4Sight Holdings is a small cap to watch (JSE: 4SI)

The share price has more than tripled over three years

As the name suggests, 4Sight is a future-focused company that manages to use just about every tech buzzword that you can possibly think of. Unlike most international tech companies that mention AI, 4Sight is more about profit growth than revenue at the moment. This makes it far more interesting than the tech furnaces that burn investor capital in the pursuit of revenue at all costs.

4Sight’s revenue was up just 6.8% for the six months to August, yet this was good enough for operating profit to increase by 35.7% and for HEPS to jump by 30.2%!

The group has four customer-focused segments and all of them are profitable. Services range from consulting through to reselling software for international partners. It’s a model that is clearly working.

Adcorp’s earnings are much higher, but watch out for those once-offs (JSE: ADR)

The prior period included some big non-recurring costs

Adcorp released a trading statement for the six months to August 2025 that reflects a huge jump in HEPS of between 83% and 92.9%. Before you get too excited about extrapolating that growth rate into the future, the company points out that the comparable period included once-off costs of R25.6 million. I went back and checked last year’s numbers: operating profit was R42.3 million and profit after tax was R29.4 million, so not having those costs in this period would explain a big part of the positive year-on-year move.

It’s not the sole reason for the uplift though. Adcorp’s announcement speaks to the benefits coming through from restructuring activities, a necessary step to address challenges around demand and the impact of a stronger rand.

The demand pressure is particularly clear in the Professional Services portfolio in South Africa. You can imagine the negative impact that AI is having on hiring at the moment, with the disruption caused by LinkedIn as another major challenge. Adcorp is seeing its best results in the Contingent Staffing and Staffing Solutions businesses, which makes perfect sense as AI can’t do those jobs and LinkedIn is far less relevant.

It’s much the same in Australia in terms of areas of relative strength, although the Professional Services business on that side of the pond seems to be doing better than in South Africa thanks to the focus on the technology and consulting sectors.

Although the share price closed 13% higher in response to this update, it was on lighter than average volumes.

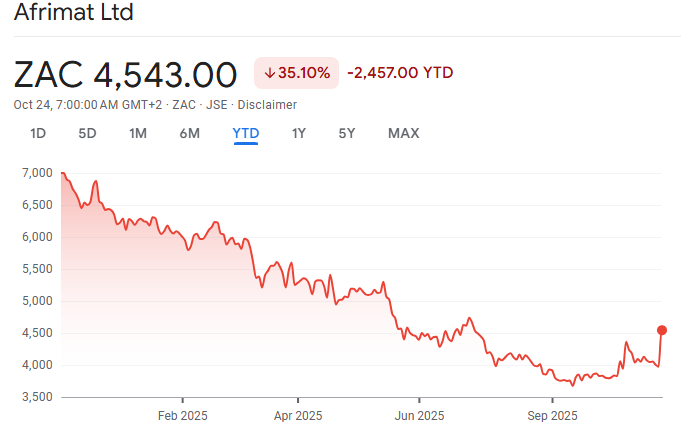

Yes, it turns out that Afrimat was indeed “primed for a big positive swing” as I wrote earlier this month (JSE: AFT)

Momentum is a powerful thing

Earlier this month, Afrimat released an encouraging trading statement that looked capable of changing the trajectory of the share price during a really tough year. In Ghost Bites at the time, I wrote that Afrimat looked promising for a positive swing and could rally back to the R50 level. After releasing full results on Thursday, the share price closed 14.4% higher at over R45. As I suspected, the market wants to close the gap on this one and see it go up.

But where does that leave us on a year-to-date basis?

As you can see, there’s a long way to go. Afrimat is still running way below the levels of profitability seen in the past few years, and not just because of the impact of the Lafarge integration.

The trick in this period was the second quarter momentum, where things got better in local iron ore sales and the ex-Lafarge cement factory. Markets absolutely love momentum, as share prices move in anticipation of future earnings. When the second quarter is better than the first quarter, the market focuses on the exit velocity for the period and buys accordingly.

For the six months, Afrimat’s revenue was up 29.9% and HEPS almost doubled, up 92.3% to 101.9 cents. For context, this is measured against a terribly weak base, as interim HEPS was 263.4 cents in 2023 before plummeting to 53 cents in 2024.

Part of the gap to historical earnings is that the cement business is still loss-making, despite revenue increasing by a whopping 118.8%. They truly did swing for the fences with the Lafarge deal and the jury is still out on whether it was the right call or not.

Iron ore export volumes need to be highlighted. Although they increased 13.5% year-on-year in the interim period, Afrimat has noted that the full-year volumes are likely to be flat based on expected pressure in the second half from maintenance activity on the Saldanha export line. There are also other major headaches in the local market, like the sad state of play in the ferrochrome industry and what this means for the Nkomati Anthracite Mine.

