Two steps forward, one step back at Accelerate Property Fund (JSE: APF)

There’s a lot of good stuff happening at the fund, but the related party issues aren’t over

Accelerate Property Fund has been making a lot of progress recently on not just the balance sheet, but the underlying property portfolio as well. There are legacy issues though, primarily related to major claims by and against related parties. The intention was to agree to offset the claims, thereby extinguishing the overhang once and for all. Alas, it doesn’t look like a settlement agreement is being reached, which means that there is risk of the claim against Accelerate being successful and not necessarily offset by the claim that Accelerate has against the related party. If the reverse is also true, Accelerate should say so. But right now, it feels a lot like risk in only one direction.

This doesn’t affect the rights issue that is currently underway, nor does it affect the publication of financial statements. But it has led to a cautionary announcement and pressure on the share price, adding to the risk factors in what is still a speculative stock.

Assura’s latest financial numbers look solid (JSE: AHR)

The same can’t be said for acceptance levels of the Primary Health Properties merger offer

It’s still looking pretty bleak out there in terms of acceptances by Assura shareholders of the offer by Primary Health Properties (JSE: PHP). As things stand, valid acceptances have been tendered by holders of 1.18% of the ordinary shares in Assura. The closing date for the offer is 12 August.

Separately, Assura released its audited financials for the year ended March 2025. It includes a comment in the CEO’s statement that “the NHS is in crisis” – a nice reminder for those who think that South Africa is the only country with problems. This is an opportunity for Assura, with the argument being that the company can play a role in supporting the development of new infrastructure in that space. To address this opportunity, Assura has been busy with projects like a £250 million joint venture with the Universities Superannuation Scheme, with a seed portfolio of £107 million and a goal to get to £400 million over time.

They also acquired a portfolio of 14 independent hospitals in this period for £500 million, with tenants including all the major hospital operators in the UK. The idea is that the pressure in the NHS is increasing demand for private healthcare. Sounds like a familiar trend, doesn’t it?

In terms of capital recycling, they disposed of £188 million in assets during the year at an average yield of 5.1%, with that capital being redeployed into private hospitals at an average yield of 5.9%.

The loan-to-value (LTV) at the end of the period was 47%, which they are looking to reduce to 45% through disposals. The average interest rate on the long-term debt is 2.9%, with the a weighted average maturity of 2.9%. Fitch Ratings has them on an investment grade rating of A-.

The dividend increased for the 11th consecutive year, posting growth of 3% for the year. This is well off the compound annual growth rate over 11 years of 6%, but at least it’s still in the green.

I can see why the potential private equity buyers (KKR and Stonepeak) want this asset, as it ticks a lot of the usual boxes for private equity. I can also see why Primary Health Properties sees Assura as an opportunity for a merger to achieve scale.

And as I keep saying, I can also see why shareholders aren’t exactly fighting over each other to get to the front of the queue to accept the Primary Health Properties offer. I maintain my view that the offer price just isn’t high enough to reward Assura shareholders for accepting merger risk vs. the alternative cash offer.

Castleview is a reminder that the NAV of a property fund is a near-useless number (JSE: CVW)

There should probably be a sector-wide impairment to NAV

Here’s an update for those who still believe that all shareholders are always treated equally on the market, presumably alongside a steadfast belief that the Easter Bunny delivers the chocolates each year.

On the same day, Castleview announced the results of the dividend reinvestment alternative – where dividends could be reinvested at R9.54 per share, being the NAV – and then released a circular dealing with a specific issue of shares at R6.56 per share to a related party. This circular features an opinion by the independent expert that such an issue price is fair.

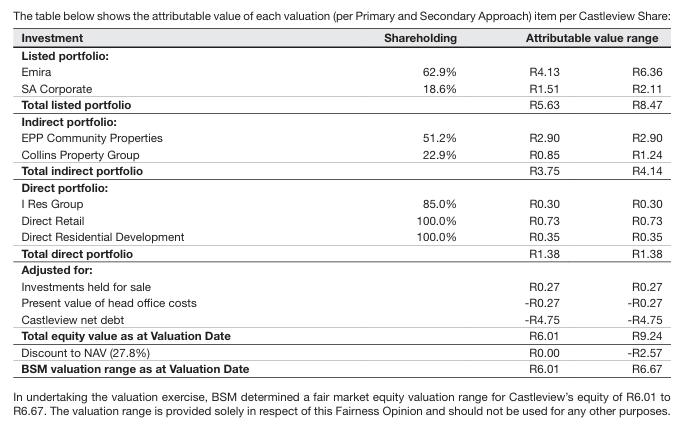

Here’s the calculation by the expert, which includes a discount to NAV of 27.8% (noted as the sector-wide average) as part of determining the fairness of the pricing:

Luckily, holders of only 10.2% of shares were suckered into reinvesting their dividends at the NAV, a price that is clearly nonsense based on the above.

As for the subscription price of R6.56 per share for this capital raise, that’s only available to the controlling shareholder who will be investing a further R200 million into the company. For context, the market cap of Castleview (based on the last traded price of R8.20, which itself is another nonsense price as there’s no trade in this thing) is R8.1 billion, so at least the subscription is a small percentage of the overall value.

