AVI is in the green despite such a demanding base (JSE: AVI)

AVI’s food and beverage businesses have done the heavy lifting

AVI is an interesting group. It includes food and beverage businesses that have strong market leading positions. It also includes fashion, footwear and apparel as well as personal care businesses that don’t seem like a great fit. The food and beverage businesses showed total growth in revenue of 3.0% in the year ended June 2025, while the businesses that don’t belong here did a great job of almost entirely offsetting that growth.

At group level, revenue increased by 1%. This doesn’t reflect the underlying volatility, with Entyce Beverages as the best segment (up 5.4%) and Personal Care posting the most disappointing result with a drop of 9.6%.

Despite the modest revenue growth, the group’s gross profit margins headed in the right direction. This is impressive, with operating profit growing by 7.8%. AVI has a strong reputation for driving margin expansion.

And here’s the really impressive thing: AVI was always going to find it tough to grow in this period, as they managed 21.7% operating profit growth in the prior year. That’s a strong base to say the least. It gets even tougher if you isolate the second half of the year, with comparative period growth of 27.8% in operating profit. Despite this, AVI grew operating profit by 6.4% in the second half of this year, which isn’t far off the 7.8% growth rate for the full year. That’s decent momentum.

It’s always fascinating to dig into the underlying business units to understand more about market forces. For example, the abalone operations in I&J are struggling with poor demand in Asia, while the deodorant body spray business in personal care was affected by heightened competition. In footwear and apparel, the decision to close the Green Cross retail business was of course a drag on performance, including once-off closure costs.

With all said and done, HEPS is expected to increase by between 5% and 7%, which puts AVI on an expected HEPS range of 721.5 cents to 735.2 cents. At the midpoint, the current share price of R93.75 is a P/E multiple of 12.9x.

Despite low inflation, Cashbuild’s sales are up (JSE: CSB)

But it’s taking a long time for things to really get going here

Cashbuild has been quite the rollercoaster ride, with far too much exuberance in the stock into the end of 2024, followed by a nasty sell-off this year. Despite the share price chart jumping around like an overexcited toddler, the underlying business is growing steadily in an economic environment that isn’t exactly supportive of sales of consumer durables and semi-durables.

In the fourth quarter, the comparable sales growth was 4% based on the same number of trading weeks in each period. As the prior period was a 53-week financial year, the comparable fourth quarter includes an extra week of trading that obviously skews the results, so the 4% growth rate takes that into account. Without that adjustment, sales would’ve been 5% lower for the quarter.

For the full year, group growth was 5% on a 52-weeks vs. 52-weeks basis, so the fourth quarter was a slowdown vs. what we saw previously in the year (but not by much). Without the adjustment for the extra week, sales would be up 3% for the full year.

For existing stores, revenue was up 3% this quarter. New stores were good for 1% growth. Selling price inflation was 1.7% as at the end of June 2025 vs. June 2024. Transactions through the tills increased by 6%, so these numbers can only balance if there was a negative mix effect that brought revenue growth down to 3% for existing stores.

The P&L Hardware business is once again a headache, recording a drop in sales of -10% for the quarter vs. -1% for the full year. Although it’s only 7% of group sales, this is still a frustrating drag on performance.

The share price closed just over 2% lower for the day.

Hyprop terminates the bid for MAS (JSE: HYP | JSE: MAS)

There’s definitely no love lost between Hyprop and Prime Kapital

Unless you were living under a rock for the past week, you would’ve seen the news of Hyprop putting in a bid to MAS shareholders. It was a part-cash, part-shares offer, but at an implied price per MAS share that was well below the recent traded value. On top of that, it also had a highly unusual requirement for shareholders to accept the offer (via an irrevocable undertaking i.e. a legally binding commitment) within a week of the offer going live. The TL;DR is that Hyprop didn’t exactly make it difficult for Prime Kapital (the current significant minority shareholder in MAS and the company’s joint venture partner) to paint Hyprop’s offer in a negative light.

There’s been no shortage of mud slinging in general when it comes to MAS, with a group of South African institutional investors hurling some serious accusations in the direction of the MAS board. These relate to historical disclosure shortcomings around the joint venture agreement between MAS and Prime Kapital. Hyprop was essentially a white knight in the deal, coming in as a potential acquirer that is well known and acceptable to local institutional investors.

Unfortunately / fortunately (depending who you are and where your incentives lie in this matter), this particular knight was here for a good time rather than a long time. One of Hyprop’s offer conditions was that they wanted full access to all the information that Prime Kapital has around MAS and the joint venture. In other words, Hyprop wasn’t satisfied with the legal summary of the terms that MAS had already published publicly in recent weeks.

As Prime Kapital is under no legal obligation to disclose the full agreement (and because they aren’t exactly supportive of Hyprop’s offer), they refused to give MAS’ board permission to disclose the agreements. Hyprop therefore released a very grumpy SENS announcement and terminated their bid.

