AB InBev confirms that people are drinking less beer (JSE: ANH)

The switch to non-alcoholic beer isn’t making up for it

One of the themes in the market over the past couple of years has been the difficulties facing the alcohol giants.

The Gen Zs aren’t so keen to get messy drunk and fall all over the place. The proliferation of smartphones means that this behaviour becomes a reputational legacy on the internet, rather than an isolated incident that you laugh about with your mates down the line.

And of course, there’s much more focus on health these days than in years gone by. It’s not called a “beer boep” for nothing. A 500ml beer has roughly the same energy content as a Magnum ice cream. I know this because when I figured it out, I dropped my consumption of beer substantially and switched to alternatives like gin and sugar-free tonic. And more regular Magnums.

There’s definitely still a place for beer in global culture, but the drop in consumption is clear. People are having one or perhaps two beers, instead of several in a row. This is why AB InBev’s volumes fell 2.3% in FY25. Beer volumes were down 2.6% and non-beer volumes fell 0.4%. For the fourth quarter, beer volumes were down 1.9% and non-beer volumes increased by 0.6%, so at least they finished the year with some momentum.

The only way to grow is therefore through price increases. Revenue per hl grew 4.4% in FY25 and 4.0% in the fourth quarter. Due to the offsetting impact of lower volumes, this means that total revenue was up 2.0% in FY25 and 2.5% in the fourth quarter (reported in US dollars).

This doesn’t exactly sound like a share price that should be heading to the moon, does it?

Despite this, the market is paying a P/E of 18x and has ramped the share price up by 29% over 12 months. The timing does make a difference here, as the chart is very choppy. Whichever way you cut it, the market is bullish and the stock is trading at close to 52-week highs.

Is earnings growth the source of the excitement? With normalised EBITDA margin actually contracting by 10 basis points in the fourth quarter to 35.2%, it doesn’t seem that way. For FY25, margin expanded by 101 basis points to 35.8%.

By the time we reach the bottom of the income statement, we see growth in underlying earnings per share of 6.0% in FY25, and 7.5% in the fourth quarter. HEPS was much stronger due to the various adjustments, showing growth of 19% for FY25.

Earnings are still climbing, but the underlying market is washing away from them. I’ve held the view for a while that a company like this is on the same trajectory as British American Tobacco (JSE: BTI), albeit earlier on that road. And unlike the tobacco products, only a small percentage of people are in the unfortunate position where they are addicted or even semi-addicted to AB InBev’s products. Even then, they can switch to cheaper alcohol alternatives. If the shift away from beer accelerates, I think the key difference between AB InBev and British American Tobacco is that the former doesn’t have a long tail of customers who just can’t kick the habit.

Oh yes, and there’s debt. A lot of debt. Net debt to EBITDA sits at 2.87x, only slightly better than 2.89x in December 2024.

For now, the company believes they can keep growing. EBITDA is expected to grow by between 4% and 8% in 2026. Is that really enough to justify this valuation?

What do you think the growth will be? Vote in the poll below:

And before we move off this topic, shareholders in SAB Zenzele Kabili (JSE: SZK) should take note of these AB InBev results. That B-BBEE investment structure is entirely dependent on dividends flowing through from the alcohol giant. That’s not a position I would want to be in.

Altron’s earnings have jumped (JSE: AEL)

We will have to be patient for the details though

Altron has released a trading statement for the year ending 28 February 2026. The news is positive, with continuing operations expected to enjoy at least a 30% increase in HEPS to 231 cents (or more). Total operations will be at least 50% higher, coming in at 201 cents.

The sale of Altron Nexus went through in 2025, so that’s making a difference to the continuing vs. total operations.

We will need to wait for the pre-close investor call scheduled for 24 February to get further details. In the meantime, the market was happy to get on the bid and move the share price 8% higher by the close.

Sea Harvest boosts earnings at Brimstone (JSE: SHG | JSE: BRT)

The trading statement is based on HEPS, but that isn’t the metric that the market cares about

I hope that we will one day see Brimstone switching from HEPS to net asset value (NAV) per share as the basis for its trading statements. The market doesn’t really care about HEPS in investment holding companies, as the metric does a poor job of recognising the different types of investments held in the group.

There’s a big difference between how you account for subsidiaries and associates vs. portfolio investments. NAV per share captures this properly. HEPS does not.