Afrimat’s share price has turned the corner for now at least. All eyes will be on the momentum in the ex-Lafarge assets in the second half of the year.

Do they ever sleep at ASP Isotopes? (JSE: ISO)

Subsidiary Quantum Leap Energy LLC has announced an acquisition

There are many listed companies that announce only one or two unusual things a year. ASP Isotopes certainly won’t be in that category, as the group is on an aggressive growth path that means plenty of capital raising and deal activity.

The latest such example is an acquisition by US subsidiary Quantum Leap Energy LLC. They are acquiring certain assets from a company called One30Seven, which focuses on decontamination solutions for water-soluble nuclear waste. There’s a lot of cutting-edge science involved here, with the overall goal being to increase the vertical integration of Quantum Leap Energy’s business in the nuclear fuel cycle through the development and commercialisation of the Creber machines that One30Seven is building.

The size of the prize is massive, as the Department of Energy in the US is on the hook for many billions of dollars to store nuclear waste. A solution that could process the waste rather than store it would obviously be of immense value.

As a further delightful little outcome, the initial isotope they are targeting is Cesium-137, which decays into stable Barium-137 – an isotope of increasing importance in quantum computing. It sounds to me like they have a few ways to make bucketloads of cash if this goes well.

The initial deal value is a cash payment of $150k and stock worth $2.85 million. When the first Creber Mini Unit is operational, they will pay a further $6 million. When a Creber Midi or Maxi Unit is done, there’s a payment of $11 million. These names keep reminding me of buying Chip ‘n Dip once a year when I go watch the Simola Hillclimb in Knysna!

The larger initial cost is the consulting agreement with inventor Brian Creber and his company B-Con Engineering Inc, with an estimated development cost of $4.5 million for the Creber Mini and $12.5 – $13 million for a Midi or Maxi Unit.

One30Seven was clever enough to lock in an ongoing royalty agreement, based on 6% of net revenues for 15 years per product. If this thing goes as planned, that’s the most lucrative part of the deal for them.

Liquidity in the stock is still limited on the JSE, but will hopefully improve over time.

Clicks has an outrageously good return on equity (JSE: CLS)

HEPS growth in the mid-teens doesn’t hurt either

Clicks enjoys one of the most demanding valuations on the JSE. That P/E multiple has been earned though, as the company boasts a defensive offering that is taking full advantage of the upward mobility of the average South African consumer in terms of having more disposable income available for health and beauty.

Clicks achieved a return on equity of 49.2% in the year ended August 2025. Yes, 49.2%! For context, that’s 3x higher than most South African legacy banks and with a more defensive underlying business than the banks. It’s little wonder that the market pays up for the story.

There’s also no shortage of growth, with group turnover up 5.3% in this period and trading margin up 60 basis points to 9.8%. Diluted HEPS rose by a delightful 14.1% and the dividend followed suit, up 14.2%.

The private label offering is a highlight, with growth in turnover of 10.7% in the in-house brands at Clicks. Another positive element to the result is the extent of store openings, with 55 net new stores and a total base of over 990 stores. Not every store has a pharmacy, as there are only 780 pharmacies in the store footprint. Pharmacy licensing is a complicated area and it contributes to the ability of smaller pharmacies to compete (if this interests you, be sure to listen to my podcast with Hugh Cunningham of The Local Choice Pharmacy in Harmelia).

When you see such an extensive store roll-out programme, you need to watch out for comparable or like-for-like sales to make sure that all the growth isn’t just coming from capex to increase the store footprint. Clicks managed comparable store turnover of 4.7% with volume growth of 2.1% and inflation of 2.6%, so that’s decent under the circumstances.

The Retail business continues to outperform the Distribution (wholesale) business, with turnover growth of 7% in the former vs. 5.1% in the latter. More importantly, Distribution suffered a decline in margin of 10 basis points, while Retail’s margin was up 70 basis points. The distribution business is key to Clicks’ strategy and needs to be there, but nothing beats the value of having the consumer relationship in the retailer.

In case you’re wondering about the OG of loyalty programmes in South Africa, Clicks ClubCard, they are up to 12.6 million active members who account for 82.6% of sales in Clicks.

As a final fun fact, one of the drivers of higher inventory in the group was demand for GLP-1 product, leading to buy-ins at the wholesaler. That’s an interesting read-through for Aspen (JSE: APN).

The group continues to work towards the medium-term target of 1,200 stores and will exceed 1,000 stores in the coming year. They also plan to get private label participation up to 35% of front shop sales, which will further boost margin. And yet, the share price is flat this year thanks to the extent to which this growth is already priced into the story:

Labat Africa has found a buyer for the cannabis assets (JSE: LAB)

They can now focus exclusively on technology

Labat Africa has been making huge strides recently thanks to the technology assets that were injected into the group. To create a pure-play technology company that might be of more interest to investors, they announced that they were looking at selling the cannabis assets.

