ADvTECH pushes deeper into Africa as a growth area (JSE: ADH)

And their track record certainly supports this decision

ADvTECH’s schools business does well because it has a differentiated offering of private schools that appeal to high income parents. This has proven to be the right approach, with Curro (JSE: COH) struggling to fill its school footprint that is essentially a broader offering to middle-to-higher income parents. Let’s also not pretend that the birth rate isn’t a serious issue here, with a more focused offering of fancier schools looking less vulnerable than a wide footprint of underutilised schools.

Part of ADvTECH’s strategy also includes high quality schools in Africa, appealing to expats and wealthier locals. Again, it’s a good model. They are expanding this offering in Kenya through the acquisition of Regis Runda Academy for around R172 million. This will be rebranded as Makini Schools Runda, which means it will operate within ADvTECH’s existing brand in Kenya.

Given the track record of success with schools like these, this seems like a sensible acquisition to me.

Blue Label Telecoms plays its cards close to its chest (JSE: BLU)

A trading statement for the year ended May 2025 has the bare minimum disclosure

There’s a particular feature of trading statements that is very important for investors to understand: they are triggered by earnings moving by a minimum of 20% vs. the prior period. This means that when a trading statement notes that earnings moved by “at least 20%” then the company is essentially giving the bare minimum required disclosure. You can contrast this to MTN below for example, where the trading statement gives an earnings range.

Over at Blue Label Telecoms, despite this trading statement dealing with the year ended May 2025 (which is now behind us by a couple of months), they’ve only taken the route of indicating moves of at least 20%. This is across HEPS, core HEPS and earnings per share (EPS) as well. In reality, the likely move is significantly higher than that, evidenced by a share price that is up by a colossal 280% in the past 12 months!

Blue Label will release earnings on 27 August. They have indicated that a further trading statement will be released before then, dealing with a specific earnings range for these core metrics.

A bit of love from the market for Metair’s turnaround (JSE: MTA)

The share price closed 6% higher on the day of a trading update

Metair is busy with a tough turnaround. The company has far too much exposure to new car production in South Africa, a long-term risk that they are trying to mitigate by moving into the aftermarket parts business. Even if we stopped manufacturing cars tomorrow, there are still millions of cars on the road in South Africa. I therefore see it as a sensible strategy to tap into this market, executed through the acquisition of AutoZone that adds to existing businesses in this vertical that offer products like batteries.

Of course, it doesn’t hurt in the meantime if volumes at the South African manufacturers move higher, with the added benefit of Metair making progress with its strategy to improve businesses like Hesto Harnesses. Production volumes in the South African market increased by 4% this period. Thankfully, Metair’s customers don’t supply directly into the US market, so there’s no direct impact from tariffs. It’s about time that Metair had some good luck. They’ve had more than anyone’s fair share of bad luck!

For the six months to June 2025, revenue from continuing operations increased by between 52% and 54%. This immediately needs to be followed up by two important nuances. The first is that Hesto is now accounted for as a subsidiary, so its revenue wasn’t in the base period (it was accounted for differently before). The second is that AutoZone is now in these numbers and wasn’t in the base.

The percentage move is therefore unhelpful. It’s much more useful to just note that revenue will be close to R8.7 billion, with expected EBIT of R440 million to R460 million. As you can see, margins are still far too low in this business, coming in at just over 5%. AutoZone is a drag on margins at the moment with negative EBIT, as they acquired it out of business rescue and will need to improve its performance as quickly as possible to get the most out of that opportunity.

From continuing operations, HEPS is expected to be between 69 cents and 72 cents, down between 6% and 10%. This is a sign of stabilisation in the core business, as the driver of that decrease is the punt on AutoZone.

Importantly, Metair has met all covenants of its restructured debt package. They aren’t completely out of the woods yet (and there’s still the overhang of the European Commission’s investigation into battery manufacturers in Europe that impacts one of Metair’s businesses), but they are clearly on the right track.

MTN’s African subsidiaries have driven a wild positive swing in earnings (JSE: MTN)

Despite Nigeria and Ghana having already reported, MTN still rallied on this news as though it was a surprise

MTN’s share price is up 123% in the past year. That’s a pretty spectacular situation for investors, helped along by the share price closing 5% higher on Thursday in response to MTN releasing a trading statement for the six months to June 2025.

With MTN Nigeria and MTN Ghana having already released strong numbers for the second quarter, it was clear that the MTN group numbers would be solid as well. But the market seems to have gotten a positive surprise from just how good they were, otherwise we wouldn’t have seen another 5% rally on the day of results.