Is this the last we will hear from Hyprop regarding the MAS bid? I truly have no idea. The next major confirmed step is the extraordinary general meeting in August, at which shareholders will vote on changes to the board that were proposed by the local institutional investors.

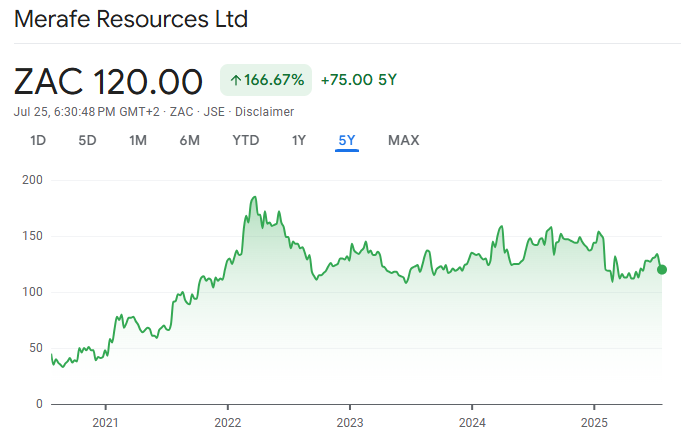

Merafe is having a hard time (JSE: MRF)

The latest trading statement is concerning to say the least

Merafe’s problems aren’t news to the market. The company has been talking about difficult market conditions for some time now, leading to the kind of things that investors absolutely don’t want to see: the suspension of certain operations.

This is why Merafe’s attributable ferrochrome production for the six months to June 2025 is down by 28%. That number doesn’t tell the full story though, as certain smelters were suspended quite late in the period. Things aren’t looking good for the second half of the year.

For the interim period, HEPS will fall by between 45% and 65%. It’s no surprise at all that the percentage drop is more severe than the decrease in production, with commodity prices under pressure and Merafe finding itself on the wrong side of operating leverage.

Cash and cash equivalents fell sharply from R1.8 billion to R1.14 billion between December 2024 and June 2025. Again, that direction of travel is worrying.

Under these circumstances, this share price chart looks far too resilient:

Spear REIT acquires Consani Industrial Park in Goodwood (JSE: SEA)

This must be the first of the transactions that the company flagged in the recent cautionary

Spear REIT told us recently that they are looking at two different transactions, each of which would be a Category 2 transaction if they went ahead. It hasn’t taken them long to announce the first deal, being the acquisition of Consani Industrial Park in Goodwood, Cape Town. The deal is valued at R437.3 million, so it’s a meaty transaction (Spear’s market cap is R4.2 billion).

This is part of Spear’s industrial assets strategy in the region. They are getting the park on a purchase yield of 9.71%. The weighted average escalation on the leases is 7.11%, which should protect Spear against inflation. The weighted average lease duration is 3.25 years and the vacancy rate is just 0.26%. Spear has identified opportunities to invest up to R34 million in capex over the next five years to enhance the asset.

They will fund the deal from existing cash resources, with a loan-to-value (LTV) ratio of 45%.

Overall, this looks like a solid deal that is typical of the strategy that we’ve seen of Spear in the Western Cape region.

Nibbles:

- Director dealings:

- Here’s one you won’t see every day: Stephen Koseff sold Investec (JSE: INP | JSE: INL) shares worth just over R40 million.

- An entity associated with Christo Wiese sold shares in Brait (JSE: BAT) worth R8.6 million. That’s very different to the recent direction of travel we’ve seen with his purchases of Brait, hence I put it in bold.

- An associate of a director of Calgro M3 (JSE: CGR) sold shares worth R8.2 million. This particular director has resigned from the board and his employment ends on 30 September.

- A director of Clicks (JSE: CLS) bought shares worth R1.2 million on the market.

- The chairman of Supermarket Income REIT (JSE: SRI) bought shares worth R761k. In a separate transaction, an independent director bought shares worth R1.2 million.

- A prescribed officer of Telkom (JSE: TKG) bought shares worth R26k.

- The CEO of Vunani (JSE: VUN) bought shares worth R12k.

- Ex-EOH (now called IOCO – JSE: IOC) director Anushka Bogdanov has been publicly censured and fined R500k by the JSE for lying about having a PhD from London Business School. She’s also disqualified from being a JSE listed company director for 10 years. And, hilariously, a Google search reveals that she is involved these days in developing ESG risk rating tools. The jokes write themselves, with yet more egg on the face of the ESG industry at large.

- Regular readers will know that I usually don’t pay much attention to non-executive director appointments. The latest appointment by Oceana (JSE: OCE) is interesting though, as Mamongae Mahlare (the ex-CEO of Takealot) has been appointed to the board. She has loads of experience in FMCG groups in general, so that’s an interesting voice to add to Oceana’s sales strategy.