Anglo American laughs off the sale of the steelmaking coal business to Peabody (JSE: AGL)

This avoids a long and expensive legal fight around the MAC terms

A MAC clause in a transaction is an important thing. It stands for Material Adverse Change and is a critical protection for the buyer, as it is effectively an escape clause if something goes wrong with the target asset during the time between the agreement and implementation of the deal. It’s rare to see it invoked in practice, but it does happen.

A perfect example is Anglo American’s attempted sale of its steelmaking coal business in Australia, which Peabody Energy agreed to buy in late 2024. An underground fire at the mine in March 2025 spooked Peabody and they invoked the MAC clause, arguing that this event gave them the ability to walk away from the deal. Based on the lack of damage to the mine and all the progress made in restarting the mine, Anglo American argued that this isn’t in fact a MAC. An AC perhaps, but not a MAC.

Sadly the arguments over the “M” (Material) can become really burdensome, particularly in vague legal agreements. Remember, the more vague the definition of a MAC, the more wriggle room the buyer of the asset has.

I suspect that the state of the coal market this year is also part of the decision. If Peabody really wanted the asset, they would’ve surely negotiated with Anglo and gone ahead with a deal. Instead, it’s a convenient escape clause that allows Peabody to be more cautious with its capital.

Rather than becoming embroiled in a long and expensive legal battle in which only the lawyers are the ultimate winners, Anglo American is giving up on the deal and focusing on the safe restart of the mine and the performance of the broader steelmaking coal portfolio. Having said that, they will be initiating an arbitration process to seek damages for wrongful termination, so that could get pretty interesting.

Anglo claims that they have received unsolicited inbound interest for the asset in recent months, which suggests that an alternative sales process could be on the table soon. Of course, the price is what really counts, with the coal market in a rough place this year and unlikely to support a strong price.

BHP’s headline earnings dipped in 2025 and remain well off 2023 levels (JSE: BHG)

If you want consistent growth, the mining industry isn’t for you

BHP’s share price is up 4% in the past 12 months, which is probably a fair reflection of the mixed bag that the commodities sector has been in the past year. This is the benefit of buying one of the diversified mining houses as opposed to one of the specialists that can have great years and awful years. The diversified names tend to have a smoother experience.

This doesn’t mean that earnings are smooth, though. In the year ended June 2025, HEPS fell by 6.9% (reported in USD). This puts HEPS at 182.4 US cents, which is way off the 2023 levels of 256.1 US cents. Even in the diversified names, you’ll see the cyclicality in the sector coming through.

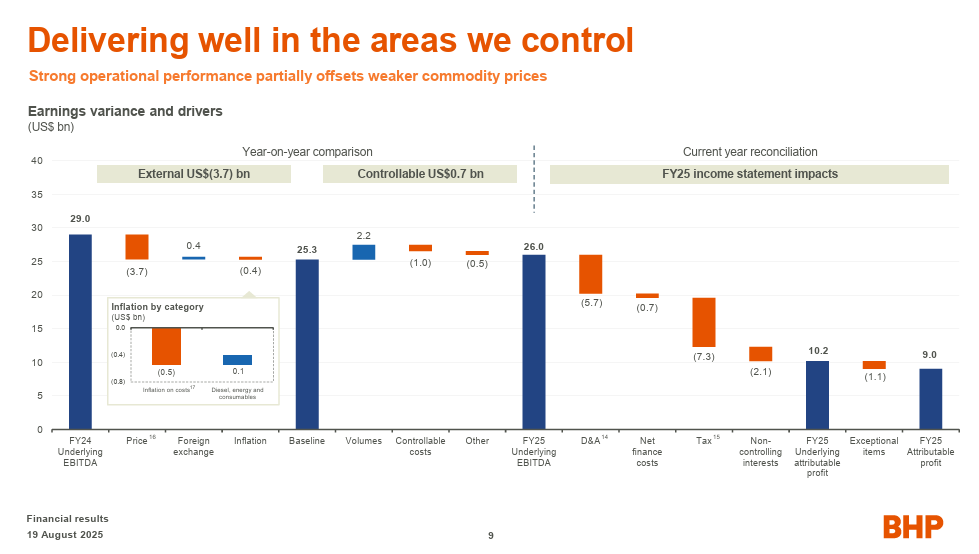

I quite enjoyed this waterfall chart in the earnings presentation, which shows the split between “external” factors (like commodity prices and forex) and “controllable” factors (like production and operating costs):

The EBITDA margins vary substantially across the different commodities. For example, iron ore (with record production) was the star performer in this period, with EBITDA margin of 63%. Copper (another record) wasn’t far behind at 59%. Steelmaking coal was then some way off at 17% and energy coal firmly brought up the rear at 10%.