The percentage move is slightly insane, with HEPS improving by more than 300%. What this really means is a substantial swing from a headline loss per share of -256 cents into expected positive HEPS of 614 cents to 666 cents.

Detailed results are due on 18th August.

RCL Foods had a solid year – but the second half was much slower than the first half (JSE: RCL)

The sugar business had a tough end to the year

RCL Foods released a voluntary trading statement for the year ended June 2025. After an interim period in which underlying HEPS jumped by 28.9% and HEPS as reported was up 38.8%, shareholders will probably be disappointed to see that this is only a voluntary trading statement, as it means that the full-year move isn’t more than 20%.

Sure enough, HEPS from total operations will be between 5.6% and 12.6% higher, while underlying HEPS from continuing operations will be between 9.6% and 17.5% higher. Viewed in isolation, that would be decent. But after what happened in the interim period, it’s almost a tough pill to swallow.

The challenge in the second half was in the sugar business, with RCL Foods attributing the issues to the presence of imports that took market share from local volumes at a time when global sugar prices moved lower.

For all the significant movements in earnings, the share price has managed to come out flat over 12 months.

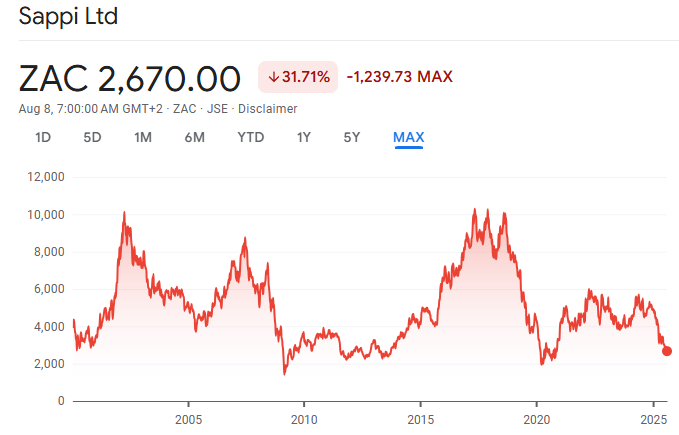

The Sappi rollercoaster ride continues (JSE: SAP)

I don’t think there’s a more volatile sector out there than paper

Do you miss Ratanga Junction in Cape Town? Wish you could get to Gold Reef City more often? Well… do I have a stock for you!

If that’s what the volatility looks like over such a long period, you can imagine what it looks like from one quarter to the next. For example, in the quarter ended June 2025, revenue fell 4% year-on-year and adjusted EBITDA tanked by 46%. With net debt up 45%, this combination was enough to push them into a net loss of $33 million vs. profit of $51 million in the comparable quarter.

But if we look over the nine months to June vs. the comparable nine months, the situation is reversed in terms of net profitability. Despite revenue being up just 1% and adjusted EBITDA falling by 15%, the bottom of the income statement shows a swing from a loss of $46 million to profit of $17 million.

The reason for profits that bounce around like a Jack Russell on heat is that the global paper sector is cyclical. Sappi is a price taker, not a price maker – just like a mining company. Then you can layer on forex movements, potential manufacturing issues across a number of underlying facilities and of course the fair value adjustments to the forestry assets as well.

And even when Sappi manages to navigate the cyclical difficulties, they sometimes have to deal with a structural decline like we’ve seen in graphic papers.

Above all, it looks like the biggest current stress is the leverage ratio increasing to 3.2x, with a perfect storm of weaker performance and a heavy capex programme at Somerset Mill. Although the worst of the capex is behind them, they now have to claw their way out of the debt. Much as one may hope that the expansion at Somerset Mill will have an immediate positive impact on profitability, the reverse is unfortunately true – there will be a period of optimising and ramping up that project.

They do at least hope that adjusted EBITDA for the upcoming fourth quarter will be above that of the third quarter that they just reported on. Let’s see if they are right.

The Foschini Group’s share price is sliding again (JSE: TFG)

The market is unhappy about something here

The retail apparel sector has had a tough time this year. I recently switched out of my Sibanye-Stillwater position (leaving a small amount behind) and bought Mr Price (JSE: MRP), hoping for a recovery there as it strikes me as the baby thrown out with the bathwater this year. With a much more difficult portfolio that includes international exposure (and no plans to pull back from that), The Foschini Group strikes me as the bathwater itself.