Let this be final proof to you that NAV is an absolutely useless metric when it comes to the local property sector. The only metric to use is the dividend yield. The gap between what directors tell us the funds are worth and what the market says they are worth is huge. In fact, according to the independent expert, it’s 27.8% on average!

A strong jump in South African production at Jubilee Metals (JSE: JBL)

And remember, they want to sell these chrome and PGM assets

Jubilee Metals released an operational update dealing with the fourth quarter and thus the full year ended June. The numbers look strong, with chrome production up 19.9% and 24.8% for Q4 and the full year respectively. On the PGM side, production was up 14.6% and 6.0% respectively.

Looking ahead, FY26 guidance for chrome concentrate production is 1.65 to 1.80Mt vs. the 1.93Mt they achieved this year, so that’s a significant expected dip from current levels. On PGMs, production guidance is 36,000 – 40,000 ounces vs. 38,579 ounces in FY25.

Chrome prices didn’t have a great quarter, particularly compared to platinum prices which shot the lights out this quarter and gave long-suffering investors in that sector something to smile about.

Jubilee Metals is committed to selling these South African assets and is finalising sales agreements. Although this may seem odd, the reality is that this is probably the perfect time to achieve a successful sale. Jubilee will then focus on their copper operations in Zambia.

Given some of the interest we’ve seen in copper from big players, one has to wonder if the streamlined version of Jubilee Metals won’t be a takeout target?

MAS is less than thrilled with the Hyprop offer to shareholders (JSE: MAS | JSE: HYP)

And I don’t blame them

You know those people who do everything at the last minute and then turn their emergency into your emergency? We’ve all worked with someone like that. We’ve all fantasised about terrible things happening to them at the watercooler.

After sitting on the R808 million that they raised in June for several weeks, Hyprop finally pulled the trigger on a conditional offer to MAS shareholders. The problem is that the terms of the offer are incredibly unusual, with the offer being open for literally just one week, yet then having a long period (until 31 October, with risk of extension) until it becomes unconditional. And as I wrote in Ghost Bites when the pricing of the offer first came out, Hyprop has also put forward a rather opportunistic price for the share exchange ratio, with the cash portion as more of a red herring than anything else.

I have a small portfolio position in Hyprop by the way and nothing in MAS, just in case you think I’m biased. As ever in Ghost Mail, I’m calling it how I see it and giving a view that is unaffected by whether or not I have a position. As a Hyprop shareholder, I would love to see the MAS shareholders jump at the offer and give Hyprop a controlling stake in that fund at a juicy price. I’m just not sure why they would!

An independent sub-committee of the MAS board (now powered by proper corporate advisors – yay for that) released their views on the bid. As the offer is open for such a short period of time, those corporate advisors definitely cancelled all their plans last weekend and won’t be doing anything fun this week either. If you work in corporate finance, I can tell you from experience that your time isn’t your own.

The main issue (and I fully agree with this concern) is that shareholders need to give an irrevocable commitment to Hyprop to accept the offer, with Hyprop then able to take their time in actually implementing the deal and meeting the conditions. Why is this the case? A much fairer situation would be for the offer period to remain open while the various conditions are assessed, with an opportunity at the end for shareholders to accept the offer once they know that the conditions are met. The current structure just smells of two levels of information in the market, being shareholders who “know” what might happen in the future and then retail shareholders who have to sit and guess what the plans might be. And because MAS is registered in Malta rather than South Africa, there’s a much lighter regulatory regime around this deal than would otherwise be the case.

There’s a lesson here in investing in companies that are registered in obscure places rather than in South Africa.

The announcement points out that the blended offer price (based on the cash consideration of R800 million being just 6.13% of the total potential offer value of c.R13 billion) is R18.97 per MAS share. That’s a 4.8% premium to the 30-day VWAP ended 23 May 2025 before all the corporate activity, which is why the Hyprop shareholder in me would love MAS shareholders to jump at this, as that’s far too low a control premium. It’s also a 48.26% discount to the tangible NAV, although the NAV in property funds is as useful as those stapled condoms that were once handed out in South Africa (refer to the Castleview update today for further evidence).

NB to note is that shareholders who give an irrevocable undertaking to accept the Hyprop offer won’t be able to change their minds down the line if a better offer comes along. This is just one of the many nuances in the offer that the MAS board is worried about.

In addition to my views above, you can also read the Prime Kapital letter that was sent to MAS shareholders. Prime Kapital understands the value of the Ghost Mail audience and they wanted to make sure that you get to see this letter as well. As always, a sponsored post in Ghost Mail doesn’t affect or influence my opinion. This platform is all about giving you the tools to form your own view, while not being shy to share what my view is. You can (and should) read that letter here.

A dip in value at Reinet (JSE: RNI)

Early indications are a drop of almost 5% in the past quarter

Each quarter, Reinet first releases the move in net asset value (NAV) of the Reinet Fund, which comprises most (but not all) of the assets and liabilities in Reinet. They usually release the NAV of Reinet soon thereafter, which then includes all the balance sheet items in the listed group.