After negotiations with several parties, the buyer has been announced. 64P Investments, an unrelated party, will be acquiring the assets for R23 million. This is well above the independent valuation of R15 million to R17 million. It’s much higher than the NAV of R5.3 million.

Here’s the funny thing though: these assets made a profit of R17.5 million in the last reporting period, so these earnings are clearly not maintainable as the independent valuation range suggests a P/E of less than 1x!

This is a Category 2 deal, so shareholders won’t be asked to vote on it.

Raubex’s earnings have dipped (JSE: RBX)

Australia is the problem

Raubex has released a trading update for the six months to August 2025. It’s not good news unfortunately, with an expected drop in HEPS of 10% to 20%.

The Roads and Earthworks division grew its operating profit, with SANRAL projects as the major driver of performance. They’ve won some impressive new tenders to keep things ticking over.

The Construction Materials division seems to be a mixed bag, with weather conditions in March and April affecting the performance in the first couple of months of the period. They have a wide variety of businesses in this space, with underlying drivers like the agriculture sector (positive in this period) and asphalt and aggregates (both off to a slow start that subsequently improved).

The Infrastructure division has been focusing on renewable energy projects and they’ve flagged a “substantial increase” in operating profit for this period, so investors will be pleased with that. The outlook for affordable housing projects is positive, with the company referencing the lower interest rates as a source of stimulus in this space. There are other major projects in process as well, like the parliament buildings in Cape Town and the Potsdam Wastewater Treatment Plant. They are clearly keen for more wastewater work, as they acquired a company called Hlumisa Engineering Services that specialises in this space.

The Materials Handling and Mining division is where some of the challenges are to be found. Their chrome operations were really rough in the second half of the prior year (a R351 million loss), so recovering from that to a break-even performance in this half is a great sequential story. Importantly, Kookfontein’s PGM plant has been commissioned and sales are expected to commence in the second half of the year, so hopefully the PGM market will remain favourable for them. Something else worth mentioning is that although Bauba is performing better than it was at the end of the previous financial year, Raubex is evaluating the long-term strategic direction of the business. When corporates talk like that, they are usually thinking of selling.

Australia is the problem child, with an operating loss this period thanks to a major underperforming project. They lost R210 million on a specific project that was terminated in September 2025. Although Raubex might be able to recover some of the losses, they’ve taken a nasty knock here. The rest of the Australian business is profitable and they’ve been busy with acquisitions and organic growth in that market.

Looking ahead, the secured order book has reached record levels and they are seeing positive momentum in infrastructure spend in South Africa. Things rarely go up in a straight line and Raubex is no different.

A big day for Sasol (JSE: SOL)

The share price closed 17% higher!

It’s hard to think of a better example of a stock that has driven a rollercoaster ride of emotions for so many investors, especially pandemic-era newbies who jumped on the Sasol train in 2020 / 2021. Just look at this share price chart:

When the Sasol price moves, it really moves. It closed 17% higher on Thursday based on the release of business performance metrics (like production volumes) for the three months to September.

The key highlight is that the destoning plant is delivering results, improving coal quality and driving better production at Secunda Operations. They also enjoyed better sales volumes in Fuels thanks to improved performance at Natref and Sasolburg.

It can’t all be good news, of course. Chemicals Africa volumes were in line with the prior period, but revenue was down due to weaker selling prices. The International Chemicals business has a more positive story to tell, with some pricing uplift seen in markets like Eurasia. This was good enough for the international business to achieve “significantly higher” revenue and EBITDA, with the latter supported by margin optimisation initiatives.

The story at Sasol remains one of driving margins in chemicals while doing the best they can in the fuels business and hoping that the oil price does the rest. The breakeven oil price for the quarter was in line with the market guidance of $55 – $60/bbl. Personally, I don’t have much faith in the oil price moving meaningfully higher over time, hence I don’t have a long position in Sasol.

Nibbles:

- Director dealings:

- The CEO of Vunani Limited (JSE: VUN) bought shares worth R10k.

- A director of a major subsidiary of OUTsurance Group (JSE: OUT) bought shares for a minor child to the value of R7k.

- Spear REIT (JSE: SEA) announced that the acquisition of Consani Industrial Park in Elsie’s River Industria has met all the conditions precedent. The registration of the property transfer is expected to take place in December 2025.

- If you’re interested in Oasis Crescent Property Fund (JSE: OAS), a Shari’ah-compliant property fund that runs with no debt (something you won’t see anywhere else in the sector), then you may want to flick through their presentation showing the portfolio and the future plans.

- Mantengu Mining (JSE: MTU) renewed the cautionary announcement related to the potential acquisition of Kilken Platinum. They are busy with the due diligence and assessing the price and regulatory requirements for the deal.

- The offeror in the Barloworld (JSE: BAW) deal is up to a 67.3% holding in the company. If you combine this with the related and concert parties, it’s up to 90.6%.