Nevertheless, the company always uses HEPS. The trading statement doesn’t give any details on NAV per share, so we have to wait for results in March to get a view on that.

In the meantime, we know that the stronger performance at Sea Harvest (JSE: SHG) has driven stronger earnings at Brimstone. We also know that finance costs are lower, so that’s helpful. Along with tax adjustments as well, this adds up to an increase in HEPS of between 88% and 98%!

The share price is up just 3% over 12 months. If that isn’t proof that the market ignores HEPS at this company, then I don’t know what is.

It’s a game of inches at British American Tobacco (JSE: BTI)

Every small change to the growth rate is important

British American Tobacco is a company that is all about small percentage movements. For example, revenue dipped by 1% in the year ended December 2025 due to currency headwinds, but increased 2.1% on a constant currency basis. Adjusted profit from operations increased by 2.3%, while operating margin was flat vs. FY24. Dividend growth was 2%.

You get the idea. This is what happens when the core product is essentially in terminal decline, much like the unfortunate customers who can’t (or won’t) stop smoking.

But the New Categories range is designed to address this, with double-digit revenue growth in the second half of the year. The so-called “smokeless products” are now 18.2% of group revenue, up 70 basis points vs. FY24.

The most volatile number in these results is the Canadian settlement provision. Thanks to adjustments to that number, reported profit actually jumped by 265%. This is why the company gives us the adjusted profit growth of 2.3%, as the larger number is clearly not a reflection of the operating performance.

The company is essentially on a treadmill, trying to replace the cigarette revenue and profits with the more palatable New Categories that the ESG consultants have been all over for years. For investors, I’ve always felt that this is the classic case of picking up pennies in front of a steamroller. If it goes well, you get growth of a couple of percentage points. If something goes wrong from a regulatory perspective or otherwise, earnings can drop sharply. That’s not a risk/reward trade-off that I have much love for.

The share price is up 32% over 12 months though, so my approach means I’ve missed out on these gains. The current P/E is 35x, but it was pointed out to me by a reader that there are important normalisation adjustments in the trailing twelve months view that are worth taking into account. Still, British American Tobacco does face numerous business risks that can have a significant impact on earnings, so it’s an indication of what can happen.

It really is one of the most polarising stocks on the market. There are those that love it and those that hate it!

Earnings are up at South32 (JSE: S32)

The volatility in underlying commodity performance shows why many investors prefer diversified groups

In mining, I often write about how management teams can only be measured based on the performance that is within their control. After all, none of them can control international commodity prices. This should apply on the way down and on the way up, although most mining execs seem to be quite happy to become wealthy when commodity prices have been favourable. It’s only on the way down that they argue that production is the right metric…

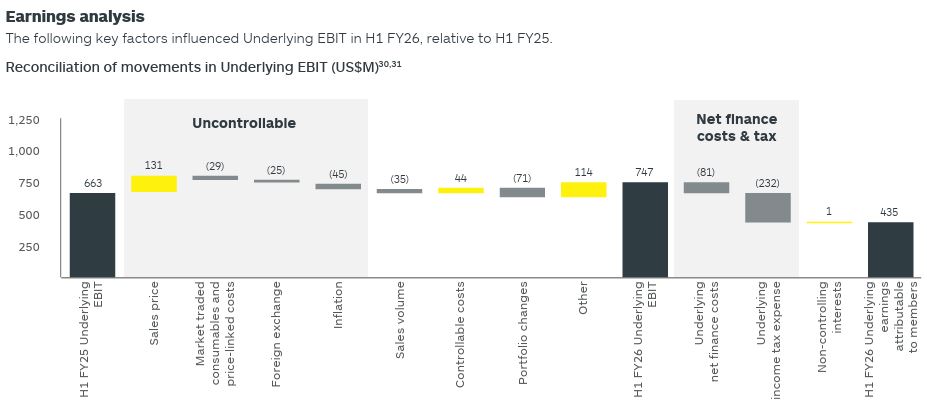

Justifiable cynicism aside, I do like this chart from South32 in their results for the six months to December. It does a good job of separating the factors into what they can and can’t control. It also happens to be a waterfall chart, something I always enjoyed putting together in my advisory days:

Right, let me remove my finance geek hat and give you the overview of how things went in this period for South32.