In the past three months (i.e. from March 2025 to June 2025), Reinet Fund suffered a drop in NAV of 4.6%. This means a decrease of EUR 315 million to arrive at the current value of EUR 6.6 billion.

Given the recent activity around a potential sale of Pension Insurance Corporation at a discount of roughly 12.5% to the last disclosed value, I would expect that a downward revaluation of that asset has been the major driver of this decrease in NAV. We will have to wait for more detailed disclosure to be sure.

Sibanye-Stillwater acquires another US metals recycling business, Metallix (JSE: SSW)

They are clearly feeling a lot more confident about the balance sheet

It really wasn’t that long ago that Sibanye-Stillwater was in full batten-down-the-hatches mode. The PGM market was horrific, the group had suffered plenty of setbacks and the share price was suffering. Today, Sibanye is enjoying a tremendous rally thanks to improved PGM prices and they are even feeling confident enough to announce another acquisition. This probably means that it’s getting closer to the time for me to sell my shares and chalk this up to a lucky escape, as my position was deeply in the red.

The acquisition target in question is Metallix, a US-based recycler of precious metals. This includes gold, silver and PGMs, mainly from industrial waste streams. There’s a track record of over 60 years and a global customer base. This complements Sibanye’s existing recycling operations in the US. Most importantly, it contributes immediately to earnings and cash flow.

The price? $82 million in cash, based on an enterprise value of $105 million. This is only a voluntary announcement, so no further disclosure around the company’s financials is available.

South32 exceeds production guidance (JSE: S32)

But no certainty yet on the Mozal Aluminium impairment

South32 released a quarterly report for the three months to June 2025. This brings the financial year to a close, with the highlights being a 20% increase in copper and a 6% increase in aluminium, along with the group exceeding production guidance on an overall basis and meeting operating unit costs guidance. In a world where mining companies have to focus on controlling the controllables, that’s about as much as investors can really ask for.

Sales volumes increased by 21% in the quarter, driving a release of $225 million in working capital in the second half vs. a tough first half in which the group absorbed working capital of $267 million. In other words, they worked through their inventory stockpile in this period. For further context, group capex (excluding development projects) was $400 million for the year and they returned $350 million to shareholders during the year.

It was also a busy quarter for corporate actions, including the divestment of the Metalloys manganese alloy smelter by Samancor Manganese, as well as the agreement to sell Cerro Matoso.

Production guidance for FY26 at the Mozal Aluminium smelter remains under review and they still need to confirm the quantum of the impairment based on significant uncertainty around energy supply after March 2026.

There have been a few places where you could make money in the mining sector this year. South32 hasn’t been one of them:

Nibbles:

- Director dealings:

- Two existing directors in Argent Industrial (JSE: ART) – including the CEO – are involved in an entity where they are co-shareholders with a retired director of the company. That entity has sold shares worth nearly R3.7 million, with the rather clumsy rationale being that the retired director wants to reduce her exposure. Be that as it may, it also has the effect of reducing the exposure of the existing directors and hence counts as a sale.

- The spouse of the CFO of Tiger Brands (JSE: TBS) bought shares worth R2.5 million.

- The CEO of Vunani (JSE: VUN) bought shares worth R199k.

- Mantengu Mining (JSE: MTU) has some good news to share. The final condition precedent for the Blue Ridge Platinum acquisition (being ministerial approval) has now been met, which means that the closing date is 1 August 2025. This is a shallow, mechanised PGM mine that is currently on care and maintenance, although the acquisition does include a stockpile of 1 million tonnes of ore that contains “significant” quantities of chrome and PGMs.

- Consider me shocked: the Competition Commission’s concerns related to the Vodacom (JSE: VOD) – Remgro (JSE: REM) fibre deal were in fact related to actual competition issues rather than just B-BBEE Ownership. This is a remarkable turn of events. This means that the remedies proposed ahead of the Competition Tribunal hearings are related to conditions like costs of broadband packages, divestiture of certain assets and the impact on competitors. There are also additional public interest commitments related to the planned capex for infrastructure, along with free access to fibre lines for libraries and clinics. Of course, the Commission just couldn’t help themselves, with one of the sweeteners in the public interest conditions being an increase in the employee share ownership plan.

- Datatec (JSE: DTC) released the results of the scrip distribution alternative and they didn’t exactly make it easy in the announcement, as they didn’t indicate the percentage of shareholders who chose the scrip distribution over the cash dividend. Some rough maths suggests that holders of roughly 56% of shares chose to receive the cash, which means that 44% elected the scrip distribution alternative. This means that the company capitalised retained profits of R206.5 million.

Thanks for these bits. Can you elaborate on why JBL shareholders would agree to the sale, which was announced a week before PGM and chrome prices began to rise by 40%? Just makes no sense to me.

Thanks

Hi Daniel, apols for the delayed reply. Gotta say I’m not close enough to the economics of that specific deal to be able to comment in the detail that I would like, but I will point out that in general, the right time to sell an asset is when a market is cooking. PGMs were a very tough sell for a long time. Now, they just might get the deal away for a decent number, allowing them to focus on copper. I still think there’s a decent chance that they are a takeout target for one of the big players looking for copper.