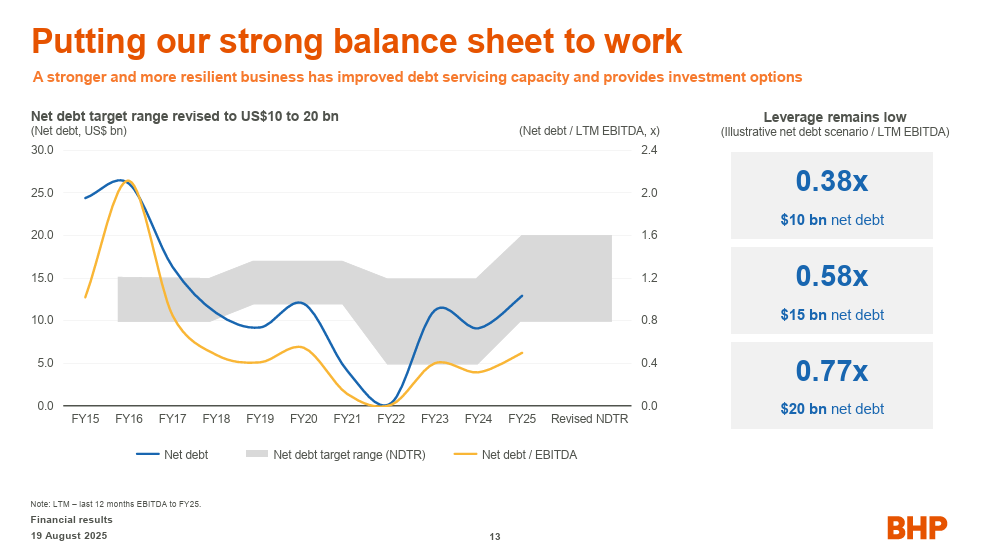

Here’s another great chart from the presentation that I think is helpful in understanding how the capital cycles work in mining, showing how the levels of debt change over time based on the extent of capex plans vs. the earnings in the business:

Aside from the obvious focus on copper, what BHP would really love to see is an uptick in global activity that would support higher iron ore prices. BHP is the world’s lowest-cost major iron ore producer, so they can literally print money when things go their way.

Deneb remains committed to selling properties (JSE: DNB)

Mobeni Industrial Park is on its way out – hopefully

Unless there is an exceptionally good reason for doing so, operating companies shouldn’t own properties. This is because property doesn’t have the same return profile (or risk) as commercial operations, so it’s better to separate the two and allow property investment companies to hold property and lease it to companies.

That’s the theory, anyway. There are many examples on the JSE of non-property companies holding large property portfolios, not all of which are for financially sound reasons.

The broader Hosken Consolidated Investments (JSE: HCI) group has been offloading property recently, which is good to see. Deneb is part of that, with a recent attempt to sell 195 Leicester Road in Durban in a deal that unfortunately fell through. Thankfully, they aren’t giving up.

The latest attempted sale is for Mobeni Industrial Park for R170 million, which makes it much bigger than the 195 Leicester Road deal which was only R48.5 million. I guess if only one of the two goes through, the bigger one is better!

Mobeni Industrial Park was valued at R170 million as at March 2025 and generated profit after tax of R11.5 million for that financial year. That’s a yield of just 6.8%, which shows you exactly why Deneb is much better off having R170 million on the corporate balance sheet and ready for investment in its own operations.

This is a Category 2 transaction, so shareholders won’t be asked to vote on it. Now we wait and see if the money actually materialises and the buyer completes the sale!

Dipula is buying Protea Gardens Mall in Soweto (JSE: DIB)

And a few other properties as well

There aren’t many pockets of growth in South Africa at the moment, but one of them is in township-adjacent and commuter-focused retail properties. Dipula Properties knows this, which is why they are happy to spend R478.1 million buying Protea Gardens Mall in Soweto.

