. As consideration for the deal, Ninety One issued shares to Sanlam. Sanlam now has a 1.5% stake in Ninety One.

- Glencore (JSE: GLN) announced that the merger of Viterra with Bunge has now met all conditions and will close in July.

- Caxton and CTP Publishers and Printers (JSE: CAT) completed its odd-lot offer for total consideration of R340k. This reduced the number of shareholders by 31%, thereby significantly decreasing the administrative burden of the share register.

- Eastern Platinum (JSE: EPS) has suffered a cybersecurity incident. This hasn’t disrupted business operations, but it does appear as though some sensitive files made their way onto the internet. No further details have been given at this stage.

- In the naughty corner for late submission of financial statements, we find African Dawn Capital (JSE: ADW), Brikor (JSE: BIK), Efora Energy (JSE: EEL), Copper 360 (JSE: CPR) and Visual International (JSE: VIS). If they fail to release financials by the end of June, their listings may be suspended.

- In case there are any desperate souls out there hoping that PSV Holdings (JSE: PSV) might one day return to life, the company has renewed the cautionary announcement on the basis of recent engagements between DNG Energy and the company liquidator regarding taking the business out of provisional business rescue. There is no further clarity at this point on what might happen. The fact that their old website domain currently reflects as being held for sale tells you a lot.