Revenue from continuing operations dipped by 3%, so that’s not a fantastic start. Commodity price pressure came through in alumina and manganese. There were some positive offsets here, like aluminium, copper and zinc, but it wasn’t enough to put revenue in the green.

Despite this, underlying EBITDA increased by 9%. Aside from cost benefits, a major driver of this outcome was the restart of operations at Australia Manganese. This helped offset the considerable pain in areas like alumina, where EBITDA more than halved thanks to a 27% decrease in the average price of alumina.

Copper, the talk of the town, saw underlying EBITDA more than double. In the commodities game, the underlying volatility in each commodity can be breathtaking.

One of the challenges heading into the second half of the year is that Mozal Aluminium is scheduled to transition to care and maintenance in March. This is because they couldn’t secure an electricity supply that allows them to operate profitably. Smelters require an extraordinary amount of energy.

This was a period of heavy investment for the group, with significant capital expenditure at Hermosa, along with the usual investment requirements in the group. This is why there was a cash outflow from operations of $183 million, worse than the outflow of $116 million in the comparable period. This is only part of the story though, with the group still able to fund dividends and share buybacks.

Looking ahead, guidance for FY26 and FY27 is unchanged at all operations except for Brazil Aluminium, where the smelter’s operator has revised production guidance lower.

The share price is up 20% over 12 months. The real story is the 90-day move though, up a meaty 42%!

The show is over at Tongaat Hulett (JSE: TON)

The business rescue plan has fallen through and the company is headed for liquidation

After a mammoth effort to save Tongaat Hulett (literally a household name in South Africa), I’m afraid that it’s all come to nothing. The transaction with Robert Gumede’s Vision consortium has failed due to conditions precedent not being met in time. With the acquirer not being willing to grant an extension to the timelines, the plan is no longer capable of implementation.

This means that the business rescue practitioners have filed an application in court for the provisional liquidation of the company. This is a huge blow to stakeholders in the industry, particularly as there was hope that the business would be rescued in some form.

With thousands of jobs on the line throughout the value chain, will someone come through with a last-ditch plan to save the company?

Nibbles:

- Director dealings:

- Sam Sithole of Value Capital Partners (VCP) sits on the board of Tiger Brands (JSE: TBS), so any sales or purchases of shares by VCP come through as director dealings. The numbers certainly aren’t what you’ll be accustomed to seeing in this section, as VCP is an institutional-level investor. VCP has sold shares worth R748 million, or roughly 32.5% of the original number of shares they acquired. I can’t blame them for taking some profit off the table here – the share price has had an incredible run!

- An associate of a director of Visual International (JSE: VIS) sold shares worth R156k. And no, the website still doesn’t work.

- The Mantengu (JSE: MTU) share price has unfortunately been dropping sharply in value recently. The latest announcement is that the CFO has bought R5.9k worth of shares. For a purchase to send a strongly positive message to the market, I think it might need a couple more zeroes on the end.

- As a sign of the far more positive times in the PGM sector, Valterra Platinum (JSE: VAL) has established a R10 billion Domestic Medium Term Note (DMTN) Programme. It’s always good to see this type of thing happening. The bond market has some fascinating dynamics, as expanded on by Ian Norden (CEO of Intengo Market) in this recent podcast.

- Labat Africa (JSE: LAB) has announced a share repurchase programme for up to 20% of shares in issue. The words “up to” are important here, as time will tell how many shares they actually repurchase in the planned window of 16 February to 31 May. The programme has been introduced as the board believes that the shares are undervalued. With a NAV per share of 23 cents and a share price of 8 cents (up a meaty 60% in response to this news), there’s certainly a huge discount to NAV.

- In case anyone was wondering about the appointment of the Life Healthcare (JSE: LHC) CEO to the board of Nedbank (JSE: NED) as a non-executive director, we now have confirmation from Life Healthcare that they fully assessed conflicts of interest and the CEO’s ability to discharge his duties. I’m not sure how a CEO has time to take on another board role (especially of a systemically important bank), but here we are.

- PSG Financial Services (JSE: KST) announced that chairperson Willem Theron will be retiring at the AGM. After founding the company in 1998 and switching from CEO to chairperson in 2013, he’s certainly earned his retirement. Lizé Lambrechts, currently an independent non-executive director, has been nominated as the next chairperson. Lambrechts has extensive industry experience that includes executive roles at Sanlam (JSE: SLM) and Santam (JSE: SNT).