Importantly, the mall boasts 70% occupancy by national tenants (i.e. large retail chains), so that’s a strong income underpin.

Instead of just giving us the latest financial performance of the mall, the announcement includes a forecast for the 9 months to August 2026 and then the 12 months to August 2027, as they assume that it will transfer during November 2025. This is frustrating disclosure.

Given the seasonality inherent in retail, I can’t see much use for the 9 month forecast. Using the 2027 12-month forecast, net property income is estimated to be R56.2 million. If we discount that for two years at 10% per year, that’s roughly R45.5 million in 2025 terms. This would be an acquisition yield of 9.5%, which feels a bit expensive to me. By the time you allow for debt, it’s likely that the distributable income of the mall will be below the dividend yield that Dipula’s shares are trading at (currently 8.7%).

Of course, if they actually disclosed the current level of net property income, I wouldn’t have to guess.

Dipula has hinted in its announcement that they may need to issue new shares to help fund the deal, although nothing is finalised at this stage. That’s perhaps something for retail shareholders to keep in mind, as such capital raising activity is usually in the form of an accelerated bookbuild that focuses only on institutional investors. Perhaps the company will surprise us here and give everyone a chance. Just to be clear on this – there’s no guarantee that any issue of shares for cash will take place.

But that’s not all folks – Dipula has also concluded a further R215.6 million in acquisitions that get a casual mention near the bottom of the announcement. The biggest individual one is Abland DC for R134.4 million, accompanied by the acquisition of Airborne Industrial Park for R63 million and marking a significant investment in logistics property around the airport in Joburg. They’ve also announced the acquisition of the Woolworths Gezina building for R16.2 million, along with land adjacent to the Tower Mall in Jouberton for R2 million.

Dipula has clearly been very busy. As the fund’s market cap is over R5 billion, the size of these acquisitions means that shareholder approval won’t be needed for any of them.

Harmony Gold can finalise the Mac Copper deal (JSE: HAR)

Harmony Cold? Harmony Gopper? Perhaps a better name is needed

Harmony Gold has ambitions to grow beyond what the name suggests. The allure of copper is so strong at the moment than even gold companies are keen to get in on the action, with Harmony acquiring MAC Copper in Australia in a deal that was announced back in May. The relevant update is that the Australian Foreign Investment Review Board (FIRB) has given the green light for the deal.

I can only assume that one of the conditions was to let them win a game of rugby. The timing is too suspicious.

There are a few remaining conditions to be met, not least of all shareholder approval 29 August.

Nibbles:

- Director dealings:

- After suffering a massive sell-off, the Bytes Technology (JSE: BYI) share price has recovered by 11% over the past 30 days and can now boast significant insider buying by various directors as part of the bullish thesis. The on-market purchases come to roughly R6.6 million in total.

- A non-executive director of Primary Health Properties (JSE: PHP) bought shares worth R3.6 million.

- An associate of the CEO of Acsion (JSE: ACS) bought shares worth R604k.

- Des de Beer has bought R454k worth of shares in Lighthouse (JSE: LTE).

- A director of Orion Minerals (JSE: ORN) participated in the company’s Share Purchase Plan to the value of A$6k (almost R70k).

- The CEO of Vunani (JSE: VUN) bought shares worth R11.5k.

- The chairman of Assura (JSE: AHR), Ed Smith, has notified the board that he is resigning as a director. As Assura might remain listed depending on the level of acceptances achieved in the Primary Health Properties (JSE: PHP) offer, the company has appointed senior non-executive director Jonathan Davies to take his place.

- CAFCA (JSE: CAC) has almost zero liquidity in the stock. The cable manufacturing company operates in Zimbabwe and saw a 14% drop in sales volumes year-on-year. It looks like the mining sector was the culprit, with the construction and manufacturing sectors achieving growth to offset some of that pain. With three quarters out of the way, revenue is down 5% year-to-date and margins have also fallen.

Note: Ghost Bites is my journal of each day’s news on SENS. It reflects my own opinions and analysis and should only be one part of your research process. Nothing you read here is financial advice. E&OE. Disclaimer.