The share prices are highly correlated, but I’m not convinced it will play out that way for the remainder of the year:

My thesis is strengthened by the market’s sharp negative reaction to the quarterly trading update from The Foschini Group, with the share price down 5.7%. On the same day, Mr Price was flat.

The first important point when looking at the trading update is that you need to exclude the acquisition of White Stuff in the UK. Like all acquisitions, the timing impacts comparability, as you have a business included in one period and not the other. On that basis, group comparable sales for the first quarter were up just 2.5% (in ZAR), while TFG London was down 2.6% in local currency. As for TFG Australia, sales were down 2.8% in local currency. Ouch.

As we’ve seen at rival Woolworths (JSE: WHL), the Beauty category is doing the heavy lifting at the moment. The Foschini Group’s sales in this category in TFG Africa grew by 24.5%, which is way higher than Clothing (4.2%) and Homeware (8.5%). Sadly, Beauty is just 3.2% of TFG Africa’s sales, so it’s much too small to offset slower growth elsewhere.

Store sales in TFG Africa increased by just 3.2%, while online sales were up 40.2% thanks to Bash. Online is now 7% of total TFG Africa sales, up from 5.2%. The omnichannel model is certainly working well.

Credit sales in TFG Africa increased by 9.3% to now contribute 28.2% of total TFG Africa sales. They aren’t explicit in the announcement, but some quick maths shows that cash sales must therefore have grown 3.7%.

The announcement is very light on details on TFG London, which doesn’t help when sales excluding White Stuff are down. They unfortunately don’t give online sales growth with an adjustment for White Stuff either, but we do know that online is 43.1% of TFG London sales. Sales growth excluding White Stuff was 6.3% for the three weeks to 19 July 2025, but I would be very nervous putting much faith on such a short period.

And in TFG Australia, there’s also little to hang your hat on – they blame the macro environment and its impact on consumers, along with the overall extent of promotional activity in the market that is hitting margins.

In addition to this update, the market has the Capital Markets Day presentations to chew on. It includes some great stats, like in the omnichannel deck where there’s a note that omnichannel customers spend up to 9x more without cannibalisation (i.e. of in-store sales), which improves share of wallet and customer retention.

I think this is the most worrying slide for me, showing White Stuff as being right in the middle of this quadrant that describes the competitive environment:

If you try and appeal to everyone, you appeal to no one. I’m certainly no retail exec, but “bridge market” just sounds like to me like a strategy that doesn’t know what it actually is. Zara is the most valuable name on that chart and they aren’t anywhere near the centre.

As for TFG Africa, apart from the deck including an incredibly odd map that talks about the “national footprint across South Africa” and then has pins only on the Western Cape, they’ve also put out an astonishingly ambitious 3-year CAGR for turnover of 12.9%. This would drive a 3-year CAGR for EBIT of 15.9%. I think the market would be pretty happy with even half of that, so that’s a huge target to make a public commitment to.

Time will tell!

Nibbles:

- Director dealings:

- An associate of a non-executive director of Glencore (JSE: GLN) bought shares worth around R330k.

- Montauk Renewables (JSE: MKR) is an obscure name in the market, as the company is engaged in renewable energy projects in the US. There’s not much familiarity with the business among local investors and the company doesn’t really put in any effort to change that. So, I’ll just give the quarterly results a brief mention down here on an otherwise busy day of news from companies that you’ll recognise. For the quarter ended June 2025, Montauk increased revenue by 4.1%, but suffered a 27.7% drop in adjusted EBITDA. This was driven by a 22.4% decrease in pricing for the renewable fuel that they produce. The net loss for the quarter was $5.5 million, worse than $4.8 million in the comparable quarter in 2024.

- An important milestone has been achieved in the Prime Kapital offer to shareholders of MAS (JSE: MSP). The SARB has approved the inward listing of the preference shares on the Cape Town Stock Exchange. This is a biggie, as it removes a concern around South African shareholders who might otherwise have needed to accept share-based settlement without a guarantee of the listing being approved. That uncertainty is now gone and investors can consider the preferences shares based on their merits rather than their potential existence.

- Life Healthcare (JSE: LHC) has announced a special dividend of 235 cents per share from the proceeds of the disposal of Life Molecular Imaging. For context, the share price is around R13.60, so this is roughly 17% of the market cap.

- Here’s your daily update on acceptances in the Primary Health Properties (JSE: PHP) offer to Assura (JSE: AHR) shareholders: with less than a week to go in the offer period, acceptances have been received by holders of 3.38% of shares.